Industries To Watch in 2021

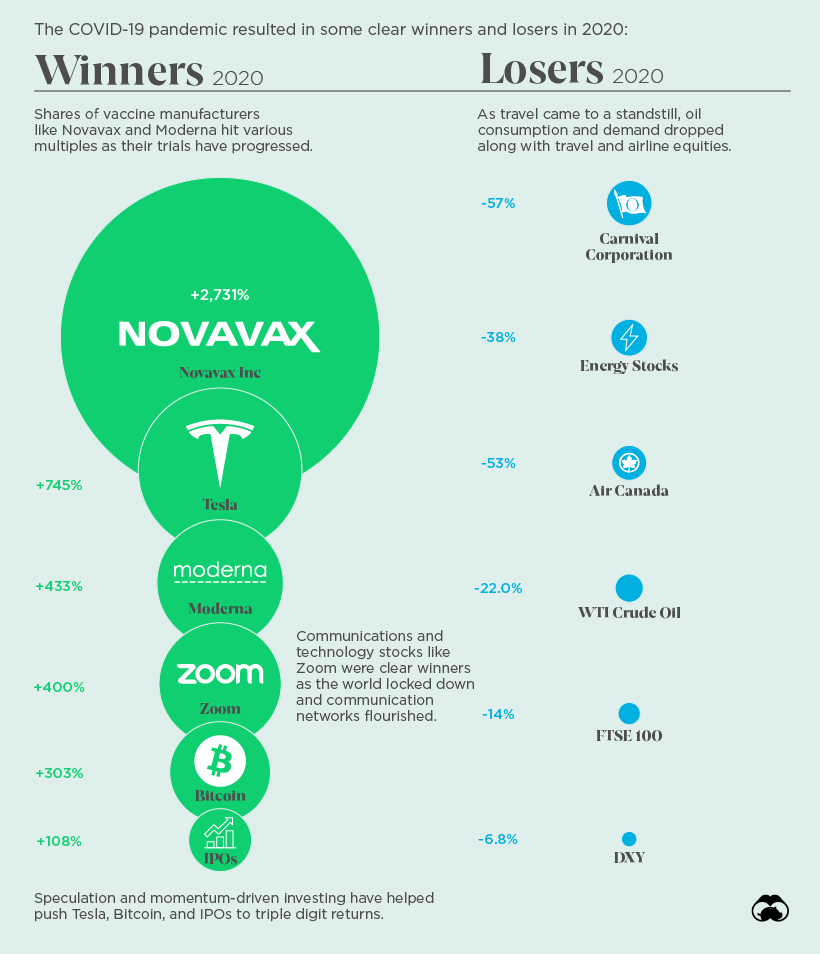

SPAC, Bitcoin, and Electric Vehicle stocks surged in a whirling year for financial markets. Can some of these trends continue in 2021?

The market has been so hot lately, reaching all-time highs and kicking every bear in the nuts. You had some industries run with incredible momentum like technology, solar, electric vehicle, cannabis, and SPACs. I think the momentum continues into this year with crazy valuations and fiscal/monetary policies. The U.S. Federal Reserve has indicated that it might not raise rates until at least 2023. Low bond yields make stocks sexier. But we ride whatever pump is going on. The way to win in this game is to load before the pump even happens.

Cannabis

The pandemic, as devastating as it was, opened up an opportunity for many industries. We have seen COVID accelerate many trends in business, from e-commerce to digital payments; look at Bitcoin breaking 33,000 on a Saturday morning. The cannabis industry has been popping off lately, as a record-high percentage of Americans now support cannabis legalization (take that D.A.R.E., HA!). I personally think it's a no brainer to create another source of revenue for state economies. Cannabis soured on Election day, with legalization passing in Arizona, Montana, Missouri, New Jersey, and South Dakota. Over 111 million people now live in a state with legal recreational cannabis. By 2021, the legal industry is expected to be worth $24.5 billion.

Legal cannabis sales have reached $20 billion this past year, and growth is expected to top $40 billion annually within the next four years. A growing industry means more companies have to hire people, and these companies are trying to keep up. The legal cannabis market supports 243,700 full-time jobs, and that is set to multiply by 250% by 2028. Apart from creating jobs, cannabis will also strengthen state economies and generate opportunities for tax revenue. The pandemic accelerated demand for e-commerce and digital payments, ain't nobody wanna see your face anymore. Dispensaries quickly turned to e-commerce and digital payment solutions in order to keep their employees and consumers safe while modernizing their business. In short, the hot tech sector combined with a growing industry like cannabis equals fire emoji.

