XL: Fleet Electrification

Investors will look to make money off PIC's undervalued situation. The future is electric.

XL FLEET, A COMMERCIAL VEHICLE ELECTRIFICATION SOLUTIONS LEADER, TO LIST ON NYSE THROUGH MERGER WITH PIVOTAL INVESTMENT CORPORATION II (PIC) - businesswire.com, September 18, 2020.

Summary:

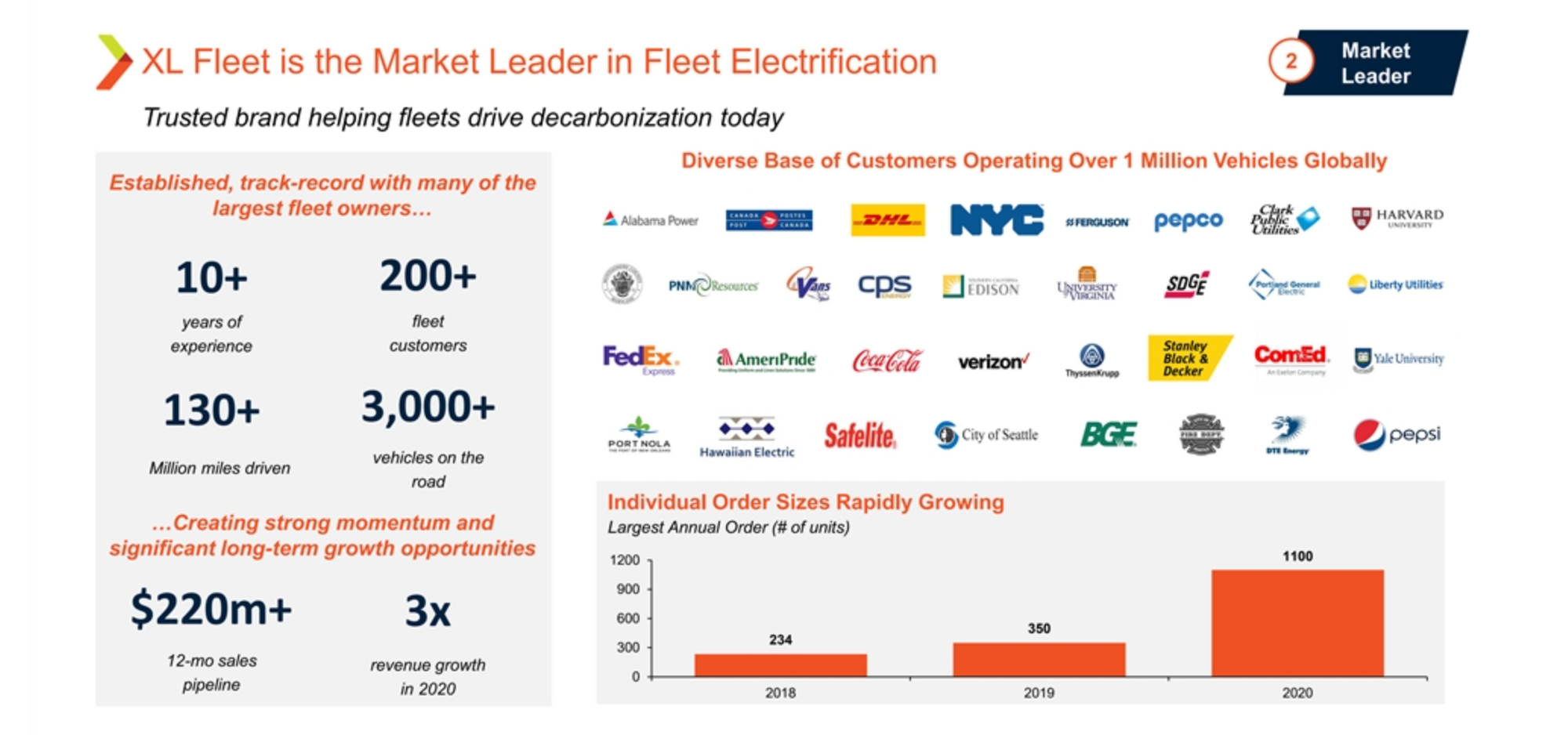

- XL is a leading provider of electrified powertrain solutions for U.S. and Canadian commercial fleet vehicles built by Ford, Chevrolet, GMC, and Isuzu.

- Thousands of XL units already on the road and over 130 million miles driven by its more than 200 customers, including FedEx, The Coca-Cola Company, PepsiCo, Verizon, the City of Boston, Seattle Fire Department, Yale University, and Harvard University.

- They are providing electric drive systems that can be installed on existing fleets, and there is no other company in the market that is doing this. They found their niche and are the pioneers.

Fleetification. This trend can best be understood as end customers shifting from vehicle owners to users, where transportation goes from owning a car to having access to some form of mobility service. As shared fleets grow and experience higher utilization rates, increasingly variable and complex demand and emergence of different form factors, vehicles in mobility service schemes will need to be acquired and operated in new ways. In other words, gas guzzling vehicles will be getting a facelift to be eco-friendly converted.

Many leaders in transportation agree that shared vehicle fleets will play a large role in mobility in the coming years and decades. To reach the goals outlined by the Paris Agreement, global transportation systems need to become more efficient by shifting towards vehicle sharing, rather than ownership. It's said to be "on the cusp of a worldwide transition driven by shared, connected, autonomous, and electric technologies." This bodes incredibly well for XL.

