CarLotz Gets the Greenlight To Merge With Acamar Partners Acquisition

CarLotz, a leading consignment-to-retail used vehicle marketplace, is going public via a SPAC. Start your engines.

Buckle up.

Summary:

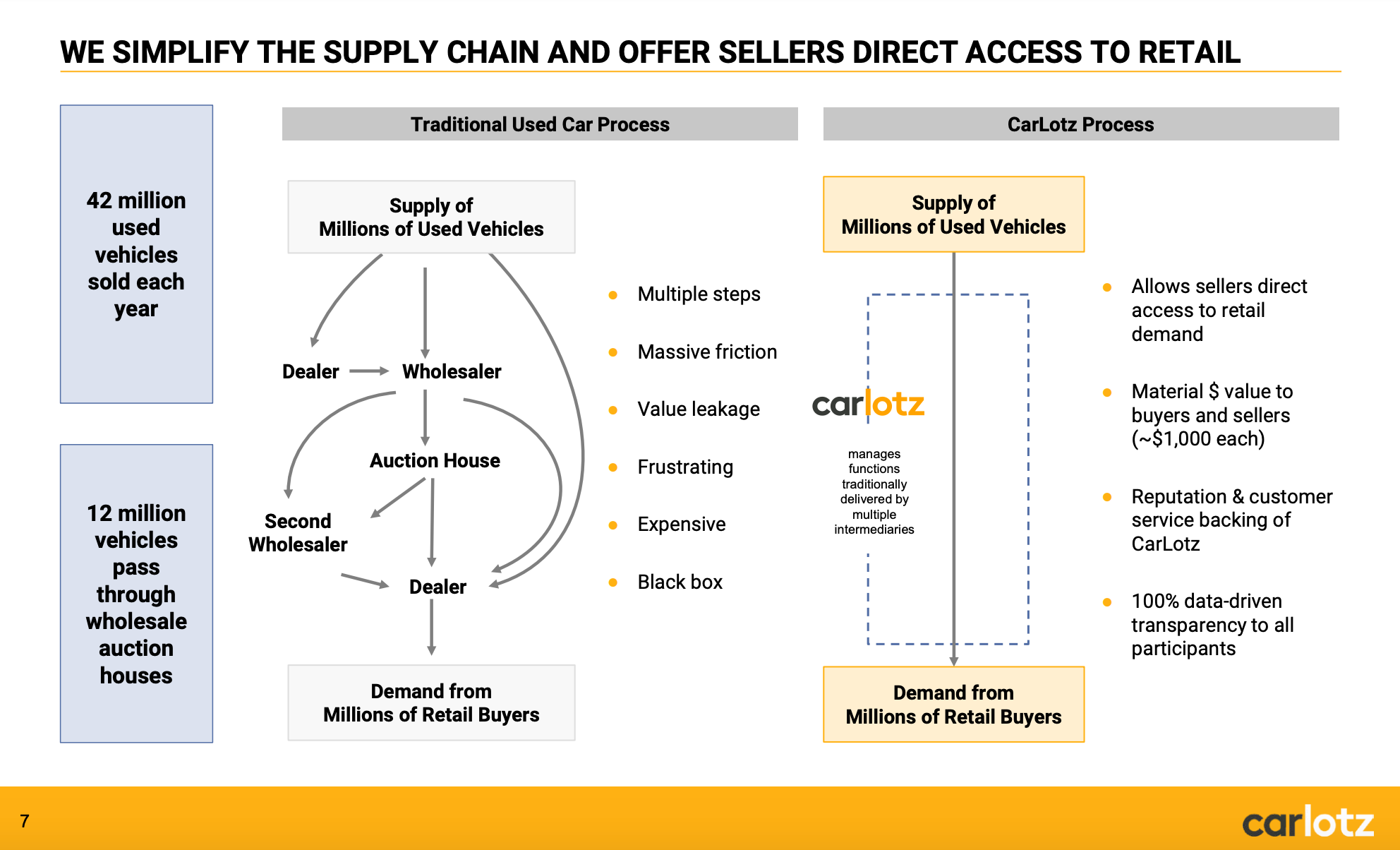

- CarLotz offers the ability to buy, sell, and trade automotive online or in person. Their emphasis is on the Retail Remarketing business that provides corporate vehicle sourcing partners and retail sellers of used vehicles with the ability to access retail sales channels.