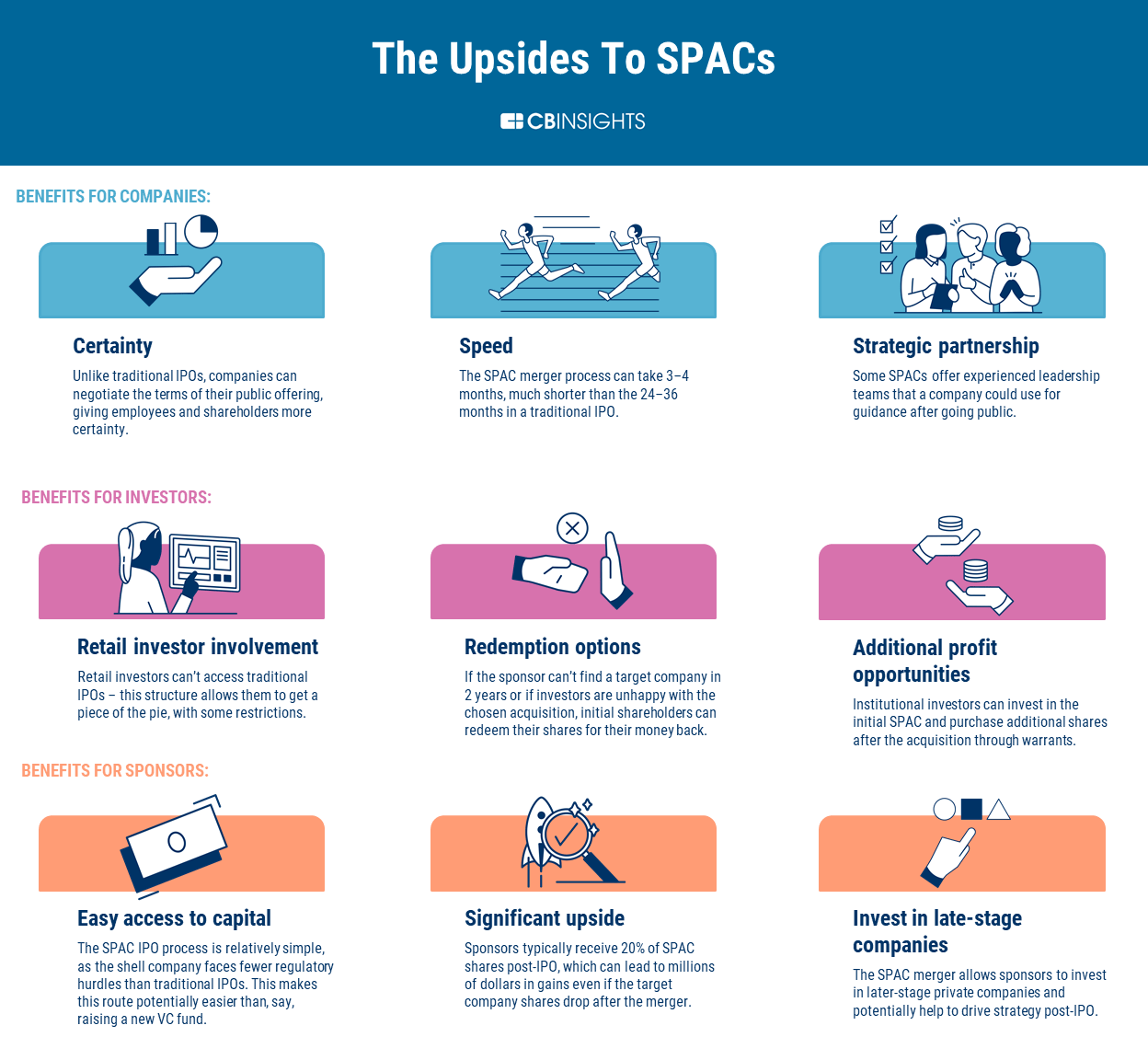

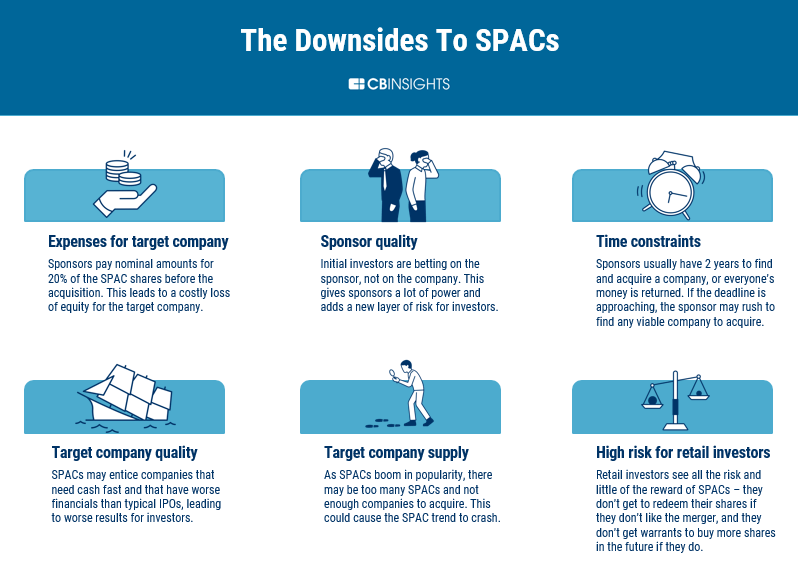

SPACs

Special Purpose Acquisition Company mergers have been life-changing for many. SPACs are shell companies that raise funds from investors and then go looking to acquire and take public a company that's currently private. The enthusiasm from investors has skyrocketed the value of SPAC deals, as the asset class has raised more than $72 billion in 2020 alone, in comparison, $13.6 billion was raised through 59 deals in 2019. The popularity has risen due to the fact that SPACs allow investors as well as the target firms the ability to leapfrog the traditional listing process and regulatory hurdles that come with that.

So let's say you go out and buy a SPAC for $12. Even after a SPAC goes public, it can take up to two years to pick and announce the target company it wants to acquire, or technically speaking, merge with (the corporate charter specifies the exact time frame, per SEC regulations). If it doesn’t, the SPAC is liquidated, and funds it raised are supposed to be returned to investors. You'll receive $10 for every $12 as that is the floor. Of course there's more to this, but it has been a relatively less risky investment as of late.

SPACs generally have to place the investor money in a trust or escrow account to keep it secure until the target company is publicly announced. At that point, if investors don't like the deal anymore, they should be able to recover their money.

Why SPACs?

- They're cheap. Many SPACs are priced at $10 a share, well within reach for us small fish. And they stay low for a while. Look at SPACs like QuantumScape and DraftKings. They started trading in the low double digits (teens) and have grown massively after going public. We have the opportunity to acquire large companies in the beginning phase.