How does this help fleet owners?

- They'll be able to obtain more data that is generated from transactions with larger fleets. The more data obtained, the more costs can be reduced and money can be saved.

- Integrating new driving factors, such as self-driving vehicles and micro-mobility. Shared micro-mobility refers to any communal fleet of small vehicle, like a bike or scooter. This mode of urban transportation slashes commute times and allows people to get where they need to go in a way that's cheaper, faster, and better for the environment. This helps reinforce the whole "driving factors" movement.

- Vehicle optimization will allow use to improve margins and drive profitability. Things like optimizing routes, reducing risks, tracking trucker behavior and improving productivity are ways to grow profits and minimize losses.

Why hasn't this been done before?

Uber ran a leasing company, Xchange Leasing, which quickly grew to a 40,000-vehicle portfolio. This would’ve made it the eighth largest commercial fleet lessor in North America. Uber shut down Xchange after it lost an average of $9,000 per vehicle. LOL. That sucks for them, but that is great for PIC investors as this strongly backs up the belief that worlds are colliding. Collaboration is essential in this industry. Starting up your own fleet is risky, and what better way to gain exposure than by netting a deal with XL Fleet. No, I'm not sponsored by them.

Trucking fleets today are experiencing a shortage of 50,000 drivers; this gap will increase to 250,000 drivers by 2025, said Jack Roberts, Heavy Duty Trucking (HDT) Magazine’s editor and resident futurist. Roberts then explained that the in-home grocery delivery market, worth $1.7 billion in 2017, will grow to $100 billion by 2025. For trucking fleets- platooning, deep learning of routes, and the advent of autonomous trucks can’t come fast enough.

The chart

- Picking up momentum as merger date gets closer (Quarter 4). The parallel lines represent the supply zone, in my opinion. That's where it's being accumulated.

- Gapped up this week. I believe it's because of the EV mania going on as well.

- Biden presidency pushes our hypothesis further. Government will be investing in this stuff.

- This is a long term swing, few months. I think it'll get hot once it merges into $XL.

The financials

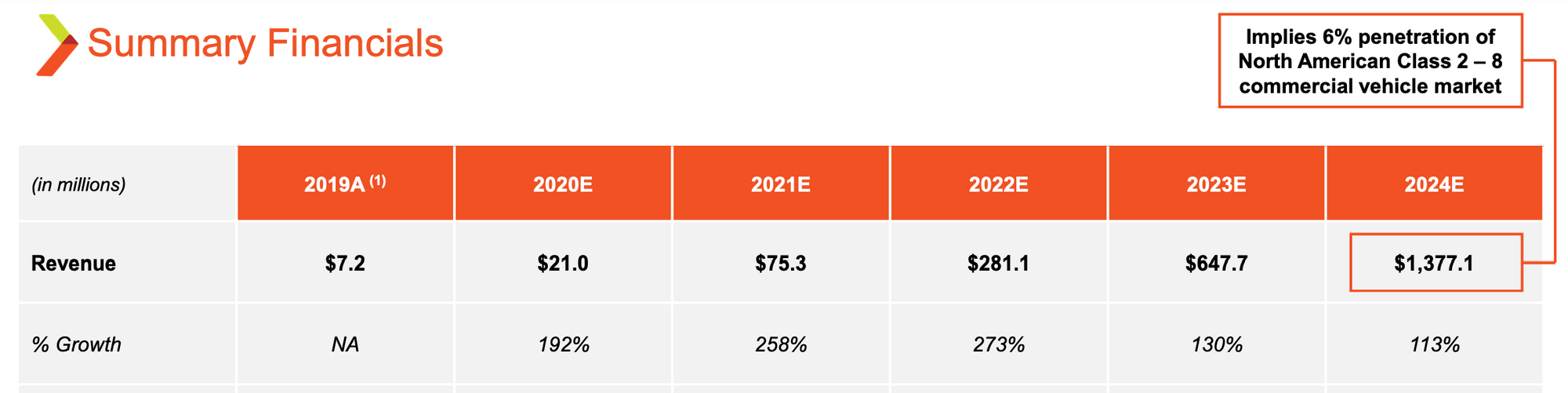

- XL achieved record quarterly total GAAP revenue of $6.3 million for the third quarter of 2020. In comparison, XL achieved $2.6 million in revenue for the third quarter in 2019, and approximately $7.2 million in revenue for the full fiscal year ended December 31, 2019.

- The revenue increase was driven by continued product adoption across the company’s portfolio, which is currently comprised of XL’s core hybrid and plug-in hybrid electric drivetrain business. They expanded margins that resulted in positive gross margins of 12.1% for the third quarter of 2020, as compared to negative (3.7%) for the third quarter of 2019.

Due to strong year-to-date results, XL remains on track to deliver on its full year 2020 revenue forecast of approximately $21 million. XL continues to grow its sales opportunity pipeline for 2021 to $220 million as of today, which supports XL’s current revenue forecast of $75 million for fiscal year 2021. They just did well on their latest earnings report, in other words. You can look at their investor presentation here.

This is my new baby. I am swinging this and accumulating slowly, as I think there will be plenty of opportunity to scoop on the low. Projected to be a billion dollar company in a few years with strong demand growing, I can feel good about this. Fleets move goods, materials, people, and facilitate sales and services. Think about how essential that is to absolutely everything.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.