Can Gamestop Make a Comeback?

Billionaire investor to step in and restructure our childhood hero. Give us power to the players.

I know what you're thinking.

"Why would I invest in a company that gives me $3 for an entire PlayStation 4 and 40 games when I go to exchange it?"

Summary:

- GameStop's new billionaire investor, Ryan Cohen, blasts Gamestop and urges them to push for more digital sales and fewer retail stores. He has taken a stake of 10%.

- GameStop has been under pressure as more consumers download games on the internet instead of going to a store and buying physical copies. Sales have been sagging like a grandfather's nut sack, and the company has been streamlining its operations with fewer stores.

- Lately, the company has seen some promising signs. Last quarter brought an 800% spike in digital sales—bringing online channels to about 20% of GameStop's total revenue. The company also recently announced a deal with Microsoft Corp, through which it will get a cut each time customers use an Xbox purchased at a GameStop store to buy digital-only products.

From chew toys to PlayStation controllers, the new GameStop investor is ready for a change. Ryan Cohen, managing director of RC Ventures LLC, said, "GameStop leadership needs to conduct a strategic review of the business and provide a plan for seizing opportunities in the fast-growing video-game sector" according to a letter sent to the board of directors that was filed with the U.S. Securities and Exchange Commission. GameStop gets a bad rep for being known as the place that will low ball you on exchanging used games, but now we know why. They need to save dat money and MAKE dat money. Do you guys remember rushing into GameStop after school and gazing at the used game shelf for your Game Boy? GameStop is where you bought your first Pokemon game, isn't it? Well, it was for me, and I will gladly buy into my childhood's haven. Legends never die.

The letter reads:

1. The gaming industry is experiencing explosive growth, with the global gaming market expected to be $174.9 billion this year and reach $217.9 billion by 2023.

2. GameStop has valuable assets, including a strong brand with a large customer base and 55 million PowerUp members.

3. Despite GameStop losing substantial market share to forward-looking competitors, the company can still emerge as the market leader and ultimate destination for gamers if the Board can set a credible strategy for capturing growth opportunities.

“GameStop needs to evolve into a technology company that delights gamers and delivers exceptional digital experiences – not remain a video game retailer that over-prioritizes its brick-and-mortar footprint and stumbles around the online ecosystem,”. - Ryan Cohen

Shareholders have seen the value of their equity decline by nearly 68% over the past three years and decline by nearly 85% over the past five years. It's apparent that investor sentiment is very weak, given the huge decline. GameStop is also one of the most shorted stocks in the entire market, which speaks volumes about investors’ lack of confidence in the current leadership team’s approach.

Short squeeze

Stocks that are heavily shorted are stocks people should avoid, right? There are normally good reasons, both technically and fundamentally, why a company has so many bets placed against it. Sometimes, the market gets it wrong on the short side, just like it does on the long side. The difference however, is that your risk is limited on the long side to the amount of your investment. In theory, a losing short position can result in unlimited losses. As of September 15th, GME had a short % of float of more than 101%. We need news good enough to send the stock price higher. Causing shorts to cover their position to create more buying. We had a buying influx on October 8th, when GameStop announced a partnership with Microsoft. In my opinion, the stock is still very cheap and wasn't good enough to send it flying. Do you know who else was involved in a bet against everyone else? Michael Burry, the man who predicted the housing crash in 2008, owns 4% of GameStop. I think I'll follow his lead.

GameStop needs to take the right steps to cut its excessive real estate costs and hire the right talent. If it does, it will have the resources to begin building a powerful e-commerce platform that provides competitive pricing, broad gaming selection, fast shipping, and a truly high-touch experience that will make consumers excited about GameStop. “This is the type of world-class infrastructure that was constructed at Chewy, which is worth multiples of GameStop’s current market capitalization", says Cohen. Be right back, I'll be playing Fortnite on my PlayStation 5 with my GME gains this Christmas.