- CarLotz announced on January 8th that it has successfully received the requisite approval from its stockholders to complete the merger with Acamar Partners. The stockholders' meeting to approve the merger is on January 20th.

- Former General Motors CEO Rick Wagoner is an investor in the PIPE.

- $321 million of cash proceeds to the company at transaction close, with zero debt.

- Capital resources injection to fuel expected growth, including planned technology investments and nationwide hub expansion.

- The enterprise value of $827 million and the equity value of $1.1 billion.

- The third quarter's financial performance provided a record revenue of $29.8 million along with record gross profit.

What is CarLotz?

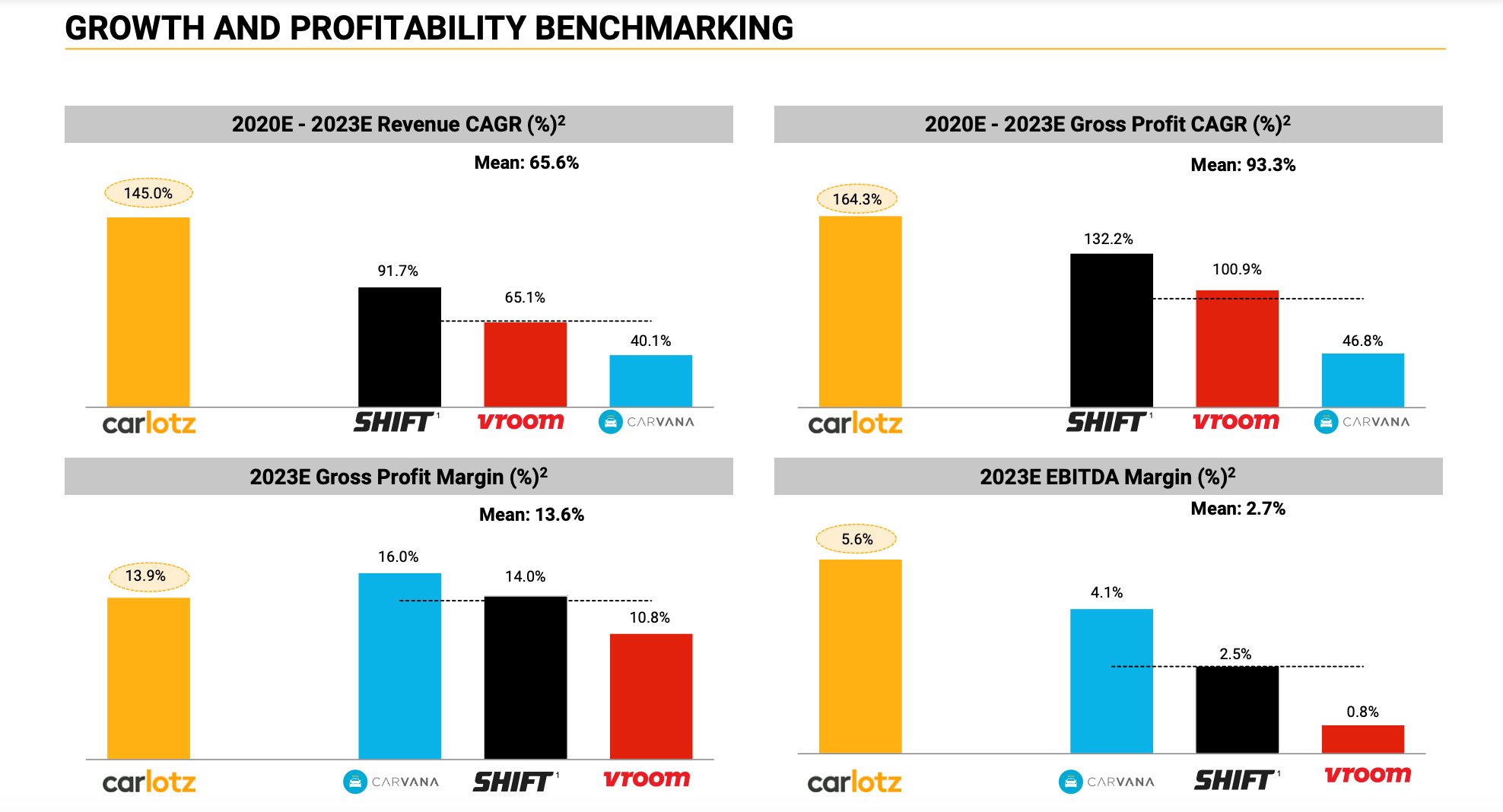

CarLotz offers the ability to buy, sell, and trade automotive online or in person. Their emphasis is on the Retail Remarketing business that provides corporate vehicle sourcing partners and retail sellers of used vehicles with the ability to access retail sales channels, while also providing good deals that would be unavailable through normal dealerships. This is a disruptor in the used vehicle retail industry, and with competitors like Carvana and Vroom, why can't this go past $20 in the price? It's currently trading at under $12 and the merger date is on January 20th. If you guys read the article I wrote back in 2020, I talk about how the pandemic accelerated demand for vehicle delivery services and online dealerships. This is the industry's ONLY consignment-to-retail sales business model: retail re-marketing. They get buyers and sellers the best deal, hassle-free! (or so they claim). CarLotz operates with eight hubs, covering all 50 states, and has sold over 25,000 vehicles through its platform.

CarLotz's corporate vehicle sourcing partners earn on average around $1,000 more by Retail Remarketing through CarLotz than by selling at wholesale. They provide more than satisfactory customer service and also provide great value for their consumers.

Their model is fairly simple, and unlike Vroom and Shift which buy and then sell used cars, CarLotz operates a consignment platform whereby it splits profits from sales made on its platform with owners.

Buyers:

- Price: Upfront with haggle-free prices generally lower than competitors. I love how they use 'generally' in their investor presentation.

- Selection: Nationwide inventory. They offer trade-in and consignment services.

- Customer service: Contactless end-to-end e-commerce capabilities.

Sellers:

Price: Higher average proceeds compared to other alternatives.

Selection: Accepts all car models, ages, and values. In-house reconditioning dependability.

Customer Service: End-to-end technology to enable no hassle selling.

Qualitative Thesis

The market and the opportunity.