- The new breed of SPACs focuses on sexy sectors in the tech or consumer fields. Promising startups like Opendoor, Clover Health, and XL Fleet have seen large increases, with Clover going up over 50% as the merger vote approaches (January 6th).

Solar

Over the past decade, solar has been on a solid growth trajectory because of the country's attempt to reduce dependency on fossil fuels and make a switch over to cleaner energy sources. You see those turtles and pelicans covered in oil? F that. This year, factors like the declining cost of solar projects as well as corporate investments and supportive government policies are expected to boost the solar market, as well as investor sentiment (wink).

Lately, prices of solar modules have dropped because of improved labor productivity, low supply chain costs, and higher module efficiency. This drop in prices along with technological innovation has brought down the price of solar projects. According to the Solar Energy Industries Association, the cost to install solar in the U.S. has dropped more than 70% over the last decade. Things like solar investment tax credits have created more growth in the industry, with residential and commercial solar investment tax credits helping the solar industry reach 50% growth over the last decade alone. Follow z money, I think solar stays hot.

Cyber Security

F'ing Russians man.

The Cyber Security Market is estimated to record significant growth this decade, anticipated to reach over $269 billion by 2026. The increased demand for protection of sensitive data (all started with the dang Jennifer Lawrence nudes cloud hacks, didn't it?) and increasing cyber terrorism (where are you MegaMan?) has boosted the adoption of cybersecurity solutions. The additional increased demand from small and medium enterprises has supported market growth over the years. Increasing investments by vendors in technological advancements and the growing demand for cloud-based cybersecurity solutions will make this a hot industry for 2021.

