Stay-at-Home Economy Creates Surge in Demand for Vehicle Delivery Services From Local Dealerships

Just when you thought life couldn't get any better, now you can buy a car while you sit on your ass.

Amid the booze bug, demand for contactless home delivery for cars continues to grow more than 60%, as recent buyers say they want their car delivered to them at home. Imagine that, hopping on a website and picking out a Subaru Impreza as if it were an article of clothing on Zara. No more eyeballs bulging at you as the car manager waits for you to sign a piece of paper. You can simply work out the price and monthly payment from the comfort of your basement. What? Doesn't everyone else live in one?

CARS is a leading digital marketplace and solutions provider for the automotive industry that connects car shoppers with sellers. Consumers are finding new ways to purchase their new or used cars from local dealerships, leaning on real-time messaging and chat functionality, virtual vehicle walkarounds and test drives via video. If satisfied, the consumer can complete financing and trade-ins online. The best part? Their newly purchased car is delivered same day right to their driveway. Having to juggle taking care of the kids' homeschooling, working from home, and stress cleaning your room for the eighth time in a day, the pandemic accelerated the adoption of virtual car-buying tools and contactless home delivery options from both shoppers and sellers. CARS has given these dealerships a pulse during the months their doors were closed due to COVID. These digital offerings help them effectively compete against disruptors in the space and national online-only car sellers. And it's working.

Straight from the horse's mouth (and man am I tempted to add a Mustang pun):

"Research from Cars.com shows demand is growing for home delivery and virtual car-buying options from dealerships;

- People are still buying cars and the main reason is COVID-19. Of those who purchased a car within the last six months, 57% said it was due to the pandemic. Thanks China!

- The pandemic accelerated online car shopping and buying. Walk-in traffic to dealership showrooms is still down 15% nationwide, largely replaced by digital visits as customers prefer to stay home and shop from afar. And 57% of recent buyers said they conducted the bulk of the vehicle transaction online with their local dealership. Online buying is highest in New York (81%) and Los Angeles (73%), followed by Chicago (65%), Atlanta (64%), and Dallas (63%).

- Consumers want to deal with annoying salesmen through the screen, not risk getting spit on with quick sales jargon. Since Cars.com launched its new Virtual Appointment and Home Delivery badges on their website to indicate which dealers are offering these services, they've reported an increase of 30% in contact and user engagement for dealers offering home delivery and virtual options versus those still offering the traditional showroom experience.

- Customers have the ball in their court. Dealers are making house visits. I wish all types of dealers did this. In March, at the start of the pandemic, 49% of dealers said they offered home delivery services. By August, 66% offered the services, an increase of 35% in less than half a year. Approximately 20% of recent car buyers used home delivery from their local dealership, while 61% of recent buyers state they would use this service from their local dealership if it were offered, showing sustained interest in this growing trend.

- Home delivery is dominated by luxury brands, but non-luxury is starting to infiltrate the top 10. Of the recent car buyers who took advantage of home delivery, they purchased from a mix of luxury and non-luxury auto brands. Most home deliveries by brand by recent buyers include (1) Land Rover, (2) Mitsubishi, (3) Lincoln, (4) Mercedes-Benz, (5) Volvo, (6) Nissan, (7) Infiniti, (8) Cadillac, (9) Acura, and (10) Buick.

- My buddy who works in the industry told me executives have said COVID has advanced dealership online services by 10 years. Yes, I'm using this as a part of my thesis.

CARS sent out a press release on October 14:

Based on preliminary information, CARS expects third-quarter revenue of approximately $142 to $144 million and an Adjusted EBITDA margin between 33% and 34%. A measured approach to investment in the business helped drive a strong estimated quarterly Adjusted EBITDA margin and year-over-year growth in Adjusted EBITDA. CARS expects to continue to invest in the business through increased marketing and selective hiring to drive growth in the coming quarters. CARS continues to work to reduce leverage and optimize its capital structure.

CARS continued to see strong value delivery to its customers during the third quarter, capitalizing on consumers' desire to connect with dealers digitally, leading to all-time low cancellation rates and net growth of nearly 100 dealer customers during the quarter.

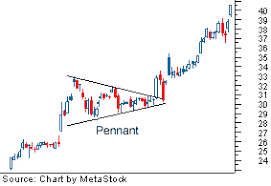

The Chart

I like the news on CARS, and I think they are due for some positive price action. This chart is telling me it wants to be taken out for a swing.

- Buyers have been accumulating since August, with a bullish trend since April.

- Currently trading below both moving averages, but holding the trendline.

- Lower lows started in August, followed by a love tap on the white trendline, bouncing off of it, and potentially creating higher lows. A bullish indication.

- Following the bullish pennant pattern, it looks to be coiling under pressure, potentially going to follow a breakout.

Here's an example of a bullish pennant, because really, who knows this crap off of the top of their head?

All things said, I intend on taking CARS out for a lovely swing date. It was trading in the 30's in 2018, I want $16 so I can double my money and finally be able to afford an Elon Musk product.

**Not a financial advisor. Articles are opinions only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.