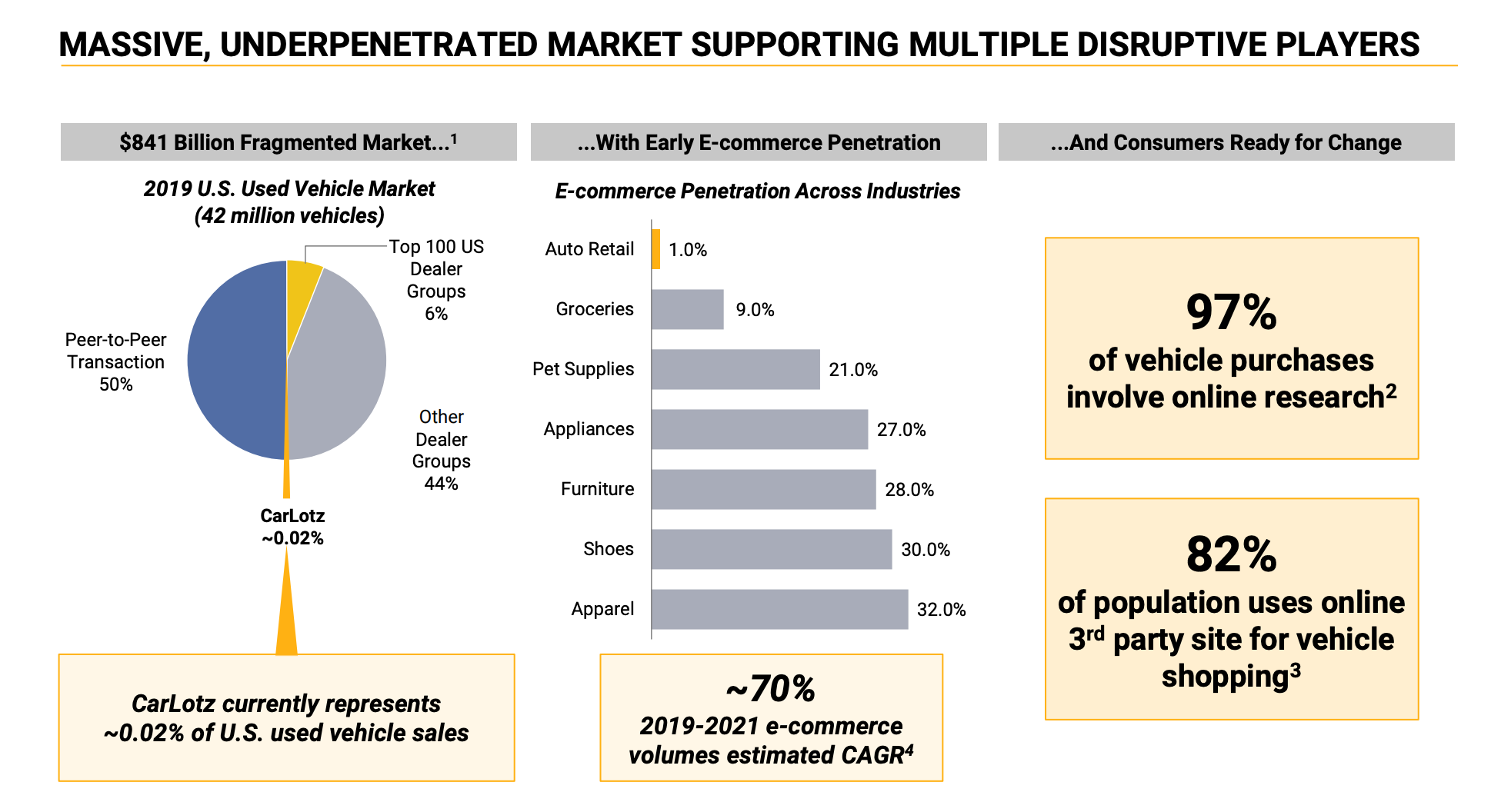

- Online sales only accounted for 1% of the total addressable market which is worth $841 billion.

- The pandemic brought upon an emphasis on online retail car sales and home deliveries as dealerships went on lockdown throughout the country. The cancellation of nearly all auto shows; idling car factories across the country for two months, engineers working remotely, and car giants like Ford and GM converting into face shield and ventilator manufacturers.

- Car dealers showed flexibility by adopting online sales and home deliveries, pulling the digital car-buying experience ahead by years and likely making it permanent.

In an interview with Michelle Krebs, executive analyst for Cox Automotive, she goes on to talk about trends in the industry and car dealership sales: "They had to find ways to sell cars and they really embraced online services and pickup and delivery, which is what consumers have been clamoring for years. People with money continued to buy and those who lost their jobs or had trouble with credit can't buy anything and that will likely continue." Cox has increased its 2021 forecast to 15.7 million vehicles expected to be sold, based on the strength of year-end sales and other good news such as a second stimulus package having been passed, a settled election, vaccines, and a red hot stock market. According to the findings of the third annual Cox Automotive and Grant Thornton Automotive Insight Report, two-thirds of dealers surveyed expected used car transactions to increase in 2021.

