Indie Semiconductor Enters Definitive Merger Agreement With Thunder Bridge Acquisition II

Indie is empowering the Autotech revolution with next-generation automotive semiconductors and software platforms. Keep this one on your watchlist.

Indie Semiconductor, a next-generation automotive semiconductor and software innovator, and Thunder Bridge Acquisition II (THBR) announced they have entered into a definitive agreement for a business combination that would result in the combined entity continuing as a publicly listed company. I’m late to the news as this happened December 15th, but the Twitter buzz was too strong this Monday, and this popped up on my scanner Sunday night, so I’m rolling with it. Once the transaction closes, Indie Semiconductor will be listed on the Nasdaq under the ticker symbol INDI. This is an electric vehicle, LiDAR and SPAC play with valuations based on future growth. You know I love these future revenue growth hype stocks! Thanks for setting the precedent, Nikola!

Spoiler: This is not like Nikola.

Summary:

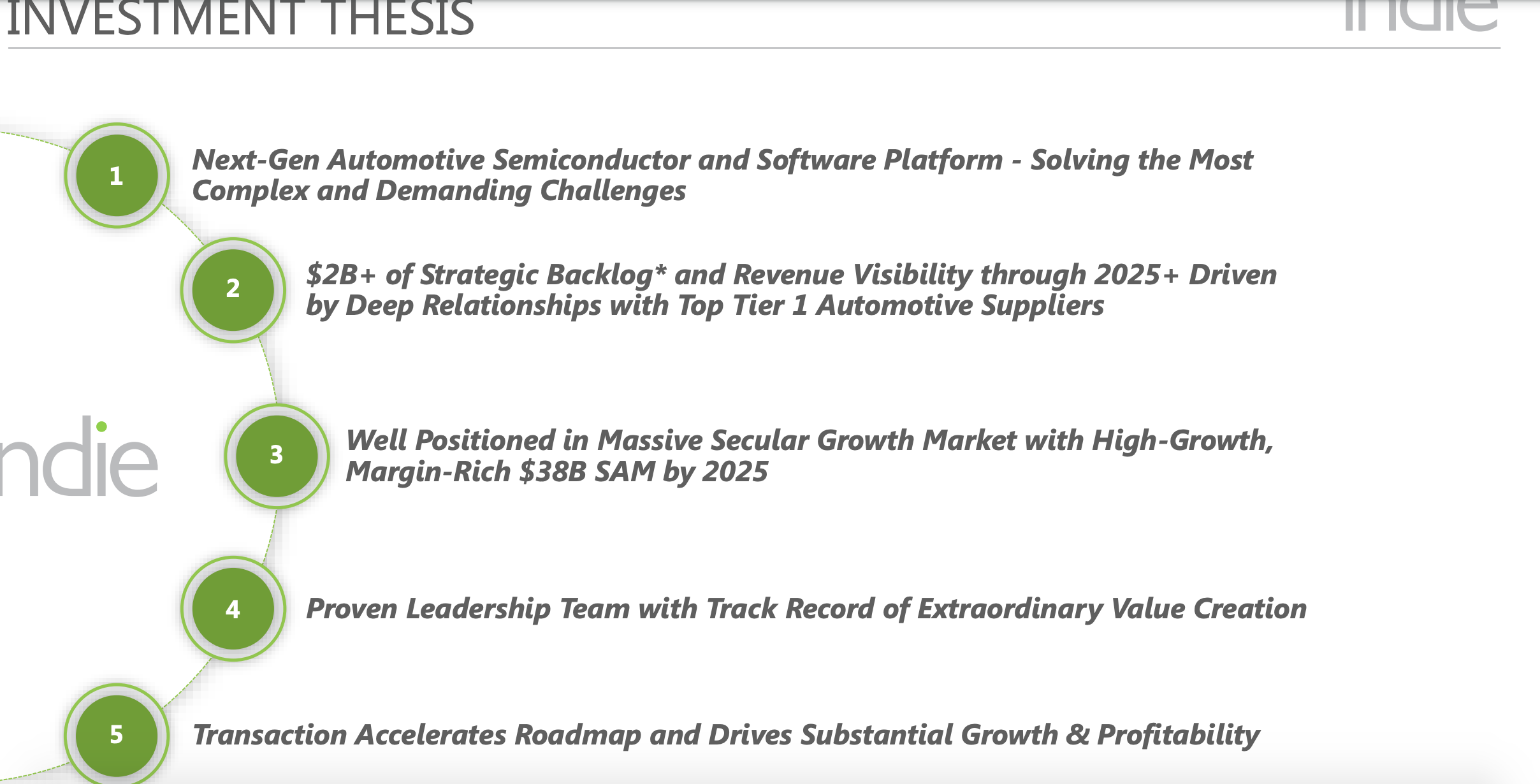

- Indie's automotive semiconductor portfolio addresses a $16 billion market, which is expected to exceed $38 billion by 2025 driven by strong demand for silicon and software content in automobiles.

