How To Deal With A Choppy Market

Turbulent markets may sting, but the difference between good and elite traders is versatility. Read on for a couple of pointers on adapting to choppy markets.

The answer is to shut off your computer and play outside. No, really!

The stress of dealing with getting knifed with little follow-through and no algorithms to push stocks, along with the current rotation of money from growth and tech (RIP Cathie Wood) to cyclicals is not worth the headache. Unless you're into that sort of thing. As addicts, we are.

Choppy market conditions are one of the most difficult conditions to trade under.

For example, if you attempt to buy the breakouts, the stock just falls and rolls over. If you try to short into the news—you are just one tweet or headline away from watching that position get ruined.

There are traps EVERYWHERE.

The way?

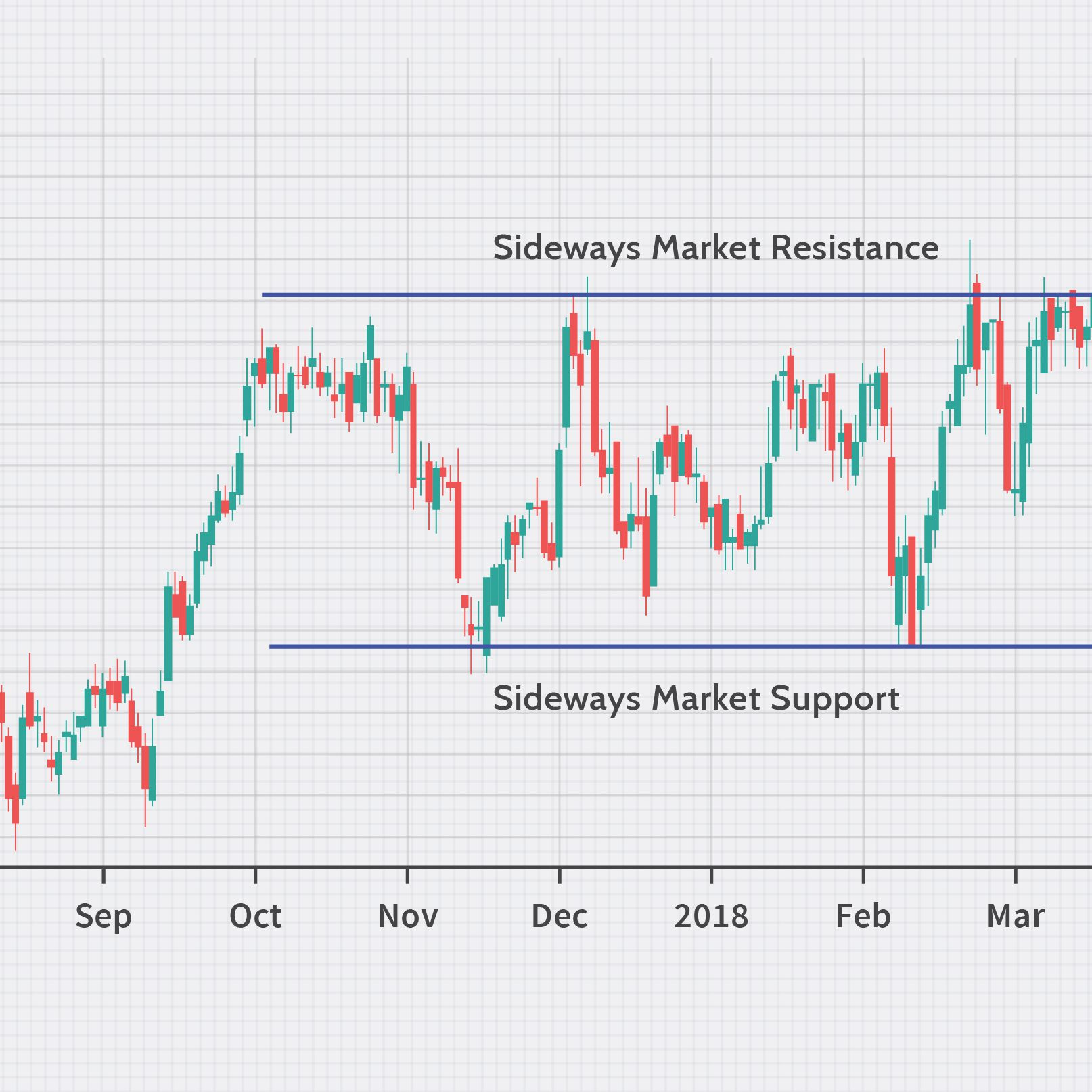

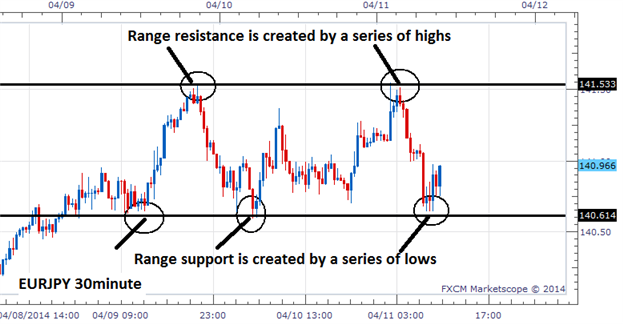

The key lies in the sideways action. A sideways market is one where price action will not trend in one direction or another and is fluctuating inside a tight price range. This up and down price action through the tight price range reflects major indecision in the markets with the bears and bulls unable to take control of the stock. You can see how the action plays out using level 2 and the tape. Price action is king.

What is consolidation?

Consolidation is a sideways pattern in the market that is extremely difficult to spot as the pattern is forming. Once a pattern is formed, the stock breaks out. Then it's easy to see where consolidation was. One characteristic of sideways markets is periods of short and sharp price movements, but upwards and downwards caused by bulls and bears attempting to control the stock.

Contrary to a trending market, a sideways market will often be comprised of brief periods of strong price action in one direction that will reverse shortly after, usually off short-term support and resistance levels.

As you can tell, sharp price actions are pushing through both the support and resistance levels as traders are trying to fight for the new trend breakout. You can capitalize on trading these short-term fluctuations.

Define Range

Once you have identified consolidation, you'll want to start looking at the range. What I mean by that is the range that the prices will gravitate towards and away from. In that figure above, you can see where support and resistance lie. Sometimes a consolidation phase will be too tight to make it not worth trading at all. Other times the range can be wide enough to allow you to trade with caution and tight stops.

The wider the range, the more space you technically have to take and manage your trade-in, but also the more risk you inherently take with your stop levels. When you know the upper and lower limits of the trading range, this allows you to watch the range itself and even position your trades for a breakout movement.

Even though you may think you are trading a consolidation where prices should be restricted and contained, many times prices will spike through support and resistance levels.

TIP: Don’t let the spikes fool you as a new trend. It’s usually a trap and prices revert back into the channel.

This uncertainty calls for a conservative trading style. This pattern requires placing tight hard stops instead of mental stops on all your trades and using trailing stops and looking for target prices to lock in profits at.

Why?

Because during choppiness, the price can reverse suddenly and wipe out all your profits before you know what happened. Execute mechanically, not emotionally. And be quick.

Of course, it's not as easy as it sounds. It's not a straightforward solution and varies widely among different stocks and markets, the strategy the trader deploys, and the risk tolerance they have for a sudden change in trade direction.

But, trading sideways markets can be an extremely lucrative trading style if executed properly. By knowing the range of the trade pattern, keeping a close eye on false breakouts, and using targets instead of trailing exits, a trader can use this strategy for quick and substantial profits. It's all in the hips.

Not a financial advisor

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.