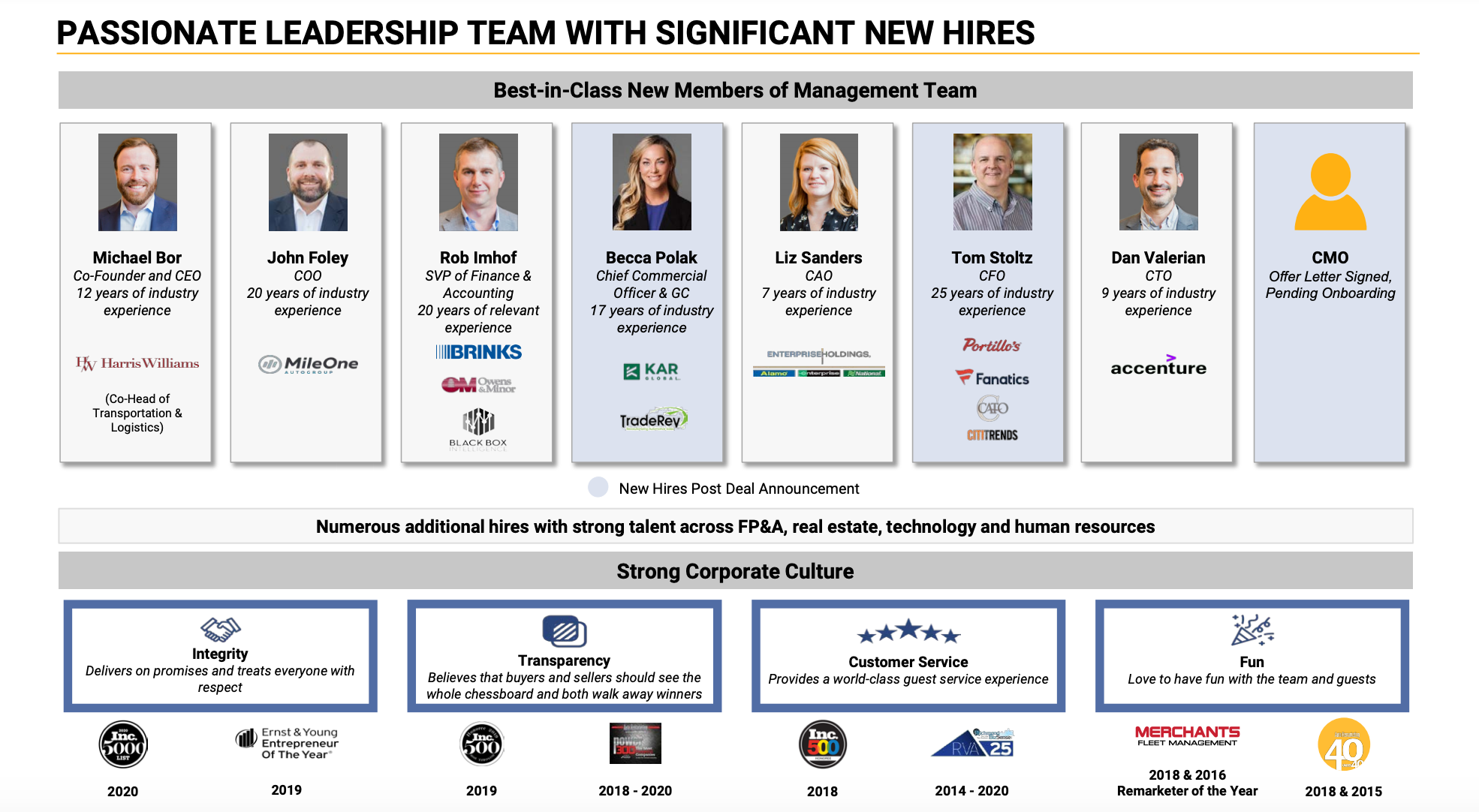

The Management

On January 8th, CarLotz nominated four business leaders for its board.

