Metromile, a Leading Digital Insurance Platform, To Go Public

Metromile, the leading digital insurance platform and pay-per-mile auto insurer, is set to go public.

On November 24th, Metromile and INSU Acquisition corp entered a business combination agreement.

Summary:

- Metromile's fully digital customer experience is designed for the modern driver. Customers simply sign up, access customer support and file claims through the mobile app. Claims are taken care of quickly and, in most cases, are fully automated.

- Transaction includes commitment for $160 million PIPE led by Social Capital (The Chamath special), joined by investors including Miller Value, Clearbridge, Hudson Structured, Mark Cuban, and New Enterprise Associates.

- Metromile expanding to 49 states by year-end 2022 and projecting $1 billion of premium run-rate by year-end 2024.

- Approximately $1.3 billion combined company pro forma implied market cap. Transaction to provide combined company with up to an estimated $294 million in cash to pursue growth initiatives.

Metromile is the leading digital insurance platform and pay-per-mile auto insurer. You essentially pay per milage on your car insurance, instead of getting screwed with outrageous monthly/annual rates. If you're like me and live the hermit life, you're likely overpaying. Which reminds me, I need to make a few phone calls tomorrow...

About Metromile

Metromile is disrupting the $250 billion U.S. personal auto insurance marketplace with real-time digital auto insurance personalized for low milage drivers. Around two-thirds of U.S. drivers are considered low-mileage and are overpaying because they don't pay per mile. Metromile's insurance customers save 47% on average compared to the cash they were burning with that stupid gecko.

Metromile's fully digital customer experience is designed for the modern driver. Customers simply sign up, access customer support and file claims through the mobile app. Claims are taken care of quickly and, in most cases, are fully automated. Street sweeping alerts and auto health tips are just two of the many exclusive features that are offered, engaging drivers during their drives. The result? A community of loyal customers who enjoy bonus features on top of saving money. What's not to like? With data driven science being an integrated part of the company core, Metromile unlocks the predictive value of data generated by autos and mobile phones. Its model translates into a better customer experience, higher customer retention rates, and greater operating profits, while lowering customer acquisition costs, fraud, and servicing expenses.

Third Quarter 2020 Key Financial Metrics

- Average annual premium per policy of $1,128, compared to $995 in the second quarter of 2020, returning to pre-COVID levels.

- Loss ratio of 58.2%, compared to 71.4% in the third quarter of 2019.

- Contribution profit of $4.5 million, a $3.8 million increase compared to $0.7 million in the prior-year period.

- Contribution margin of 16.4%, a 1,400 basis point improvement compared to 2.4% in the prior-year period.

- One-year new policy retention of 70.4%, compared to 63.1% in the second quarter of 2020.

- Average new customer lifetime is projected to be 3.5 years as of September 30th, 2020, compared to 3.4 years as of June 30, 2020.

Fourth Quarter 2020 Update – Returning to Top-Line Growth

- Due to Metromile’s significant improvements in reducing its customer acquisition cost, it is increasing fourth quarter 2020 marketing spend to execute its growth plan for 2021.

- Produced nine consecutive weeks of sequential increases in weekly policy sales in the fourth quarter to date (over 4,700 total new policies in force), while cost per acquisition has remained relatively stable.

