Tilray and Aphria Are Merging in a $3.9 Billion Deal

Tilray is merging with Aphria to create the largest cannabis company in the world. Makes you wonder how high the stock price can get.

On December 16th, Cannabis giants Tilray and Aphria announced a merger agreement to create the largest enterprise in the biz by revenue.

Summary:

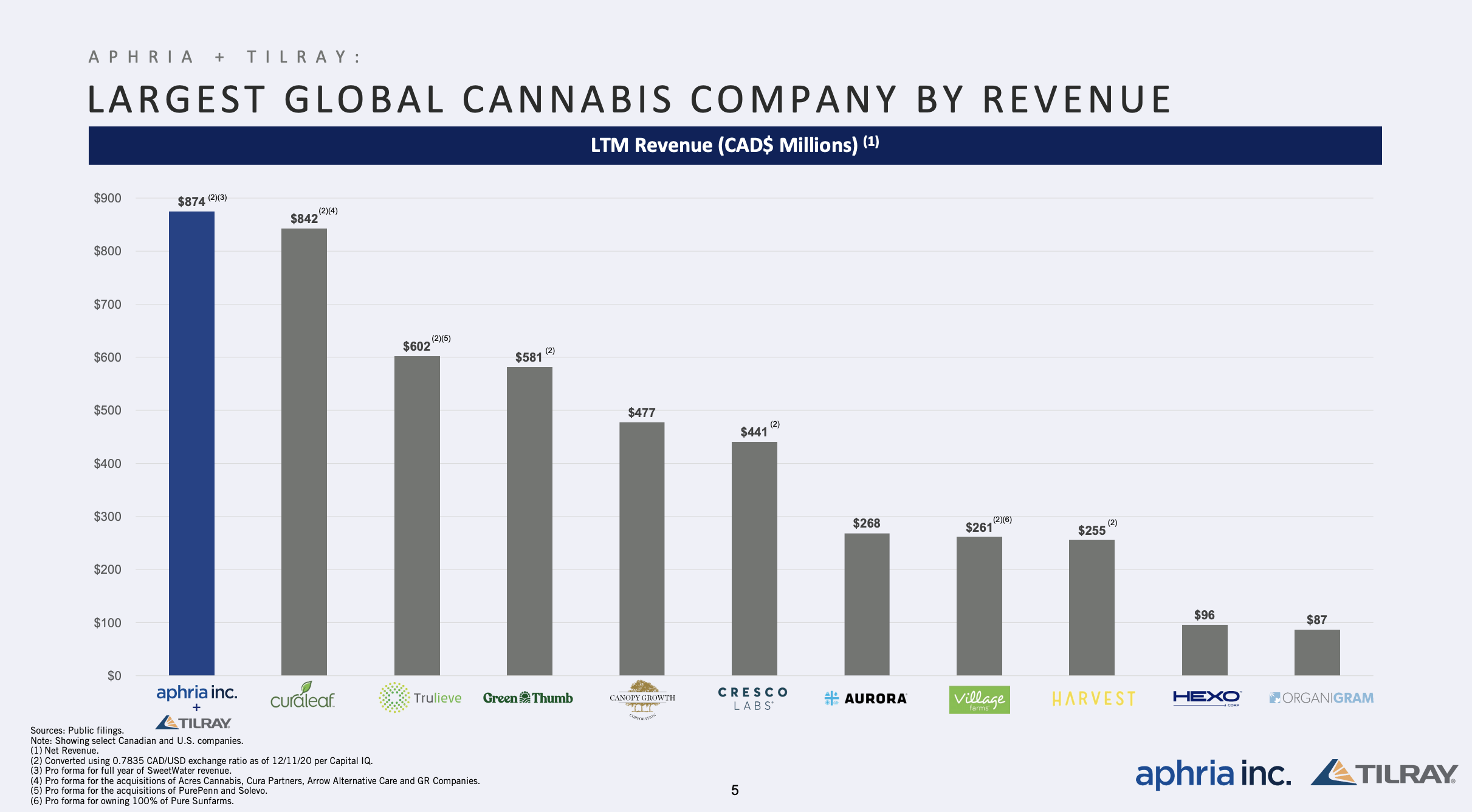

- The $3.9b deal will create the world's largest cannabis company. The Canadian based company has generated $685 million of sales over the past year, making it larger than all other companies in the global cannabis industry.

- Presence in the U.S. through Aphria acquisition cannabis lifestyle craft brewer SweetWater Brewing Co. and Tilray joint-venture partner Anheuser-Busch (BUD). Yeah, from the same guys who brought you Bud Light. Weed is going into the beverage space.

- The merger will put Aphria in a position of being cash flow positive. Tilray is expected to go EBITDA positive this quarter (or next, per the Aphria CEO) and that will put Aphria in a strong position. No longer burning through cash, there is an expectation for positive EBITDA this quarter.