Linda Abraham, Managing Director of Crimson Capital landed a gig as the chair of the compensation committee. Abraham co-founded Comscore, a company that measures the size and performance of media platforms (ranked top 50 in the U.S.)

Sarah Kauss, Founder and Chairwoman of S'well. S'well is the maker of stainless-steel water bottles and a consumer brand that has generated over $100m in revenue. Kauss will be a member of the board's audit and compensation committee.

Kimberly Sheehy, previously the Chief Financial Officer of ResMan. ResMan is a provider of software solutions to multi-family residential property managers. She will be a member of the nominating and corporate governance committee.

James Skinner, a former Vice Chairman of Neiman Marcus Group, will chair the nominating and corporate governance committee for the company's board.

"Linda, Sarah, Kimberly and James are all pioneers in their industries and bring a wide diversity of thinking and experience to Carlotz"

-- Co-Founder and CEO Michael Bor

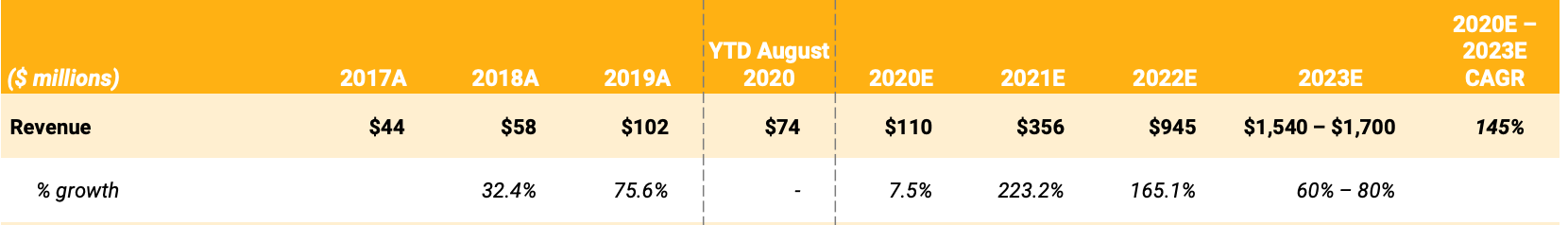

Quantitative Thesis

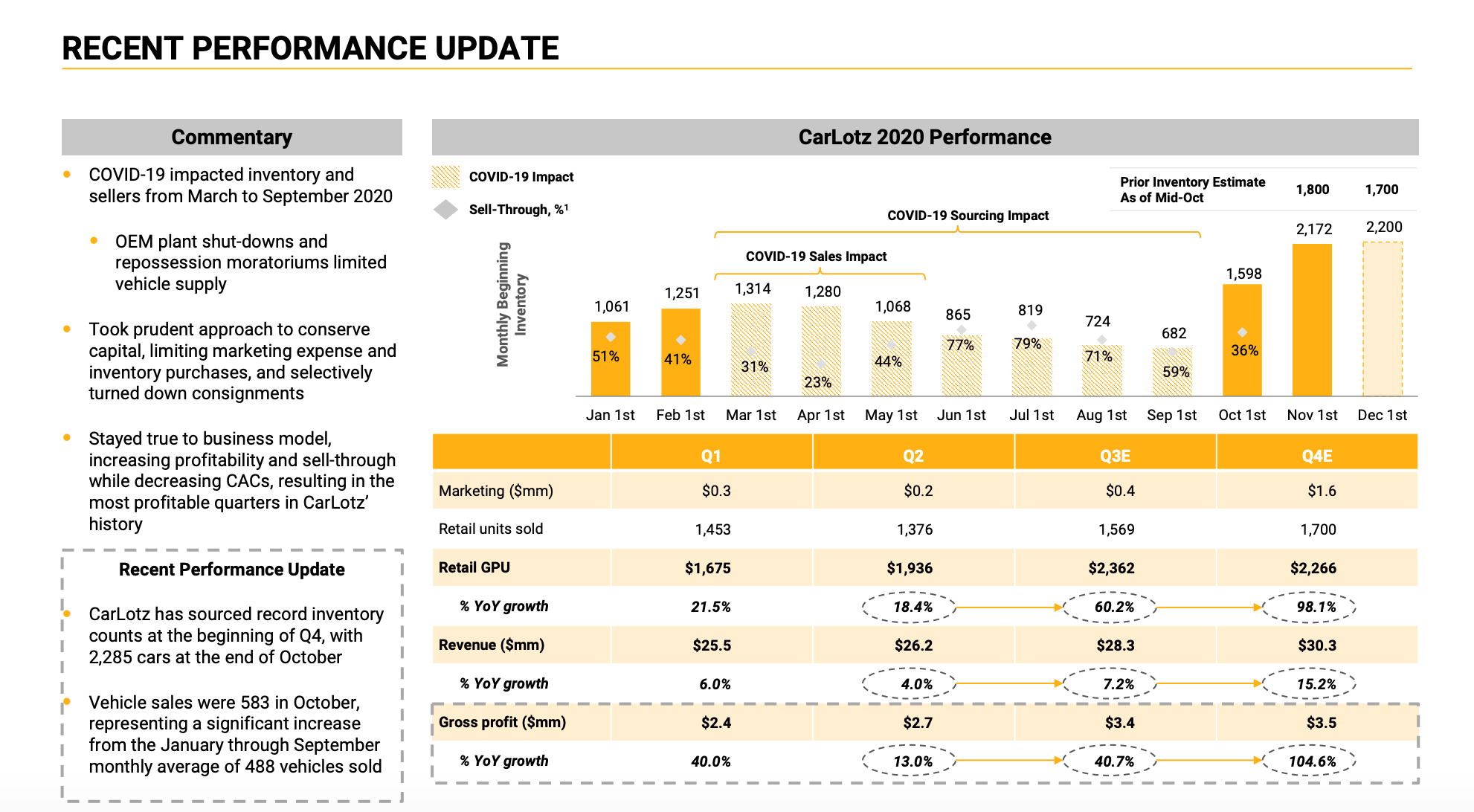

Third Quarter Financial Results

- 2020 net revenues increased 12% to $29.8 million from $26.5 million. This growth was driven by double-digit growth in retail and financing revenues.

- Gross profit increased $1.3 million, about 56%, to $3.6 million from $2.3 million in the prior year.

- Retail gross profit per unit increased 71% to $2,181 from $1,276 in the prior-year period.

- Contribution margin (revenue available after variable costs to cover fixed expenses and provide profits to the company) per unit increased 188% to $1,883 versus $655 in the third quarter of last year, primarily attributed to maintaining industry-leading CAC (customer acquisition cost) efficiency while increasing sales and gross profits.

Fourth Quarter Outlook

- Raising outlook on revenue, gross profit, and contribution.

