The Weedmaps SPAC Is Worth Watching

Weedmaps is going public through a special purpose acquisition with Silver Spike Acquisition. It's like Yelp but for cannabis.

Silver Spike Acquisition agreed to a business combination with WM Holding, owner of Weedmaps and a SaaS software business, in a $1.4 billion deal.

Summary

The Cannabis Market is projected to grow at a compounded annual growth rate of 14.5% during the forecast period of 2020-2025.

- The indicative drivers, or the reason for weed stonks to boom, is a result of the medicinal properties of cannabis, increased legalization, advances in genetic development, and the intellectual property of cannabis.

- Continuous research and standardization of products for medicinal purposes are expected to increase in popularity.

- Structural tailwind behind cannabis retail. States have shifted to medical and recreational use, but there's still a long way to go. The Democratic sweep has certainly helped, though.

- At the moment, very few cannabis retailers have created brand power for themselves. They will need a centralized platform to help them achieve business goals.

- Why don't e-commerce giants step in? Google does not get involved in regular pharmaceuticals and Amazon has a long track record of staying away from products with complex regulatory issues.

- State regulations are key for retailers, even if cannabis becomes legal on a federal level. States will want to keep tax revenue and economic activity within their own borders, so the products won't ever likely cross the laws and local laws will remain important. We need to be able to have a one stop shop for our Mary Jane.

Weedmaps is a cannabis e-commerce platform

- Weedmaps is a dominant cannabis SaaS (software as a service) player and consumer marketplace. They operate a high-margin marketplace service and never actually touch the plant. They are essentially the middleman between buyer and seller. They are being compared to the Yelp/Amazon of the weed space.

- Has a 12-year track record and has over 10 million monthly active users spread across nine countries on its propriety marketplace. Those users purchase a variety of cannabis products and the website aids with descriptions, reviews and easy ways to place orders and get deliveries.

- Dispensaries that use Weedmaps account for 55% of retail licenses across all markets where it operates. Weedmaps can also prevent retailers from making mistakes, like seeing their licenses being revoked for a simple misstep. Cannabis retailers may have a tough time advertising through billboards, social media and t-shirts, as it's difficult to monitor the effectiveness. I usually roll my eyes at weed shirts. But Weedmaps can provide advertising and marketing services to build brand awareness.

- CEO Chris Beals was formerly a technology transaction attorney at Davis Polk & Wardwell.

- End users have used Weedmaps much more throughout the pandemic. The company has said that the monthly active user engagements have jumped to 80 million in September from 50 million in January, with increasing usage in the recent months.

Qualitative

- Weedmaps has developed an operating system for cannabis retailers, solving the issues that come with regulations and law by building compliance by design into their software system. It allows businesses to survive and grow while also giving access to requisite data needed to make the marketplace transactable and convertible for consumers.

- The Yelp for weed; driving growth for cannabis retailers. Over 10 million monthly active users and 18 thousand business listings, making Weedmaps the largest proprietary marketplace for cannabis.

- Over 70% of users on the site consume cannabis daily.

- No normalized business product inventory and no normalized clinical effect. They don't get high on their own supply, rather acting as an e-commerce platform where users and buyers fill their own needs. They aggregate with almost all third-party Point of Sales systems as well as having their own Point of Sales system. This means they provide tech solutions in addition to their online market for cannabis retailers.

- Gartner, the world leading research and advisory company, anticipates that software as a service solutions will generate revenue close to $105 billion in 2020 alone. That is $20 billion more than Gartner estimates for just a year ago, in 2019. This movement has been thanks to pandemic, forcing companies to pivot to remote work—with software as a service solutions among the easiest to adopt and roll out.

- Among cloud options, the outlook for software as a service is arguably the brightest. After all, the overall growth of the software as a service industry will remain consistent through these years as more companies adopt these solutions for a variety of business functions.

Quantitative

- Founded in 2008, Weedmaps initially sought to provide individuals with information about their nearest medical marijuana dispensaries. The company has seen rapidly rising revenues since its founding, with revenue climbing from $20,000 per month in 2009 to $400,000 per month in 2010.