- The Tuesday race for control of the Senate could have a volatile effect on the price of these two stocks in the short term.

To start this off, I know this news is old and they already had their initial pop on the news. But after looking at the chart, which I'll bring up later, I think it's a good time to enter. This isn't advised, by the way, think of this as being my stock journal and you reading along for fun because that's basically what it is to me.

Anyway, this merger will create the largest cannabis company in the world. A newly minted cannabis company created in a sector that is going to heat up? Yeah, I'll take two tickets. If the government and state policies follow through with cannabis legalization, well we'd see heavy investor interest in weed stocks.

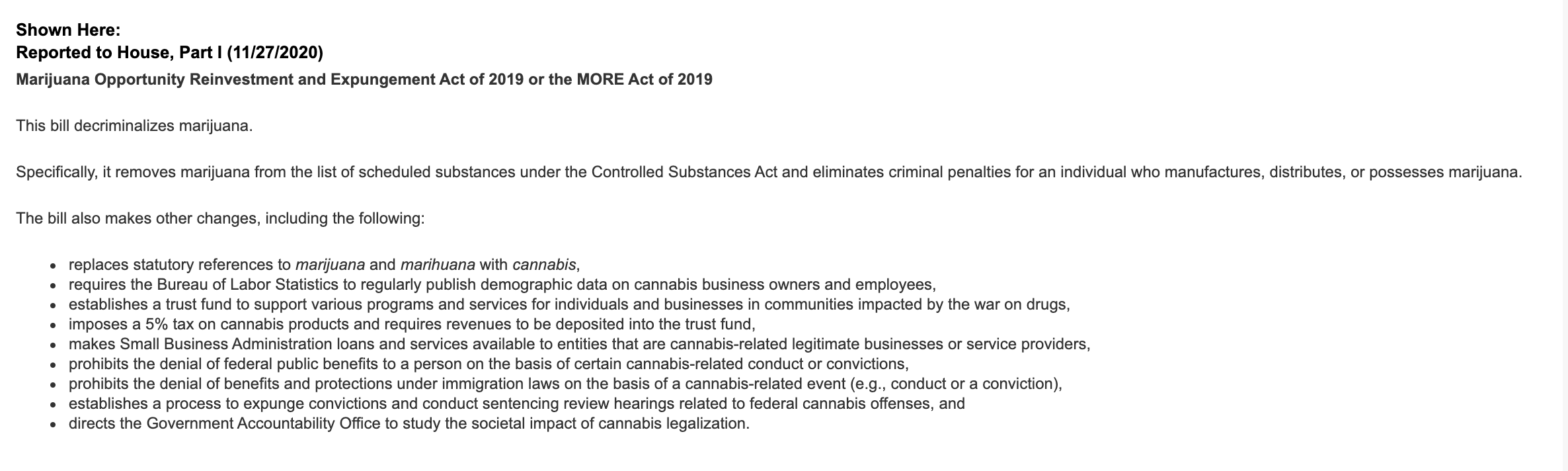

Senate Minority Leader Chuck Schumer (D-NY) said that he thinks the movement to federally legalize marijuana can "make progress" even if Majority Leader Mitch McConnell (R-KY) maintains control. If the Democrats win, it's a dub for weed stocks. Weed saw an initial run-up when Biden was declared the opposing candidate to Trump, as well as when the house was voting on the MORE act.

I now find myself in the position to run a company with the same market cap of Hain, if not bigger, in an industry that, if you look at the size of this industry from around the world, it's $100 billion-dollar-plus industry, and an exciting transformational industry.

-Aphria CEO and chairman Irwin D. Simon

In an interview with Benzinga, Simon swipes at the haters, stating that this is no longer about "just smoking pre-rolls and getting high". He claims there is more branding and professionalism surrounding the industry. The company poses a strong threat with the likes of Canopy and Aurora Cannabis due to the potential for international expansion. A bulk of their revenue comes from Canada, but they still have a strong fingerprint in overseas markets. Aphria has a German medical cannabis distribution footprint and Tilray has a 2.7 million square foot European EU-GMP low-cost cannabis cultivation and production facility in Portugal.

Anheuser-Busch

Aphria acquired SweetWater Brewing Company for $300 million. Tilray has a joint venture with Anheuser-Busch called Fluent Beverage Company. It seems obvious to me that Aphria wants to gain market share in the cannabis beverage industry, and strategically the move with Anheuser looks appetizing. Cannabis and CBD will be all the rave to Millenials who pride themselves on the ability to differentiate pH balances on IPAs.

Cash Flow Positive

The combination between both companies should result in pre-tax cost savings of at least $78 million. A big part of these cost reductions will come from moving Tilray’s purchasing of cannabis from other limited partnerships into Aphria’s facilities in Leamington, Ontario.

