United Wholesale Mortgage To Go Public Through Business Combination With Gores Holdings IV, Inc.

SPACs have been white-hot this month, and when the market gives you lemons you make lemonade.

Not to sound dramatic, but this is the biggest deal in SPAC history.

From the same team that brought you LAZR (Luminar technologies SPAC in GMHI) and Hostess (yes, the one with the twinkies), comes GHIV. SPACS have been white-hot this month, and when the market gives you lemons you make lemonade.

Summary:

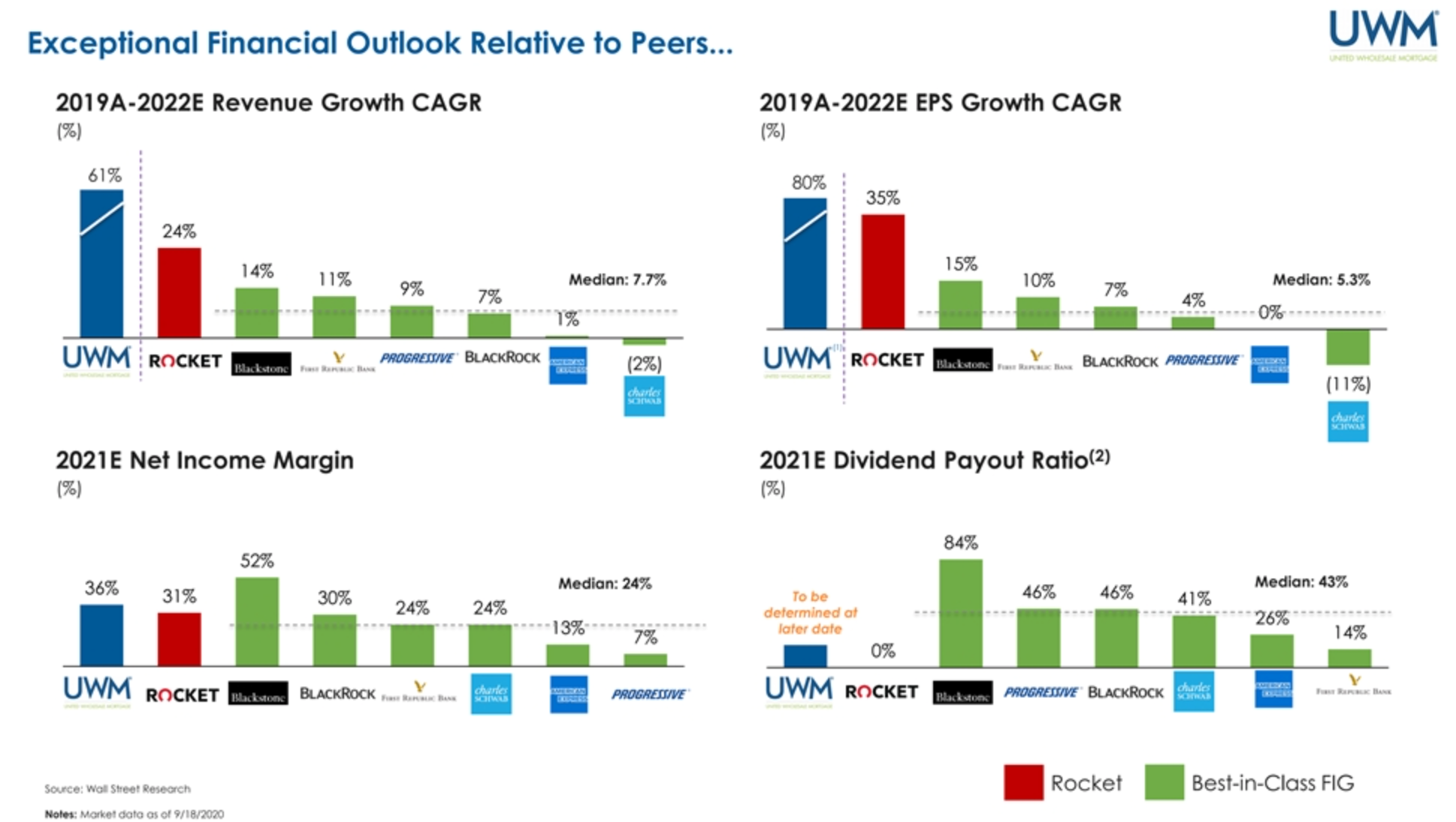

- The transaction value of $16.1 billion makes United Wholesale Mortgage, which from this point on I'll refer to as UWM, the largest special purpose acquisition company transaction to date. This strengthens UWM’s position as the #1 wholesale mortgage lender and the #2 mortgage lender in the U.S.