- Led by a strong management team, and a strong hand in Donald McClymont. He held executive roles at Axiom, Skyworks, and Conexant. Joining him are Ichiro Aoki, Ph.d., Scott Kee, and Thomas Schiller, who killed the IPO and M&A game at Skyworks. They have demonstrated a strong track record for scaling new businesses and creating outstanding shareholder value.

- The transaction reflects an implied equity value of roughly $1.4 billion.

- Tier 1 automotive customers are demanding a step function increase in electronic performance and complexity while simultaneously experiencing a reduction in qualified, field-proven suppliers caused by semiconductor industry consolidation. This creates enormous upside and opportunity for Indie.

What does Indie Semiconductor do?

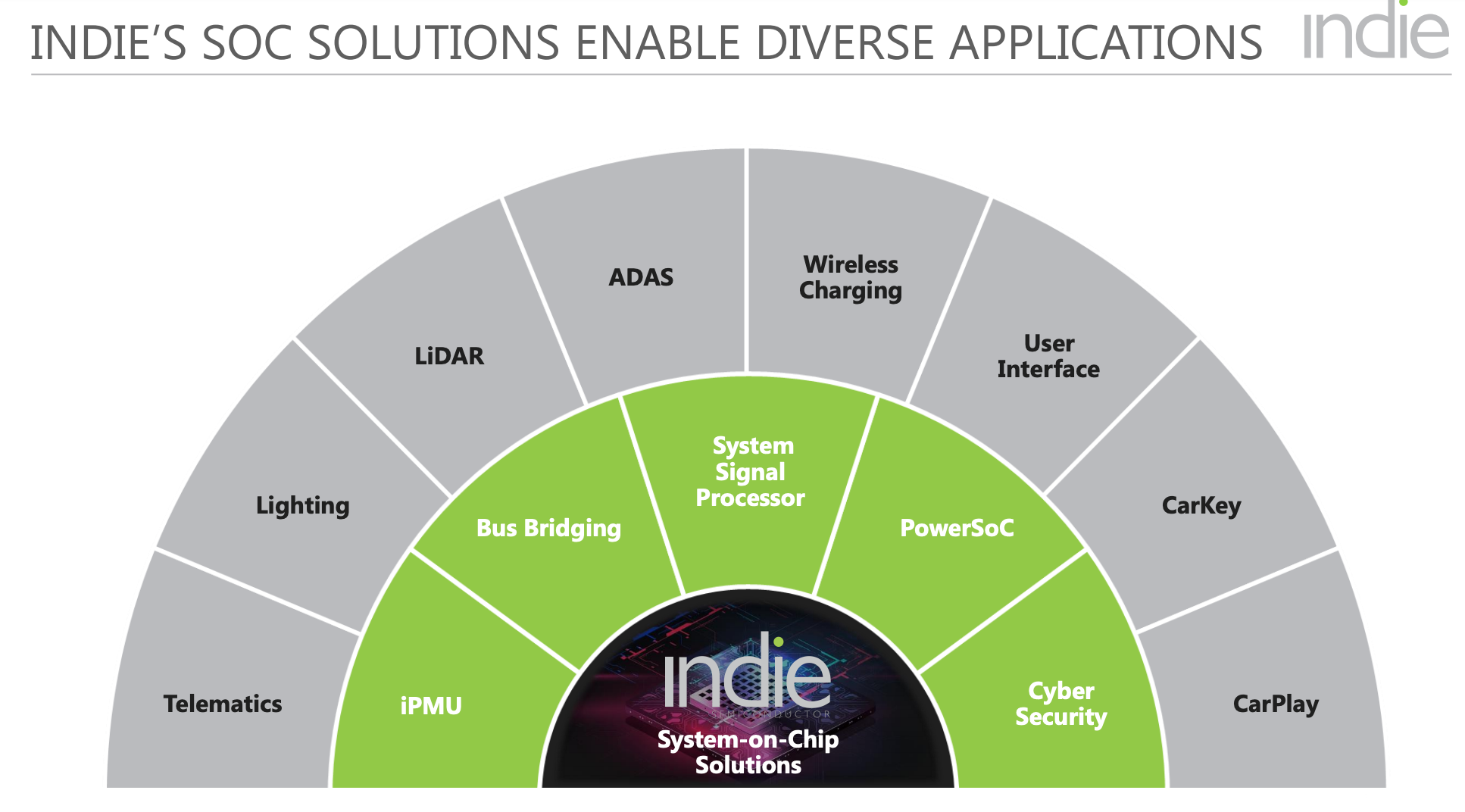

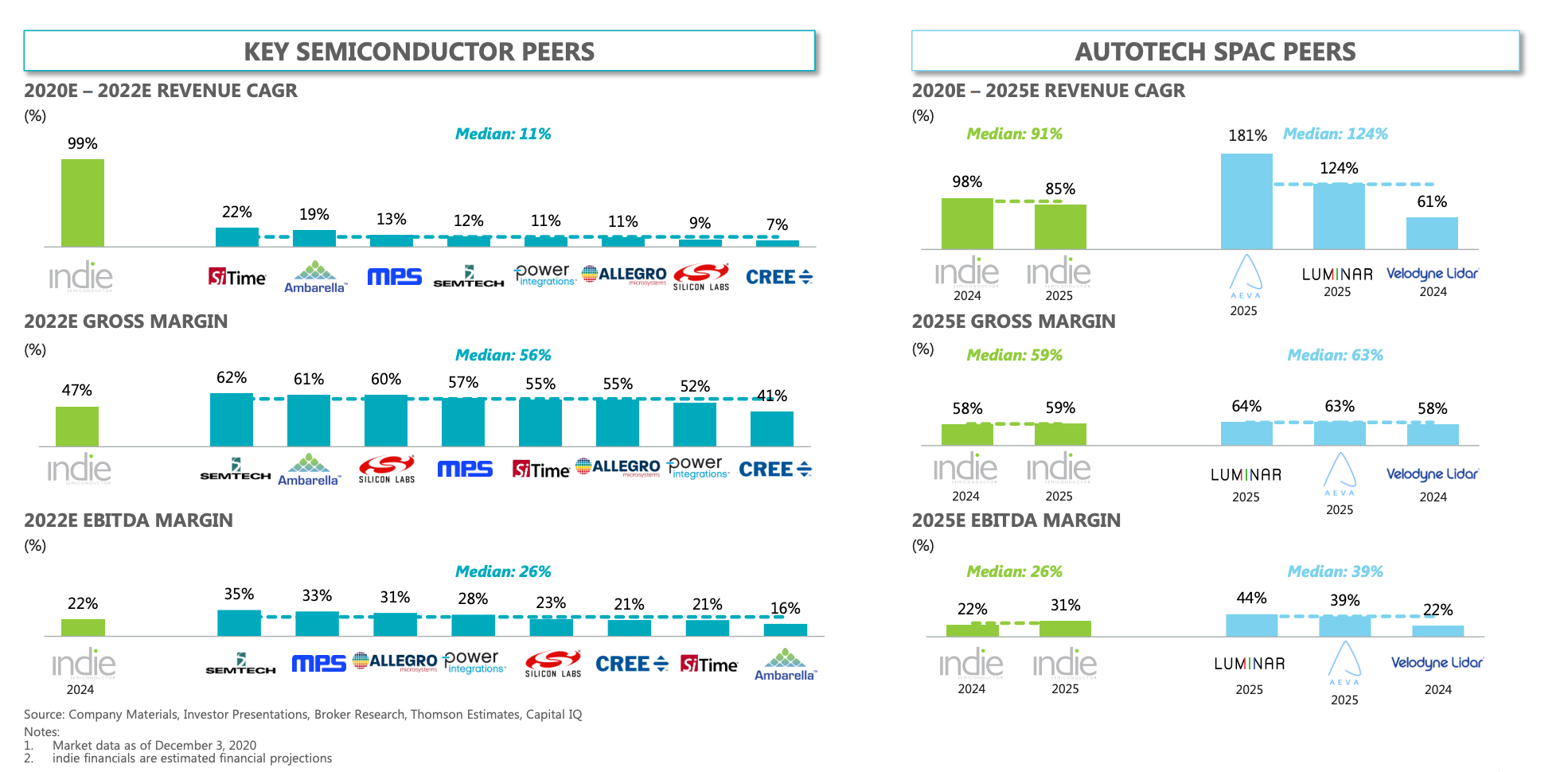

Indie is empowering the Autotech revolution with next-generation automotive semiconductors and software platforms. Specifically, they focus on EDGE sensors for Advanced Driver Assistance Systems including LiDAR, connected car, user experience, and electrification applications. I repeat, LiDAR. If you don't remember or don’t know, Luminar technologies LAZR was involved with the same technology and it ran 300%. These technologies represent the core underpinnings of both electric and autonomous vehicles, while the advanced user interfaces transform the in-cabin experience to mirror and seamlessly connect to the mobile platforms we rely on every day. This is dope technology, and it fits the current theme of SPACs, Electric vehicles, and autonomous driving.

I like Indie because they are focused on many high growth segments of the semiconductor automotive market. They have a hand in:

- Autonomous driving: Step-function increase in safety application requirements. Planning to service new entrants in the LiDAR markets. Focus on EDGE sensors for Advanced Driver Assistance Systems.

- Connectivity: Wireless charging, telematics, driver monitoring, and cloud access. They are dabbling with supporting Apple Car Key. I'm not here to pump Apple for God's sake, I'm just digging into the investor presentation.

- User experience: Carplay solutions, Infotainment, LED lighting (cool?)

- Electrification: Need I say more? They are entering a hot market.

Transaction Overview:

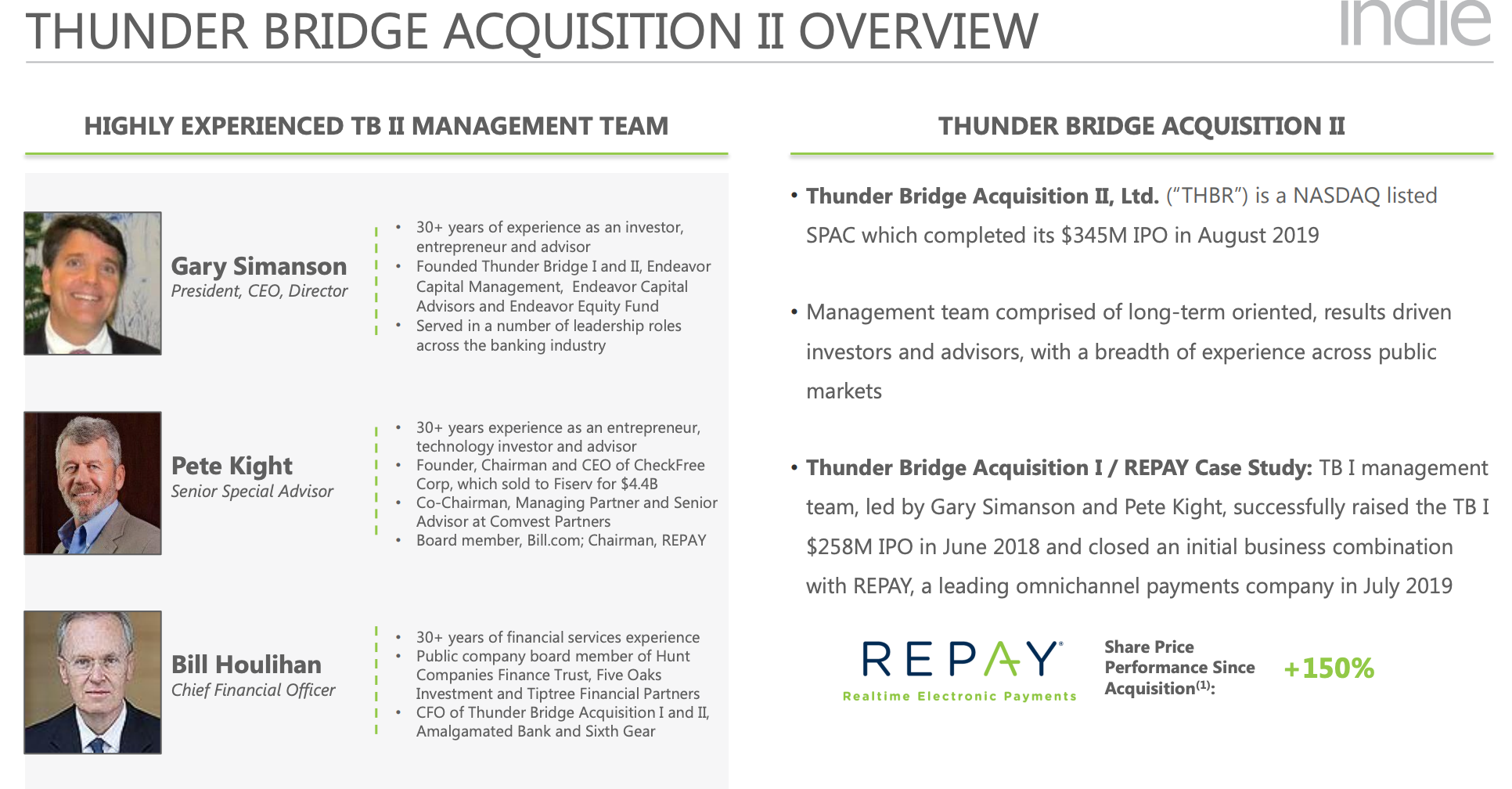

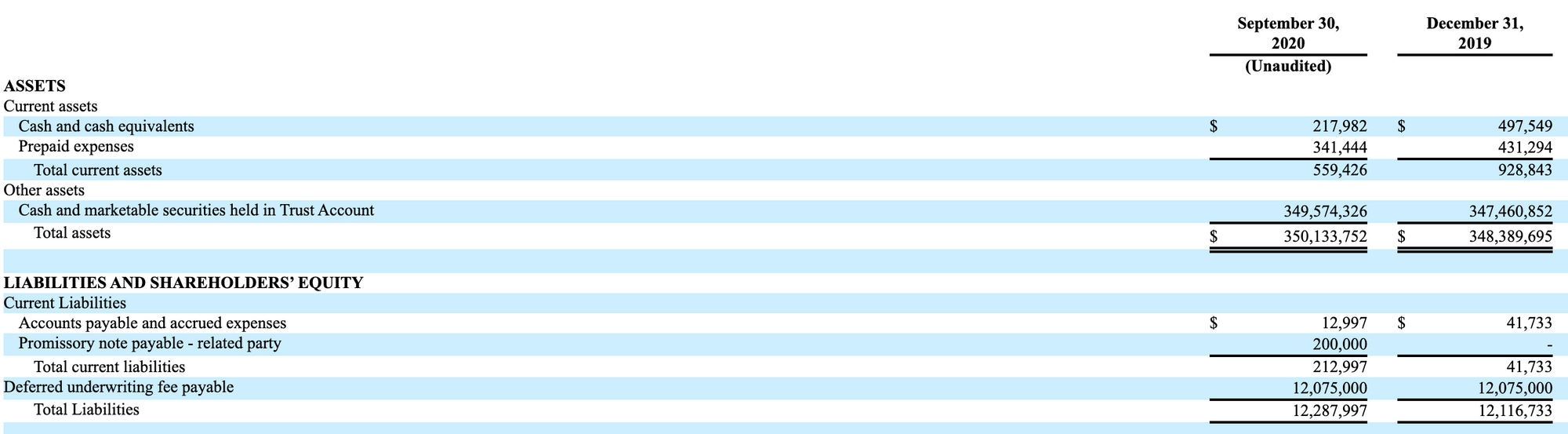

Upon closing, the combined company will receive up to $495 million in cash, comprised of a $150 million PIPE and up to $345 million in cash held in trust by Thunder Bridge II. The transaction reflects an implied equity value of $1.4 billion, based on current assumptions, with a $10 per share PIPE subscription price. Risk is nice here, ideally I'd like a lower price in waiting for a pullback. The merger is expected to be completed in the first quarter of 2021.

**Sidenote: These plays are SPACs because they are hot. There is going to be a day when the trend starts to change - please don't get caught holding a bag.