Savings in key areas:

- Combining beverage and edible businesses.

- The costs associated with running one public company, versus two separate corporations.

- Packaging, freight, and warehousing.

- A combined sales force.

- Shared marketing, communications, and social media efforts.

- Shared offices.

The merger will put Aphria in a position of being cash flow positive. Tilray is expected to go EBITDA positive this quarter (or next, per the Aphria CEO) and that will put Aphria in a strong position. No longer burning through cash, there is an expectation for positive EBITDA this quarter.

The Chart

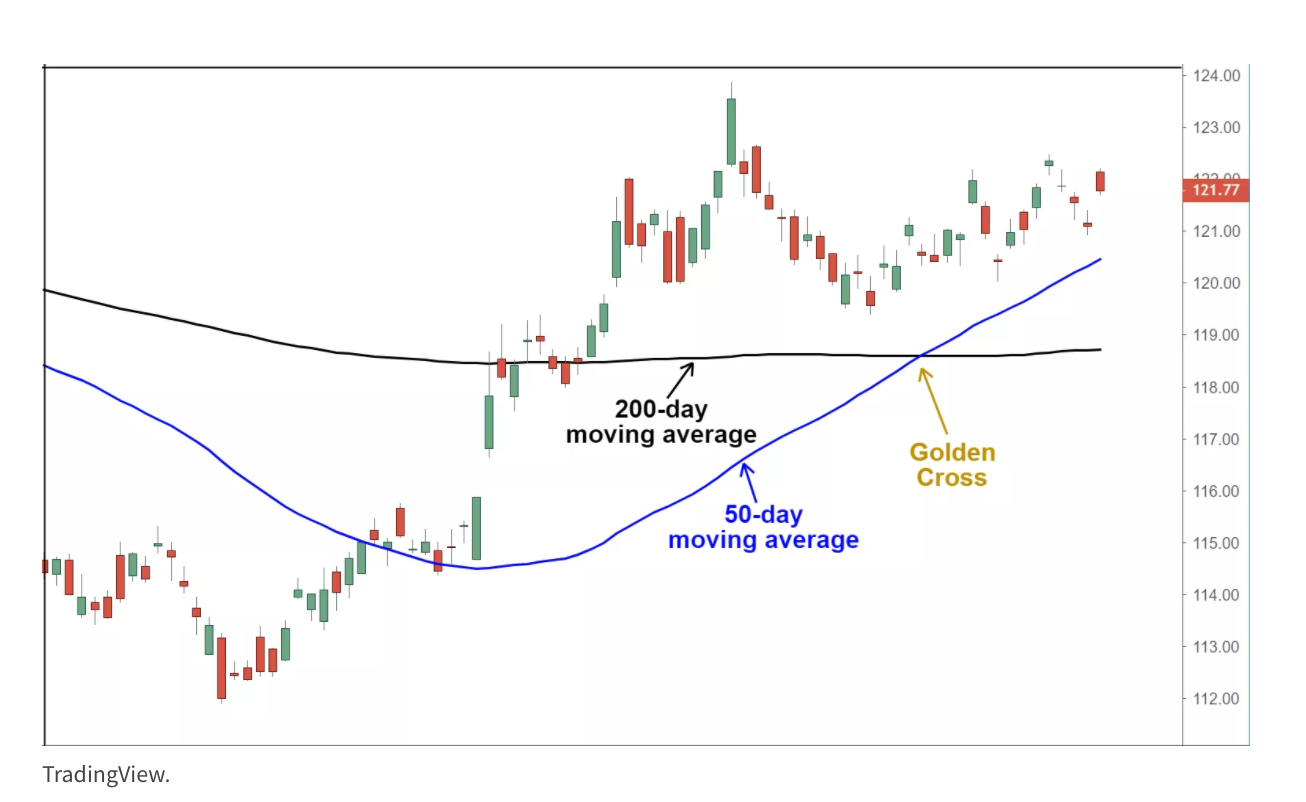

- Forming higher lows and higher highs indicate an uptrend in value for TLRY.

- Currently consolidating, needs to hold current levels before a move to around 9.80-10. Downside risk would be around the 6-6.80 mark, lower if there are implications. I want to be accumulating anyway for big moves throughout the year.

- TLRY has 40% short float, an influx in buying pressure could trigger a short squeeze, sending TLRY to near 12 levels.

- 5-day volume has been noticeably above average. 94m compared to 28m.

- Golden cross already happened, perhaps we see a continuation in the divergence between the MA50 and the MA200.

TLRY will be an interesting weed ticker to watch, it could catch fire with the voting happening on Tuesday. I'm keeping it on my watchlist for future pops and momentum throughout the year.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.