- Transaction proceeds will allow UWM to accelerate the implementation of its business plan focused on capitalization of growth opportunities and providing superior service to its broker-clients.

- The transaction includes $425 million of cash from Gores Holdings IV and a $500 million private placement, anchored by top tier institutional investors

- CEO predicts revenues north of $200 billion in 2021.

On September 23, United Wholesale Mortgage (UWM), the #1 wholesale mortgage lender in the U.S., and Gores Holdings IV, a special purpose acquisition company (the guys who turned GHMI into LAZR at a 300% gain) announced that they have entered into a definitive agreement for a business combination. Upon completion of the proposed transaction, the combined company will operate under the UWM name and the stock will be listed on NASDAQ under the new ticker symbol “UWMC.” The transaction values UWM at approximately $16.1 billion, or 9.5x the Company’s estimated 2021 Adjusted Net Income of approximately $1.7 billion.

UWM got frisky this past quarter, posting record volume and margins.

- Originated $54.2 billion in closed loans during the third quarter, an 81% increase from the $29.9 billion it originated in Q3 2019 (loan volume was up 31.8% from Q2 2020).

- Closed nearly $128 billion in production this year, eclipsing the $108 billion it originated throughout all of 2019.

- Net income totaled $1.45 billion in the third quarter, up from $198 million during the same period in 2019. The gain-on-sale margin also inched up to a record 3.18%; a year ago it was 1.29%.

- In the third quarter, UWM increased MSR from $924 million to $1.41 billion. It also increased its cash-on-hand to $756 million from $570 million in the prior quarter, and increased equity by $556 million to $2 billion. ***Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original lender to another party that specializes in the various functions involved with servicing mortgages.***

Who's behind this?

Wall Street and retail investors, like us, have been salivating every time there is news of a merger agreement. SPACs have been a much better way to take companies public due to the quickness of their nature. While IPO's usually take months, SPACs can take a few weeks. Their model is pretty simple: raise money from public markets, then find a company to merge with. When the merger is announced, shareholders can either accept stock in the new company or redeem their shares at the original price of the offering, usually 9-10 bucks in these plays. The story will change when the market cools down, so don't be without a chair when the music stops. That's always the risk.

For the time being, SPACs have been drawing in Wall Street titans like billionaire hedge-fund manager Bill Ackman, Citigroup ace Michael Klein, and former house speaker Paul Ryan. Now Alec Gores is joining the party to that A+ list, with having the Luminar merger completed. Now trading under ticker symbol LAZR, this was a 300%+ move from $9.45 to $47.80.

Alec joins the list because one of his special purpose acquisition companies are now undertaking a $16.1b merger with the mortgage lender United Wholesale Mortgages. The merger with Gores Holdings IV will make this the biggest deal any company has ever made with an acquisition company of this kind. It seems clear to me that this guy's aim is to capitalize on the rapidly changing trends in the mortgage market and the future growth prospects of the largest wholesaler in the country.

It's important to look for the hands playing behind these SPAC's. A lot of these companies will probably be tossed aside like masks in the CVS parking lots (WHY do people do this?!). The Californian private equity billionaire wouldn't sign anything unless the deal was that good. Well, the deal includes UWM retaining 94% ownership of their business, an attractive side for both parties of the deal. Despite a 'meh' control of ownership, the holding company is set to receive a total of $925m from this transaction: $425m which is held by the SPAC, and $500m from a private placement which Mr. Gores is leading. My motto is to follow the money.

This transaction values UWM in the region of $16.1b, which is 9.5x the company’s estimated adjusted net income in 2021 of $1.7b. Morgan Stanley and Deutsche Bank Securities acted as lead capital market advisors, lead financial advisors, and exclusive private placement agents to Gores Holdings IV. Moellis & Company acted as another financial advisor. For UWM, Goldman Sachs acted as the principal financial advisor.

