The Battle Of The Billionaires

A quick rundown on the GameStop saga. 2021 is the year bears suck it, shorting is so two years ago.

Alright, I'll try to sum this up as best I can, this isn't Reuters ya know.

It all really started when Michael Burry took a long position on the brick-and-mortar store back in 2019. He saw potential and upside on GameStop, and surely wanted to squeeze the hell out of shorts.

Fast forward to the second half of 2020, and Ryan Cohen blasts GameStop in a brute letter and urges them to push for more digital sales and fewer retail stores. He had taken a stake of 10% at the time, later increasing it to 13%. You can read more about the details and the idea behind the short squeeze play HERE.

What happened

GameStop shares soared 700% in less than two weeks, caused by the biggest short squeeze EVER, orchestrated by a collective unit of degenerates over on WallStreetBets. No hate though, I love em. The short interest was enormous, 139%, and this meant that total shares held short were so much there weren't even enough shares out there for everyone to cover these positions.

GameStop had announced the addition of three new board members, Ryan Cohen, Alan Attal and Jim Grube, all guys who worked together at Chewy. The same day this happened, GameStop reported a 4.8% year-over-year increase in comparable store sales for the nine-week holiday period ended January 2nd. Cohen took a 13% stake and pressed for a strategic review. This was the catalyst needed to trigger buying momentum, jumping 23% and touching a high of $38.55 that day. Demand from day traders and bulls, combined with shorts covering their asses, has been fueling the run.

As more memes, screenshots of crazy gains and rocket ships hit social media boards, more and more buyers piled into GME hoping to cash in on the wave. This caused a tsunami of short-sellers from larger institutions to cover their short positions, which made GameStop's move even larger, inducing THE BIG SHORT-SQUEEZE.

GameStop's poor fundamentals were the tinder box for bears and other losers to continue shorting and buying puts against GameStop. Yes, crap fundamentals and technicals play into stock prices but meme stonks are immune to that trash. I have no idea if Citron waved their white flag yet, but I feel it coming. At the time of writing, GME surpassed $300.

The Battle of Billionaires

Hedge fund titans Ken Griffin and Steve Cohen boosted Gabe Plotkin’s Melvin Capital, injecting a total of $2.75 billion into the firm after it lost 15% in the first three weeks of the year.

Yeah... so these contrarian knob ends get bailed out by their billionaire buddies. If you're thinking it's not fair, no duh. Us retail traders get blown up and have to resort to giving handies in the back parking lot of a Dunkin' Donuts to retrieve funds. These guys just need to hit speed dial.