- Retail units sold are expected to increase by ~10%

- Revenue expected to increase by ~19%

- Gross profit is expected to increase by ~77%

- Contribution margin expected to increase by ~97%

Expansion

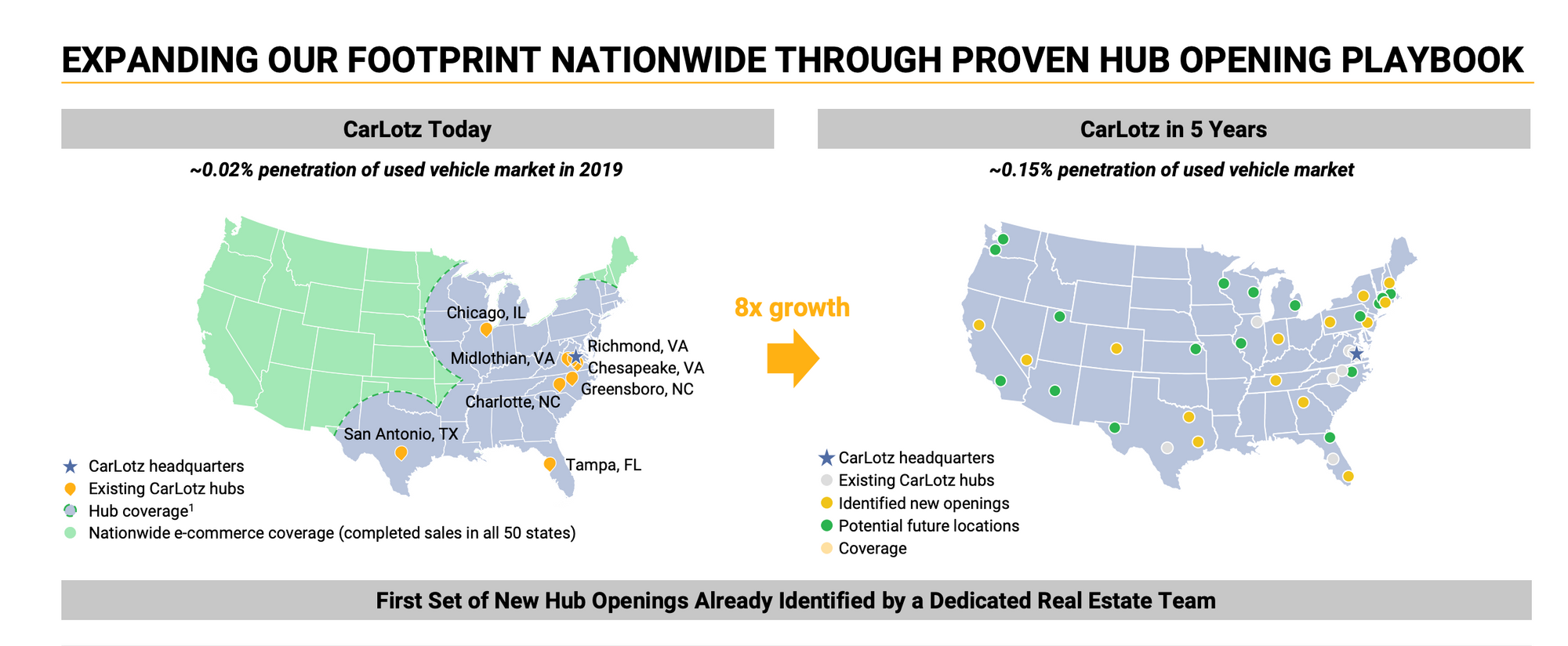

- Opening 3-4 new hubs per quarter with the first several hubs identified by an experienced real estate team.

- New hubs can be operational within 90 days and budget $750K investment each.

- Supply of consignment inventory to hubs ramps up rapidly starting within 30 days of opening.

- New hubs are sized for growth and have sell-through assumptions more conservative than existing hubs.

The Chart

- On December 28th, ACAM made a very bullish movement on high volume. No news, but about a week and a half prior was when they released their third quarter results.

- Ever since then, it has been consolidating, never going below 10.85 and anything below 11 getting bought.

- There has been a lot of buying the past month, and when it tried to cross 12 it immediately got pushed down.

- Buy dips, not rips.

- The risk level is low here as you can see it's not going below 10.85. As the merger date approaches I expect the price to be increasing.

Personally, I'm in a very small position in this stock because I'm rolling over profits from my other stocks into this. The merger vote is also January 20th so we have time. I love SPACs and CarLotz looks to be something that can see $20. I mean if Carvana can reach $200+ and Vroom is at $40, why can't hype and FOMO (along with um, valuation metrics) bring us to 100% gains? Bullish as always.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.