The Why

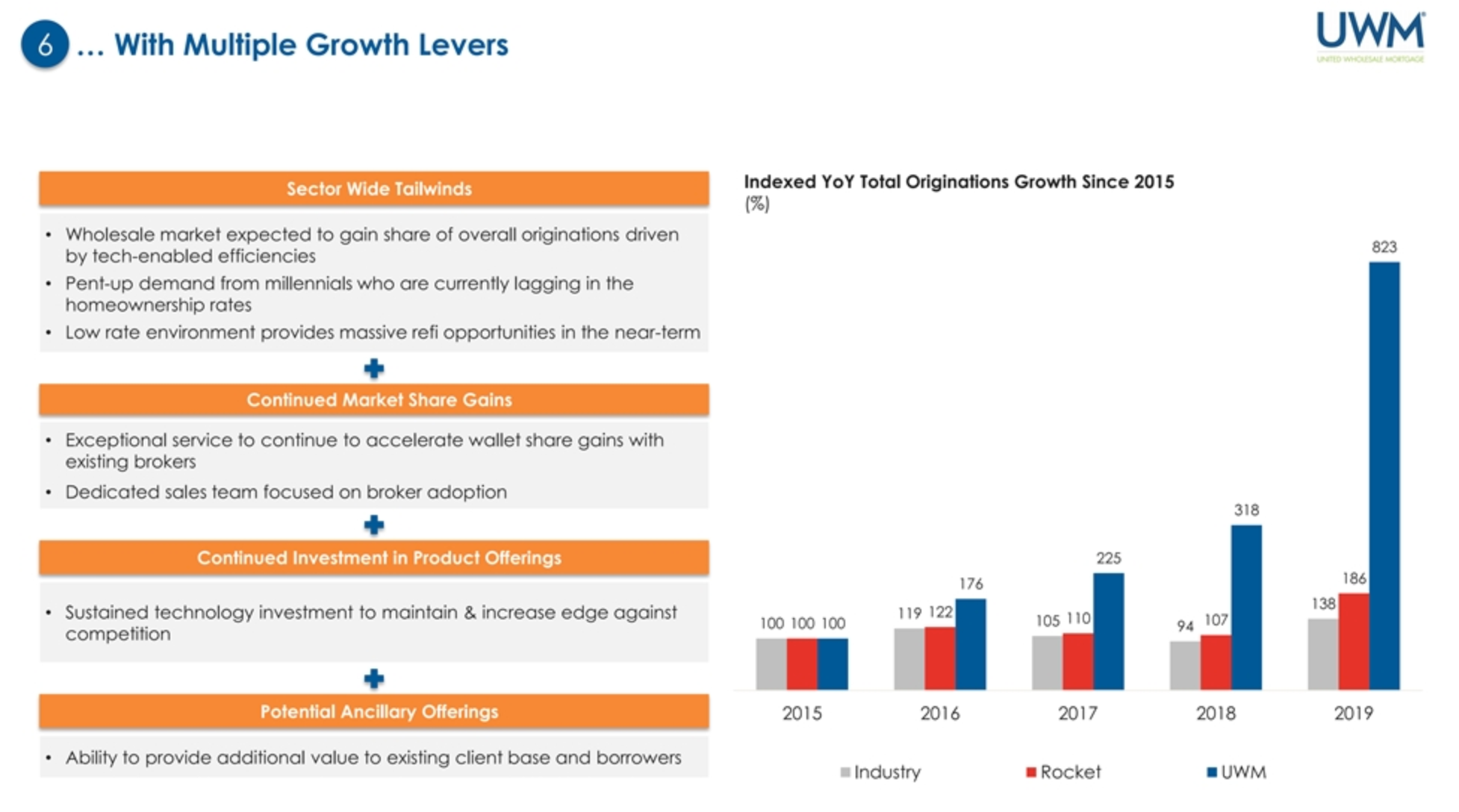

- This deal reflects Mr. Gores' foresight to benefit from acquiring a large company in a market-leading position in the mortgage industry. He's increasing his exposure with a 4.6% share in the US mortgage market while capitalizing on other tailwinds within the mortgage industry.

- Recent acquisitions such as stock-exchange-operator ICE’s purchase of Ellie Mae, a software firm that processes mortgage applications, arguably show the wider trend of digitization of the paper-based mortgage industry. With efficiency gains of up to 80% arising due to the application of AI in the mortgage origination process, this market is likely to expand in size and profitability. This offers Mr. Gore an opportunity to capitalize on the growth and changes of the mortgage market.

- For UWM, this transaction represents an opportunity to enhance the service it offers to its mortgage broker clients and therefore creates value for its shareholders. As a firm whose business model relies on incorporating innovative technology, which enables wholesale clients to process mortgage applications faster, the combined $925m UWM will receive is likely to contribute to enhancing its technology. This goal of President and Chief Executive Officer Mat Ishbia to “help our mortgage broker clients continue to build and grow their businesses” can be done with funds to invest in AI.

The chart

- SPACs are difficult to do technical analysis on because the moving averages don't represent the validity of the price action. It's all news-driven until the stock merges.

- Our key here is the volume. Look at the massive green volume bars in December. The SPAC formula involves a huge spike during news, followed by no volume contraction, followed by news expansion of the price. We're waiting for the merger to close.

The completion of the merger is expected in Q4 2020.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.