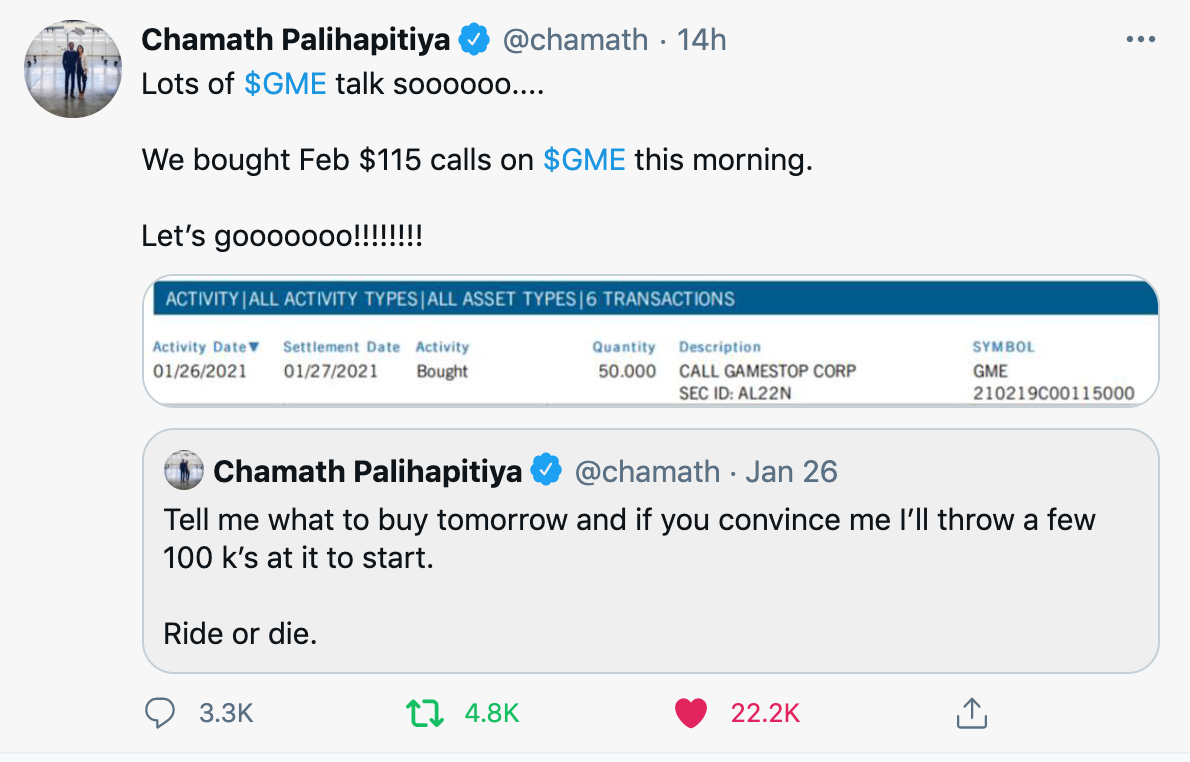

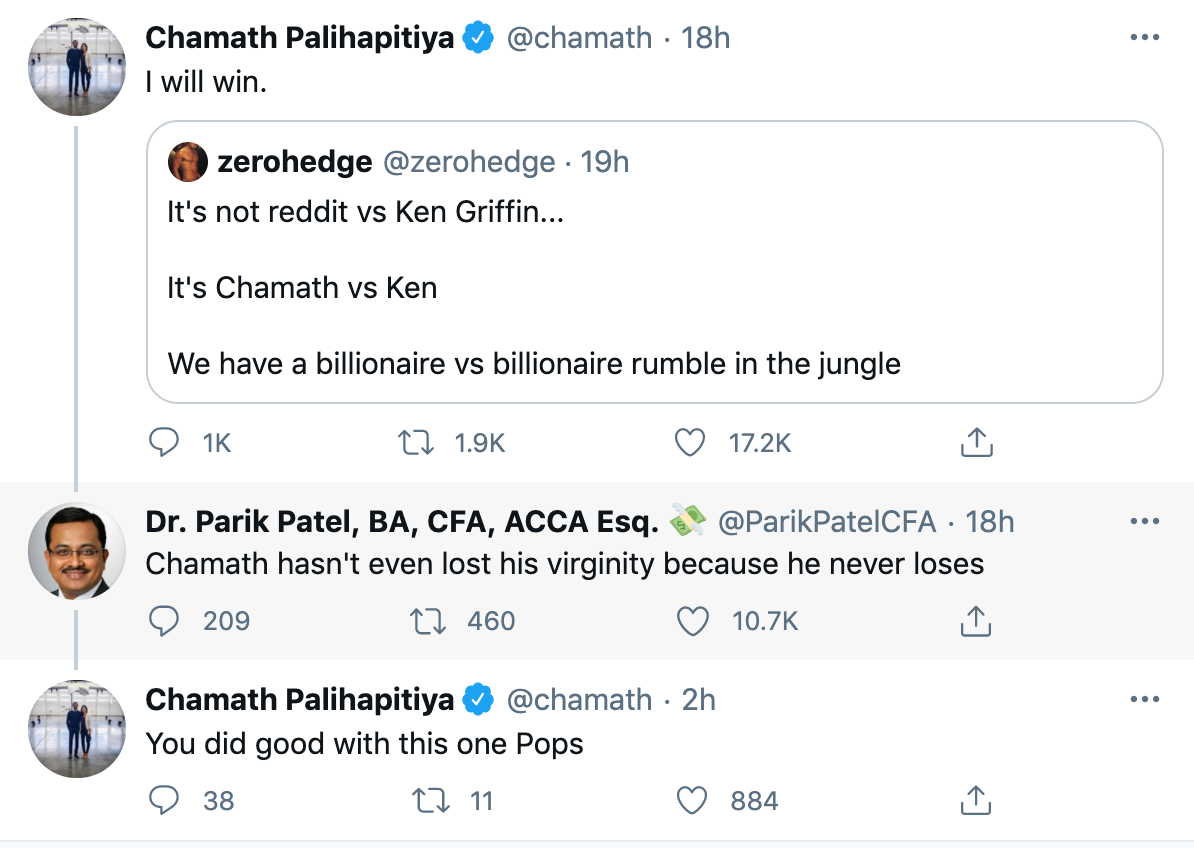

Fortunately for us, we have men of culture on our side.

Share prices have rallied to unprecedented levels because of these two. Elon was able to send the stock breaking key resistance levels with one simple tweet. I truly admire how these billionaires are looking out for us. The proof? Elon HATES short sellers. He always has talked about how he wanted to eliminate these 'jerks', and I think he will with a swift kick to the hedge funds nuts.

The SEC is currently looking for any unlawful activity, and from what I hear on CNBC and online, it seems like it's fair game. The pumping is LEGAL. The people of FinTwit and WallStreetBets can freely write their opinions online, just like short-sellers of Wall Street can. They put a short position on a stock, then come out with a reason as to why they're shorting, trying to influence other investors and traders to follow suit. Not today, Satan.

This is a big Screw You to short sellers/bears/hedge funds from retail investors.

**Not a financial advisor. Article are opinion only. Also, the rug can be pulled at any time so don't forget who is allowing us to play this game at the end of the day.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.