The Management

Management is crucial in the personality of a stock. The people running the show need to be able to deliver results, not bankrupt the company. I know I always bring this man's name up, but he's just such a great example. Chamath Palihapitiya has been a SPAC Midas this year, with every one of his investments turning to gold. When you have a good team behind an investment, you can build your conviction on management that knows what they are doing.

- Goldman Sachs Honors Donald McClymont as One of the Most Intriguing Entrepreneurs of 2020

- Indie Semiconductor Chairman and CEO Recognized as one of 100 Entrepreneurs at Builders + Innovators Summit

- "We are excited to partner with Thunder Bridge II at this key growth juncture to capitalize on our existing design win pipeline, extend Indie’s product reach, and drive scale and further consolidate within autotech, Autotechont said.

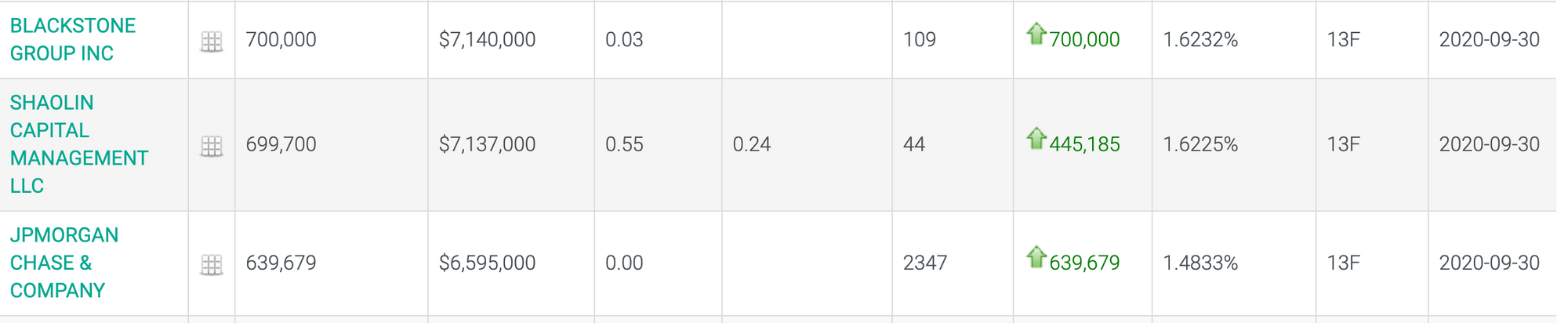

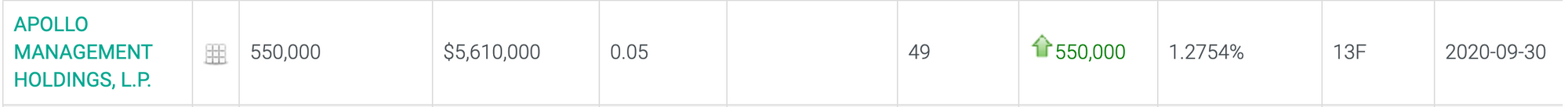

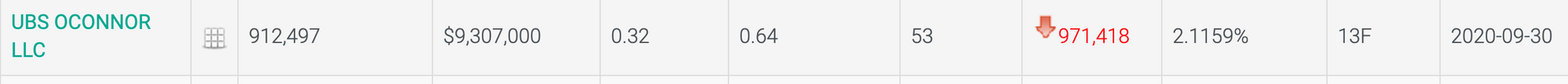

The Investors; who's buying?

JPMorgan, UBS, Blackstone, and Apollo are some notable names that are in. Apollo was the management behind the SPAQ/FSR deal. Not to mention, Indie has contracts with Magna and is on their vendor list. I like to follow the money, especially in this market. I'm not saying I'm a genius, but being right is not too difficult in this time of everything going up. Shoutout to Jerome Powell.

