WTRH Online Food Delivery Swing Trade Idea

Nearly 30% of under-18-year-olds use food delivery service systems every week. I love the lazy youth of today!

This just might be the best time to be a human. I mean, if you enjoy the simple pleasures in life, like ordering food while you binge watch The Haunting of Bly Manor on Netflix. With the rise of e-commerce and internet enabling devices, consumers and couch potatoes alike are increasingly preferring to order food through online delivery sources. The convenience factor paired with low costs and availability of a large variety of dishes is seen as more attractive than dining on premise. This is clearly preferred by a certain group of people because personally I love to eat out. Sure, scarfing down six slices of pizza in 30 minutes while you rot in bed is cool, but ordering shots for your pals with your $FUBO gains is pretty hard to beat. Nevertheless, the rising demand among consumers involved in ordering food online is driving the need for online, on-demand food delivery services. Given this high demand, vendors are increasingly investing in technology to improve various aspects of their businesses.

Waitr Holdings Inc. (WTRH), a leader in on-demand food ordering and delivery, announced on October 8th that it has launched tableside service technology for restaurants. Through the scanning of a QR code on a smartphone, the new product allows diners to access the menu from the table, place an order, pay and tip all in the Waitr app without contact.

“Contactless service has become increasingly important amid the pandemic for safety reasons. This new product will serve the need of restaurants that are bolstering their safety protocol, and will help make diners feel safer since the ordering process is contact-free,” said Carl Grimstad, CEO, and chairman of the Board of Waitr. “This product also has the potential to increase the number of times a table can turnover due to the lack of waiting on the diner side.”

Since Mr. Grimstad has taken over at Waitr in January 2020, Waitr has quickly implemented many strategic initiatives around service and profitability. Waitr also began delivering same-day groceries, offering No-Contact delivery for all restaurant and grocery orders, and now Dine-In service capabilities. This can be a big opportunity for them, with Budlight Flu cases rising and colder weather clearing outdoor seating.

Second Quarter 2020 Results Highlights:

- Revenue was $60.5 million (+18%), compared to $51.3 million in the second quarter of 2019.

- Net income was $10.7 million, compared to a loss of $24.9 million last year. In July they completed an offering for the issuance of 23,698,720 shares of common stock for gross proceeds of $48.3 million during the period of March 20, 2020, through July 10, 2020. So basically, they sold stock to be able to flex on their balance sheets, making them look like they made more money than they actually did.

- Adjusted EBITDA*** was $16.7 million, compared to a loss of $14.9 million in the second quarter of last year.

***Adjusted Earnings Before Interest Tax Depreciation Amortization. A measure of a company's overall financial performance.

THE CEO

Appointed at the beginning of this year, Grimstad is no stranger to a lavish lifestyle of escorts, strip clubs, golf outings, and yachts. This little miscreant clearly knows how to have a good time. His former company, ipayment, had sued him for $445k for hiring an escort in Las Vegas and giving her and her mother a job at the company. At least we know he has a heart, sex workers need lovin' too. Best part? Our guy is a WINNER. He landed the fat settlement after battling allegations that he looted half a million dollars from the company to fund his wife’s shopping sprees.

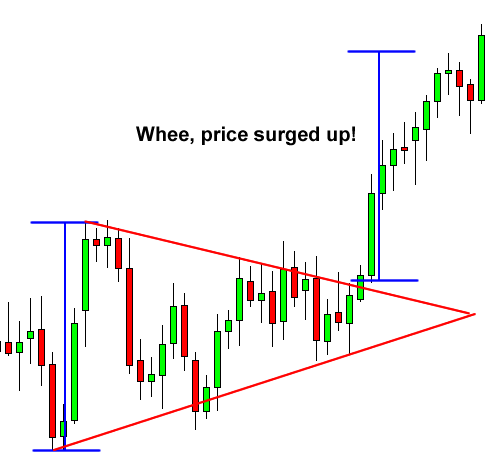

The Chart

I like the setup here.

- Forming higher lows on the trendline, with several green hammer candlesticks in October.

- Been heavily shorted lately but shares borrowed have declined from 1,1m to 400k.

- Needs volume to start picking up steam and reverse.

- Trading under the red line (MA 50) and hugging the blue line (MA 20), I think if it crosses we could see positive price action. I want it over $3.87. I'd feel comfortable risking my position with a stop loss of $3.30 right now, as the price is at $3.36 at the time of writing.

- They have earnings coming out in November, a catalyst that could boost the price.

- Symmetrical Triangle chart pattern

Of course, I want this thing to double in price, but let's maintain some realism here! If it starts to trend up, breaking the resistance of $3.87, we can see a move to $4.00. Pending the earnings run-up, with the earnings results as well (hey, you DON'T have to hold through it if you're happy taking gains prior) this could be a runner back to $6 if it maintains the trend on the chart. I mean, the chart is telling me it wants to be taken out, and so is Grimstad's lust for being filthy rich.

Manage your risk and be prepared for either the most exquisite chicken parm on me, or 3 months of ramen noodles.

**Not a financial advisor. Articles are opinions only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.