- Rated 4.9 stars on the app, 189k reviews.

- The merger with Silver Spike is predicted to bring Weedmaps up to $575 million in proceeds.

- The estimated post transaction equity value of the combined company is approximately $1.5 billion and provides up to $575 million of gross proceeds through the approximately $250 million of cash held-in-trust by Silver Spike Acquisition Corp. and a fully-committed common stock PIPE of $325 million.

- WMH is expected to generate $160 million in revenue for this year, continuing its 12-year streak of profitability.

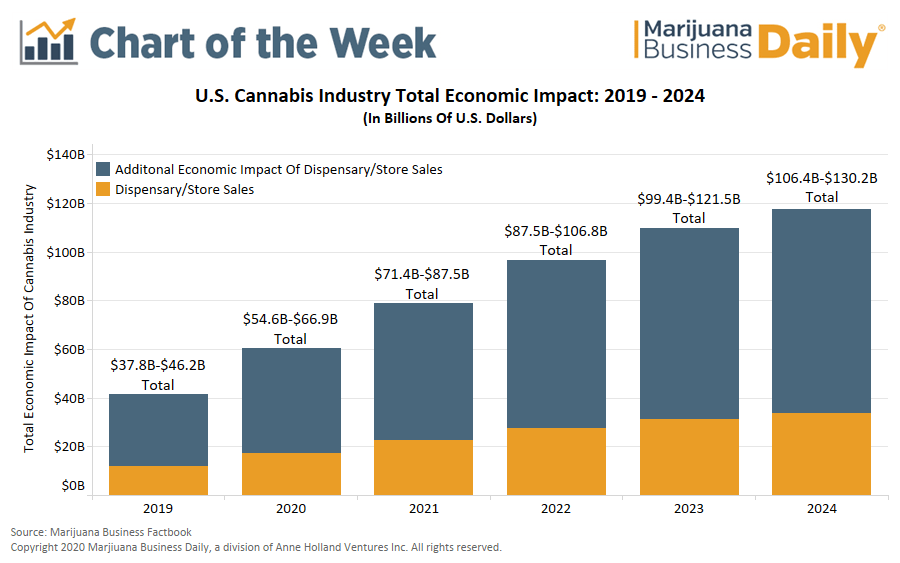

- Estimates published in the Marijuana Business Factbook show the total economic impact of legal cannabis sales increasing from $38 billion-$46 billion in 2019 to $106 billion-$130 billion by 2024 – a 181% increase.

The Chart

- The argument for an ascending triangle pattern can be made here, which is a bullish pattern. I'm looking for for a drop to the 15's, as it looks like 15.80 has been the most recent support level. Reason is the merger is still a little while away (supposed to be closed by February 4th).

- Look at the order book. I like to use level II to figure out supply/demand. You can see a giant wall of 1,000 shares at 17.60. There are bids in the 15 area, as well as high 13's. I wouldn't mind buying some at these levels and then just going HAM on a drop. The market is weird, things drop when they don't make sense. Be reactive and don't try to predict. If it falls I buy, if it goes up I buy small and make gains on what I chased.

- You can see your risk above, the breakout was around 14.50, so that is a good area to base off risk level. Of course if things go awry this can go back near $10, and I know we're late to the party on this one. I think we can see $20, this short term higher reward might not be there, but it's an interesting investment opportunity to gain exposure to a marijuana SPAC.

I think a centralized marketplace for Cannabis can be a home run with the Democratic sweep and Biden's favoritism towards cannabis legalization. Weedmaps essentially gives you the scoop on cannabis dispensaries near you, isn't that a great way for retailers to create brand awareness? Especially now with changing policies?

I do hate the price right now because of how high it is, and I think it's one to keep an eye on for dips, but if you want to be a part of it then just buy small and load on dips, why not? They are at 95% completion of the deal and the estimated completion deadline date is February 4th. I do think this is a stock that will uptick in price as the weed run gets hotter and hotter.

Either way, a joint will be lit to celebrate the gains or to forget the losses.

**Not a financial advisor. Articles are opinions only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.