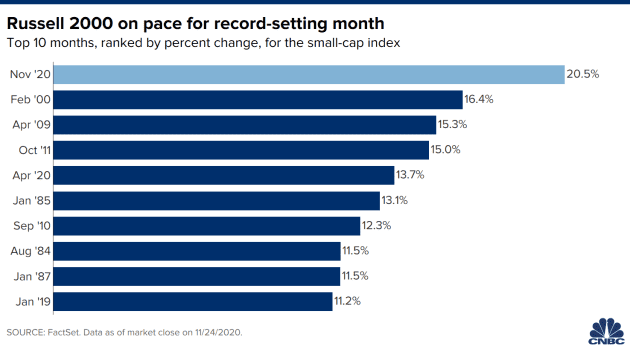

Dow Tops 30k for the First Time, Bears Nowhere To Be Found

The stock market doesn't care about your health. Thanks for the St. Barts vacation, Powell.

What a time to be alive!

The Dow Jones Industrial Average has been flirting with 30,000 for quite some time now, and finally, it has been topped. Investors sitting on the sideline, also known as FOMO chasers, have been awakened from the depths of their cliché Warren Buffet investment books. This psychological impact of not wanting to miss out on an economical recovery can be encouraging to the investment of stocks. Analysts, or people that get paid to tell you to buy junk, fully expect investors to continue betting on cyclical stocks, particularly financial, but tech and growth stocks are also on the horizon.

The Dow popped an anabolic steroid in the form of quantitative easing when the government and Federal Reserve came to our rescue. Bonds were bought in unlimited quantity, so forget worrying about the lack of yields. After the Greenspan fiasco, lord and savior Powell incorporated his own put, allowing artificial pumps in falling asset prices. Stocks being indirectly supported through low-cost loans to companies and will be bought outright, if need be, in the future. Wink. The largest stocks will continue to receive moola from the government through lower interest rates than their competitors pay, tax breaks, and the ability to acquire competitors without antitrust enforcement worries. Beyond that, the Fed will do and has done “whatever it takes.” The market still wholeheartedly embraces these platitudes as reassuring. Hence, the monstrous rebound in the U.S. stock market since its March 2020 lows as the economy plunges into the worst recession since the Great Depression of the 1930s. Capitalism rocks.

Corona? Been there, done that.

The market doesn't give a hoot that there's a tailspin on Caramba virus cases, or whatever you want to call it nowadays. We have THREE vaccines heading to the FDA for approval. We have a known commodity as Treasury Secretary (and she's a babe), and the economic data hasn't completely botched. This is a new era filled with young investors and I'm so happy to see that the secret is finally out. Money can be made on your couch, as opposed to working for some dickhead on their dime.

"The transition from growth to value, and in that regard financials, in particular, are likely to be leaders, not just to year end, but for much of 2021." - Julian Emanuel, chief equity and derivatives strategists at BTIG.

Robinhood has gone googley eyed for tech stocks, but it will soon be joined by other sectors and stocks that have lagged. Investors have been recently loading the boat on cyclical stocks like industrials, materials, energy, and financials, all sectors that could rocket when the economy reopens next year. Analysts say in every bull market cycle, there is a point where financials lead the charge. The improving economy next year should help with lending, and major banks have already taken big losses.

Join the bull life: More profitable over the long haul, more fun to be around, better for mental state, positive, more attractive to the opposite sex.

Being a bear: Boring, negative, only profitable if timed perfectly, proven to make you a miserable human being, ugly to the opposite sex.

Let's get rich, baby!

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.