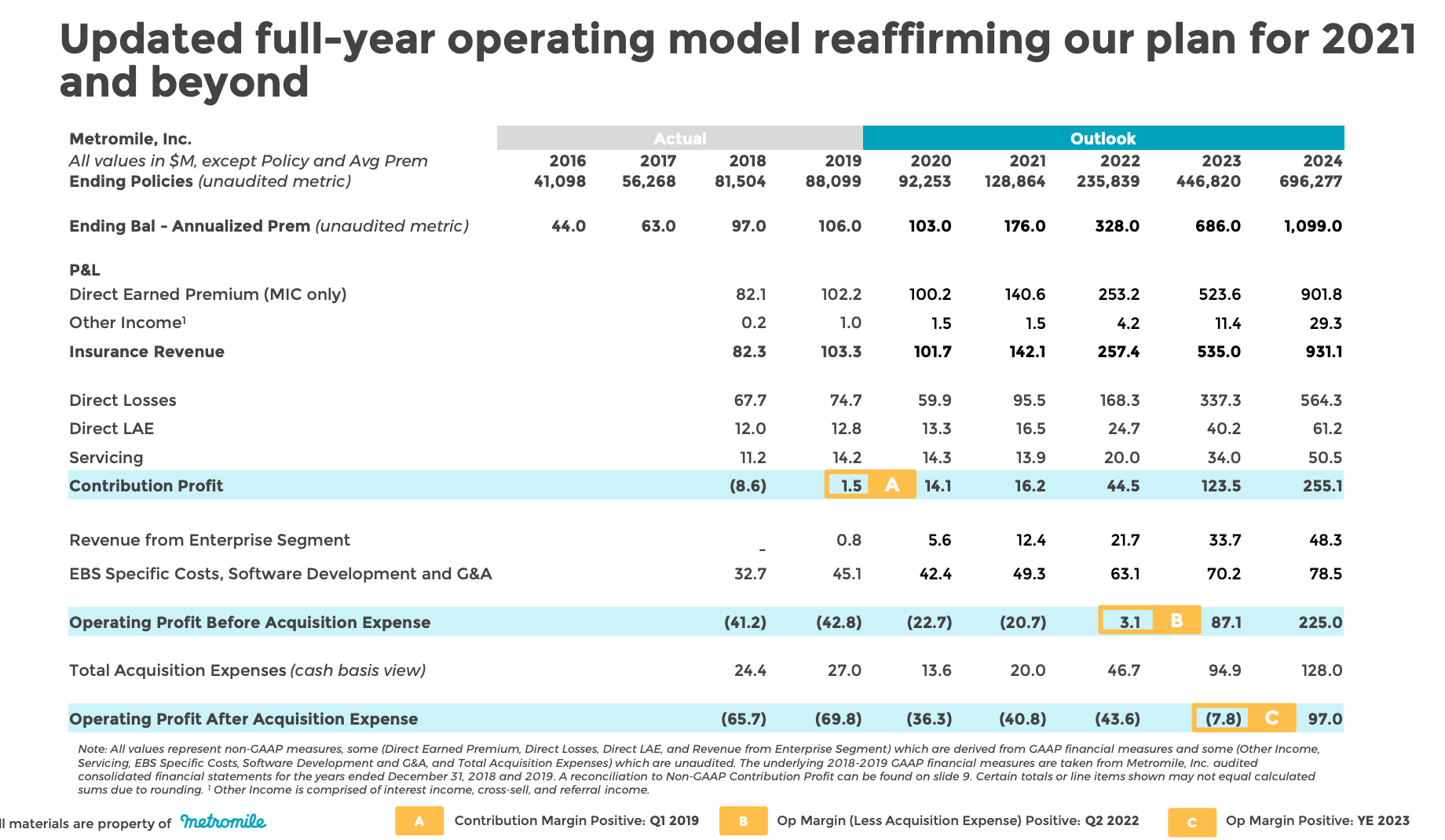

Full Year 2020 Forecast Update; Reaffirming Outlook for Full Year 2021 to 2024

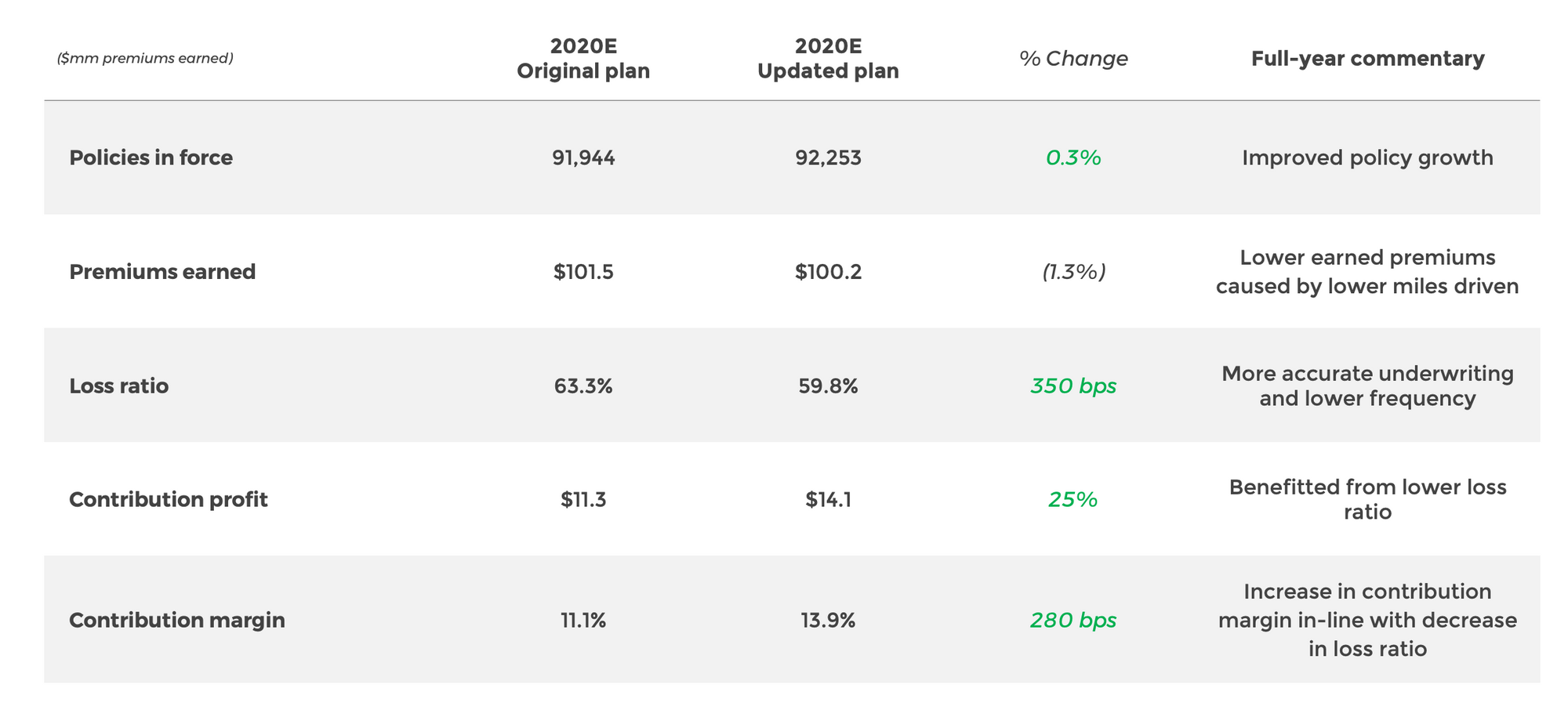

Metromile has reaffirmed its initial outlook for the full years 2021 to 2024 and updated its full year 2020 outlook as follows:

- Policies in Force – 92,253 policies expected to be in force at year-end 2020, compared to its initial projection of 91,944.

- Direct Premiums Earned – $100.2 million of direct premiums expected to be earned, compared to its initial projection of $101.5 million, due to lower miles driven related primarily to the ongoing pandemic.

- Loss Ratio – Full year loss ratio expected to be 59.8%, an expected 350 basis point improvement compared to Metromile’s initial projection of 63.3%, due primarily to improved underwriting and lower claims frequency.

- Contribution Profit – Full year contribution profit expected to be $14.1 million, a 25% increase compared to the original investor presentation forecast of $11.3 million, driven by the expected improvement in loss ratio.

- Contribution Margin – Full year contribution margin expected to be 13.9%, an expected 280 basis point improvement compared to the original investor presentation forecast of 11.1%, driven by the expected improvement in loss ratio.

**per their investor presentation.

Who's behind it?

None other than billionaire investor Chamath Palihapitiya and deadliest shark Mark Cuban. I also can't forget Dan Preston, Co-Founder of AisleBuyer (which got bought out by Intuit in 2012, by the way). Under Dans leadership, Metromile has experienced significant policy, premium, and employee growth.

“The option to pay for insurance by the mile is a game changer and why I’m incredibly excited about Metromile’s future!” said Cuban.

Follow the money.

Buffett had Geico.

— Chamath Palihapitiya (@chamath) November 24, 2020

I pick @Metromile.

The company announced today that it is going public via a SPAC ($INAQ) and I led the PIPE.

This is an incredible company disrupting car insurance and giving customers a best in class experience.

My one pager is attached. 🙏🏽 pic.twitter.com/r0ibZ0Tq5Z

No U.S. carrier owns 20% share of the auto insurance market and over 110 carriers have $100 million or more in annual revenue. The largest auto insurance companies in the U.S. are StateFarm, Geico, Progressive and Allstate.

Financials

Metromile sees its annual run rate hitting $1 billion by 2024. The software revenue is expected to hit $48 million by 2024 with four companies currently using the company’s cloud SaaS platform.