The cases of cyber attacks in the healthcare sector have increased over the year, with thirsting demand for electronic health records in the black market fueling these attacks. The healthcare sector is prone to cyber-attacks due to limited budget allocations by healthcare institutions for cybersecurity. The healthcare sector is mainly comprised of small practices and rural hospitals, which lack the moola to invest in cybersecurity, thereby increasing their risk of getting hacked. The introduction of affordable cybersecurity solutions for the healthcare sector, growing awareness, and growing cases of cyber-attacks are expected to promote the adoption of cybersecurity in this sector. I think money will roll into cybersecurity, for the sake of our embarrassing selfies to never be seen and grandpas stolen medical records to not result in his bank account being liquidated to fund a crypto account.

Electric Vehicle/Batteries

What an incredible year for the poster boy of electric vehicles, Tesla, with their stock price skyrocketing to Mars even after a reverse split. Elon Musk saw his company turn into the largest car company in the world by market value. It was recently announced that they surpassed expectations and delivered 500,000 vehicles in 2020. The momentum carried into other smaller startups striking deals with large partners to help get their products into the market. The next five years look to be filled with product announcements in EV fleets, cars, vans, etc. The future is electric, and if 2021 can carry 2020's momentum, we will see sparks fly again. It's still a relatively young industry though, and with the aftermath of the virus and fluctuations in the market, it's never a sure thing.

Peter Rawlinson, CEO of Lucid Motors, goes on to say:

It's marvelous to see there's so much fascinating interest in the market. But what I would say is this: there are some bad actors out there giving this space a bad name, and they're not all going to succeed and there will be blood on the carpet.

Some of these electric vehicle companies, if not most, have crazy valuations based off of future earnings. Tesla's P/E ratio is absolutely insane (1,417.01.) You have companies like SOLO, KNDI with absurd P/E ratios that inflate the share price. I'm not complaining here, just be careful if/when the sentiment changes. I doubt I'll see a SOLO on the road anytime soon, it looks like a clown car.

As far as batteries go, this is the thing that will power the damn EVs. The market size is expected to grow by $44.24 billion by 2024. It's projected to show a Compound Annual Growth Rate of 22% during the forecast period. The "YOY" (year-over-year) growth rate for 2021 is estimated to be 17.72% by the end of 2024.

Speaking of energy sources, the hydrogen fuel energy alternative market is one that also cannot be left in 2020. As we look for ways to replace dirty fossil fuels, we must also take a look at hydrogen-based power. While not a new concept, the idea of hydrogen fuel cells are starting to pick up steam, especially in the automobile industry. Hydrogen has always been a thing, but it was never scaled into larger-scale uses. And because of how much it costs and concerns over how safe it was, it wasn't really ever popular. Enter 2021: where we are afraid of climate change and have a great demand to reduce our global carbon emissions. This turning point has piqued investor interest in hydrogen fuel cell technology. The Hydrogen Council projects that hydrogen could grow from 1% of the energy mix today to 18% by 2050, which would translate to a production growth rate of something closer to 7% from the current 3%.

I found this article online that pretty much highlights the situation.

As a result of our research, we developed five major findings:

- Hydrogen fuel cell trucks are just starting to see real-world use and their adoption is being driven by regional or national considerations that are much bigger than what exists for trucking fleets.

- Battery electric trucks should be the baseline for hydrogen fuel cell electric vehicle (HFCEV) comparisons, rather than any internal combustion engine alternative.

- As for all alternatives, fleets should optimize the specifications of HFCEVs for the job they should perform while expecting that the trade cycles will lengthen.

- The future acceleration of HFCEVs is likely not about the vehicles or the fueling but more about the creation and distribution of the hydrogen itself.

- The potential for autonomous fuel cell trucks to operate 24 hours a day adds significant opportunity for making sense of capital and operational investment in hydrogen.

Predicting the market is a fool's game, I'm just here to give the scoop on what could be hot. Don't take this as gospel, just keep your eyes peeled for the opportunity. There's always a bull market somewhere.

HONORABLE MENTIONS:

Blockchain/Bitcoin-related stocks

Psychedelics/Gene Therapy

Artificial intelligence/Robotics

Autonomous Driving/LiDAR/Semiconductors

Cyclical (Finance, Energy, Industrials)

Gambling

Silver

Cloud

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.