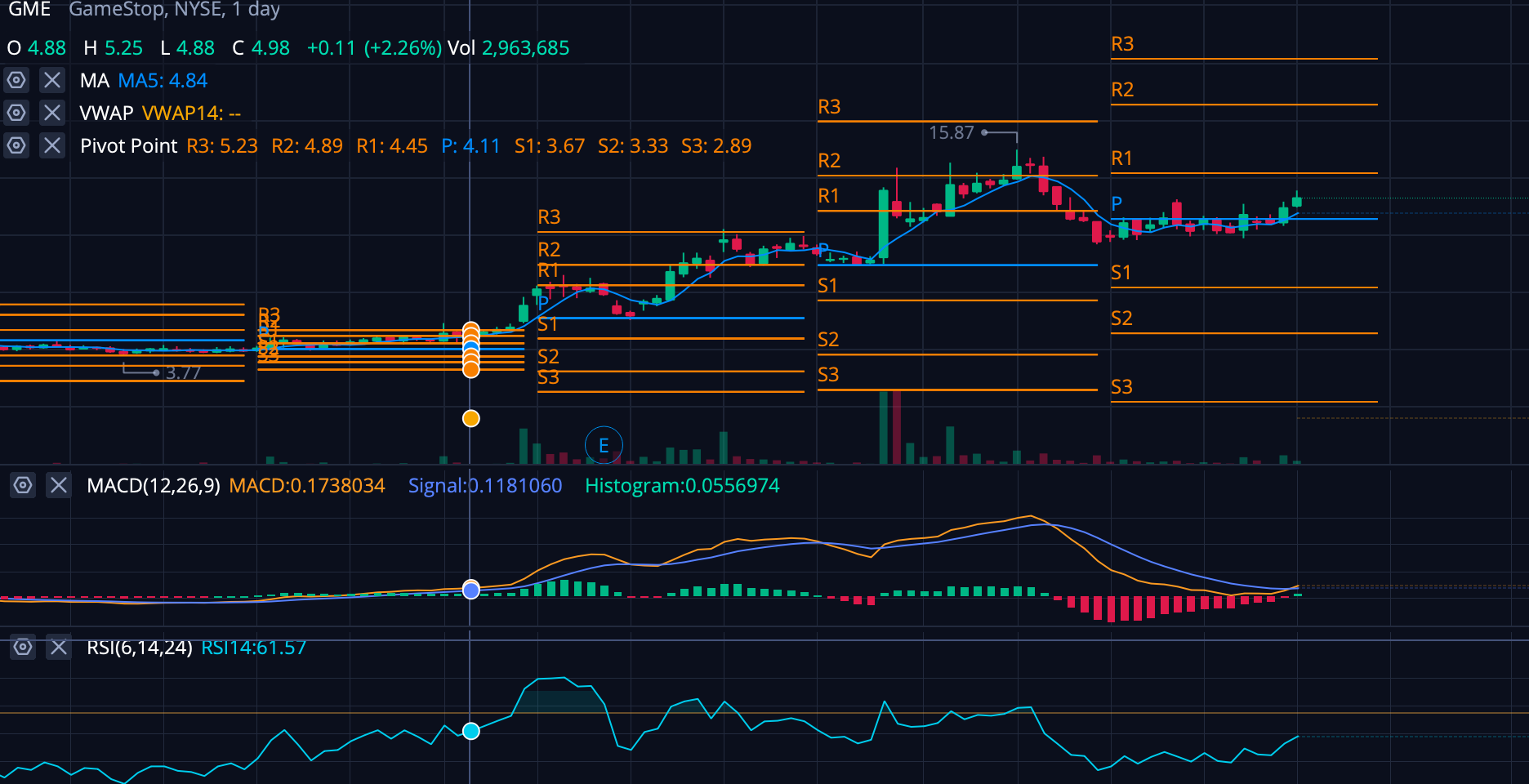

The chart

I know this chart looks a little messy guys. Here's what I think:

- GME is getting bought into as it approached the first resistance levels R1. There is a lot of selling taking place as well, as noted by the last two candle wicks. That's selling pushing the price down. Overall, looks to be trending upwards with buying volume.

- The RSI is trending upwards, away from neutral to overbought territory.

- The MACD is crossing to the upside. That signals momentum and is supposed to indicate price reversal.

- We need to break first resistance in the 15's, then 18's, before we can hit the 20's.

To wrap this up, I'm bullish on GameStop. They have positive cash flow, while also being able to cut costs in closing stores and transferring to a digital platform. They have a strong brand name with a very knowledgeable employee base. I mean, whenever I have questions about games, these guys ALWAYS have the answer. Here's the thing: Gaming isn't going anywhere! It's going to continue growing and lockdowns only amplify that. This is a $200 billion industry, and I think with the new generation consoles coming out, this is a perfect time to bet ON GameStop.

**Not a financial advisor. Articles are opinions only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.