A closer look at WISH stock

Is the internet's obsession with Wish stock brewing a perfect meme storm?

Meme stocks have proven themselves to be an asset class this month of June, with the former IPO stock having been pumped on the internet by Reddit and Twitter. So what, who cares about an e-commerce company that takes months for your cheap products to be delivered?

Most of these joke stocks are one-hit wonders, they get pumped and then forgotten about. But then you have companies with a narrative, like GameStop's comeback and AMC evading bankruptcy. These storylines help push the stock price up as hype builds and rocket emojis get posted everywhere.

And now we have a company that can rally like a meme stock: The dollar store of e-commerce platforms.

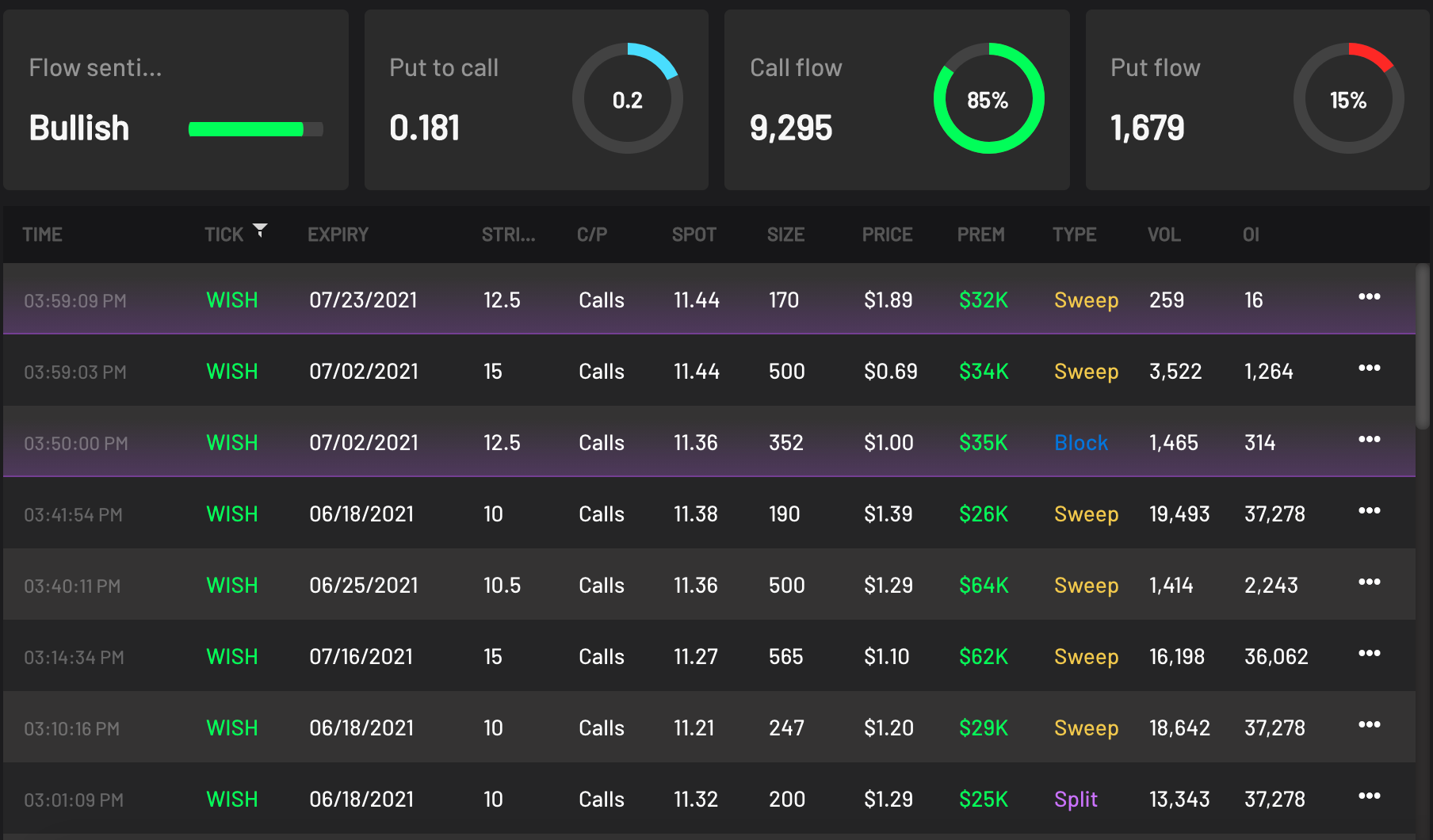

Chart, Option Activity, Headline

The chart shows how much room WISH has to run, having been offered to the market earlier this year at $24 when they IPO'd. The options flow shows how many buyers are pushing the price of the stock. Essentially, we should get 100%+ returns on this. Think Amazon, Shopify, and Alibaba.