Metromile Highlights

- A leader in digital auto insurance

- Largest pay-per-mile digital insurer in the fragmented $250+ billion U.S. auto insurance market.

- 76% average annual premium growth rate from 2015-2019.

- Average new customer lifetime of 3.4 years; customers that have been with Metromile for at least one year have average customer lifetime of 5.2 years.

- Proprietary technology and data create barrier to entry. - Unique customer value proposition

- Average customer savings of 47% from previous auto insurance policy.

- Net promoter score of 55 overall; net promoter score of 75 for claims process. - Data science-driven economic advantages

- Approximately 3 billion miles of driving data collected.

- Moment-by-moment driving behavior data derived from plug-in devices, connected vehicles, and mobile phones are built into pricing and underwriting.

- Industry-leading 59% loss ratio year-to-date as of September 30, 2020; automated fraud discovery delivers triple the recovery over the industry average. - Poised to grow and scale rapidly nationwide

- 21 state footprint by end of 2021 and 49 states by end of 2022.

- Customer growth engine leverages digital, offline, and partnerships.

- Ride Along “try before you buy” app converting 20% of users into customers.

- Expect to achieve $1 billion of insurance premium run-rate by year-end 2024. - Industry-recognized Metromile Enterprise offering growing rapidly

- Automated claims and fraud detection tools offered as a cloud-based enterprise software offering to global P&C insurers.

- Earning multi-million-dollar annual recurring revenue from enterprise software licenses with four active deployments.

- Expect to achieve $48 million of enterprise software revenue in 2024. - Experienced leadership team

- Diverse team of Silicon Valley’s big name technologists and insurance industry veterans of organizations including Google, Uber, Progressive, SAP, and Salesforce.

**Information from Globenewswire.com

The chart

The risk to reward ratio is actually not great, as it's been gaining upward trajectory taking us farther from a safe entry point. Of course, it's 2020 and stocks only go up. The chart is a stinker because it's so new, so this price action is not the best. You do see a lot of buying going on, but that's it. I believe in the company and I believe in the team behind this investment. I'll add dips, given we are so far away from this merger being complete. Keep your eyes open for news, this is a longer term swing into quarter one.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.