Financial Highlights

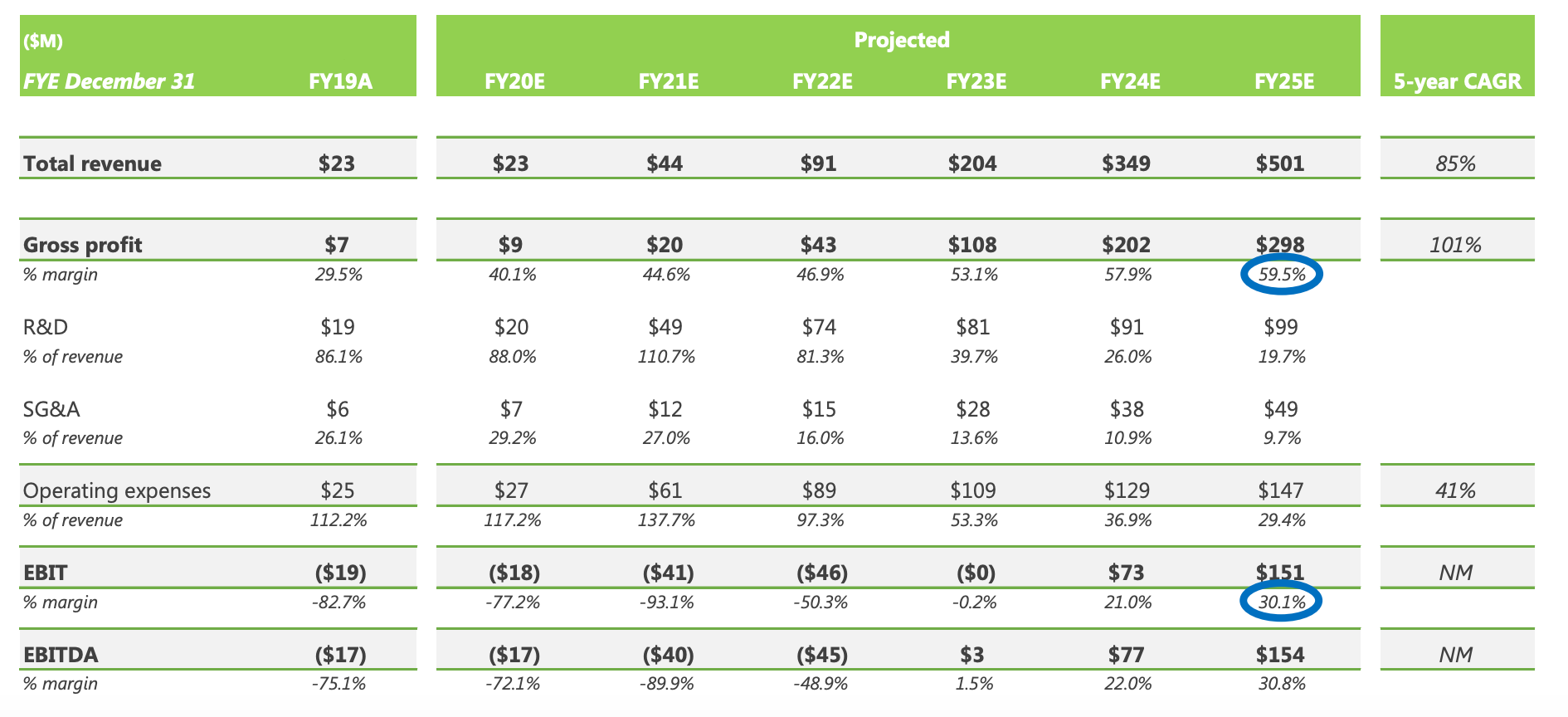

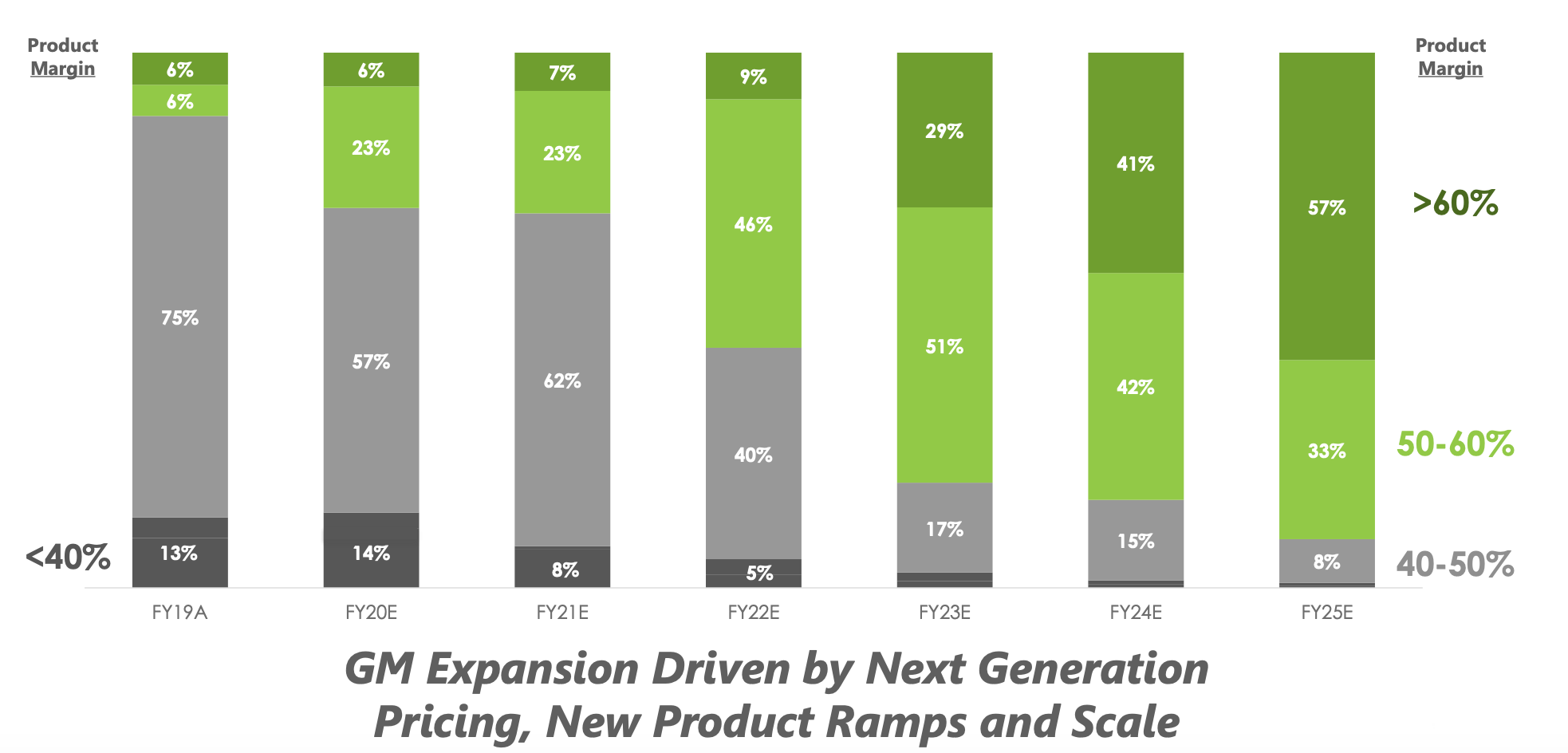

- Accelerating growth trajectory: Projected 85% compounded annual growth from 2020-2025.

- Over $2b of strategic backlog creates strong visibility: 60% of aggregate revenue through 2025 with contracts/products already in the shipping/won stages. "Strategic backlog" means projected future revenues based on existing contracts setting forth design and pricing terms and historic production trends of their customers.

- Operating leverage produces 30% target EBIT Margin: Driven by higher margin product mix.

- Capital efficient fabless business model: Highly scalable global supply chain. Fabless manufacturing is the design and sale of hardware devices and semiconductor chips while outsourcing their fabrication to a specialized manufacturer called a semiconductor foundry.

- Revenue is estimated at $23 million for fiscal 2020. Revenue is expected to ramp up beginning in 2023, with estimates of $204 million, $349 million, and $501 million, respectively, for the years 2023-2025.

- The strong demand for silicon and software inside automobiles is set to help Indie’s growth. Today, vehicles have around $310 in silicon content per vehicle. In the future, that total could rise to more than $4,000 per vehicle.

Conclusion

SPACs are hot and will hopefully maintain hot as they are a great way for companies to go public. In my opinion, many will probably end up being penny stocks in the future. These are all great stories on paper, but how many successful companies can we have? I'm an optimist and a natural-born bull who always wants things to go up, but maintaining a frame on reality is important too, right? One day, the music will stop. No need to be stubborn, there is always a bull market somewhere. As for Indie Semiconductor, I like the product and the team behind this. They seem poised to have a strong future with solid fundamentals and growth potential. I'm playing the price action, however. So do your homework if you want to invest, but I'll be switching hands once the merger closes sometime in the first quarter.

ALSO: Wait for dips, people. No need to buy when things are going up. Stocks go down too, and when things look ugly that's when you take advantage.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.