*Click here to see institutional ownership of WISH. Yes, the big boys are in.

The writing is on the wall for WISH to be the next meme stock. It has a massive retail presence, a catchy ticker name, and strong fundamentals. May our wishes come true as we bask in multi-bagger gains and cheap Chinese products.

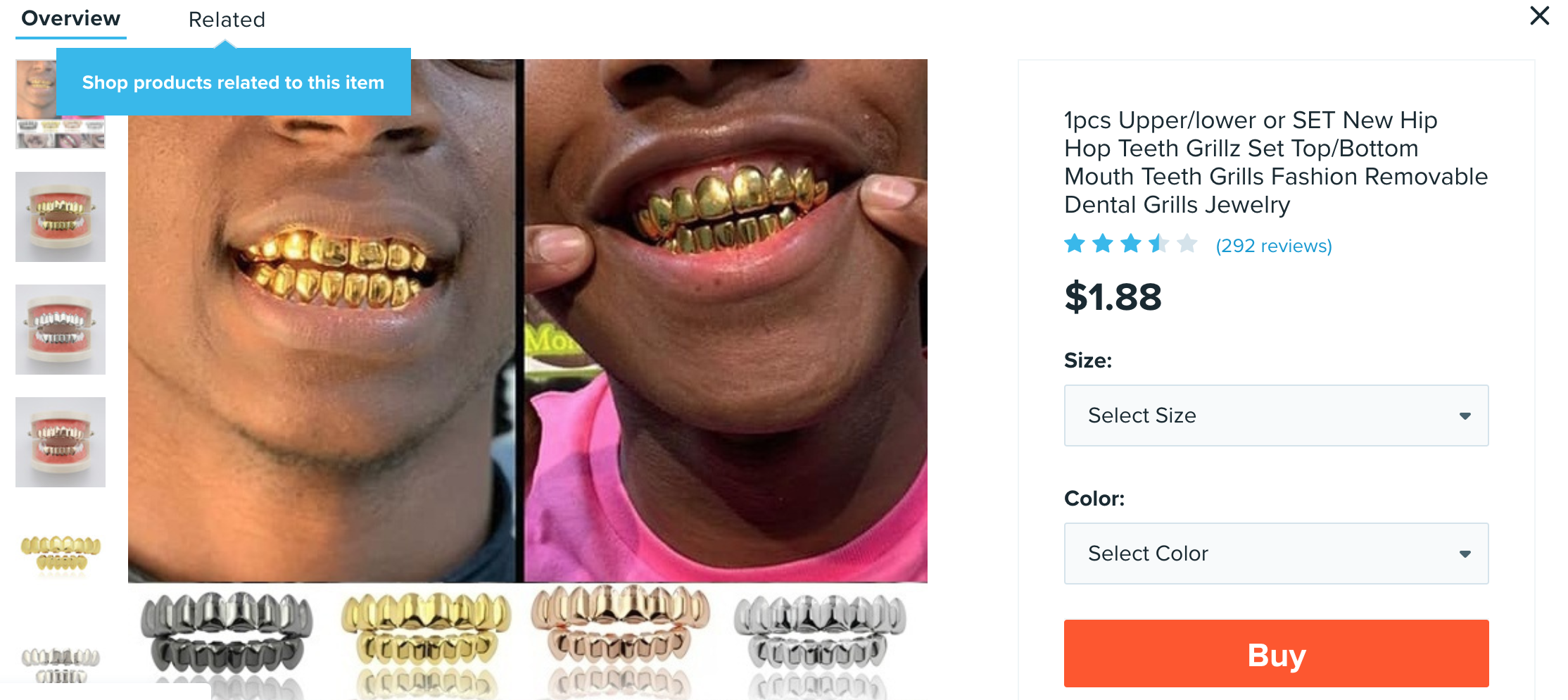

We're gonna need these when we flex on the moon.

*Not financial advice.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.