Post Election Market Plays

Stocks favoring a Democratic presidency should get some hits post election.

With an official Biden victory, stocks in these sectors should see some action:

- Clean energy

- Electric vehicle

- Marijuana

- Chinese owned/China stocks

- Infrastructure

- Health care

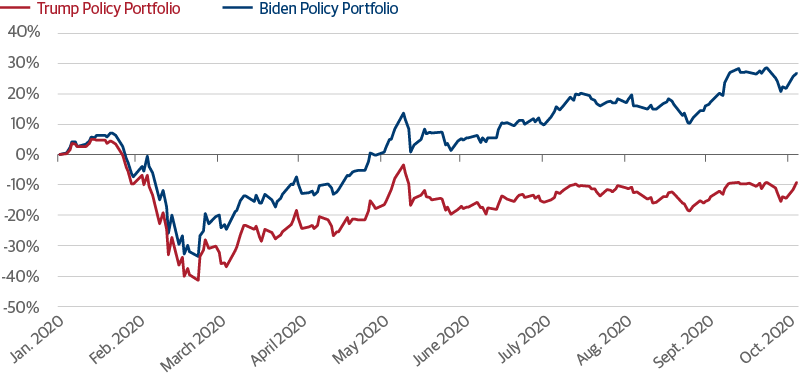

I'm no expert, but with a Biden dub I think stocks in these sectors will have rumblings. It's like a second wave of hippieism, and I'm totally for it. A green wave for marijuana stocks, buddy buddy foreign relations with China, and renewable energy are just some of the politics on the liberal side, increasing investor appetite. According to Guggenheims election portfolio poll results, the market apparently has warmed up to a Biden presidency.

Markets made up for their losses in late October with Biden being presented as the clear cut winner, as well as signs pointing to Republicans keeping their majority in the Senate. If Congress remains split, Wall Street can expect few changes in tax or regulatory policies in the coming years. Great. If Democrats do wind up taking the Senate (which will be determined by two runoff elections in Georgia in January), a wave of government spending aimed at shoring up the economy could also bolster markets. That's what I like to see.

Drugs aren't so bad, mkay.

It seems like the war on drugs has Americans thinking drugs are not so bad. On Tuesday, residents of New Jersey, South Dakota, Montana, and Arizona voted to legalize recreational marijuana. Voters in Mississippi and South Dakota did the same for medical marijuana. Oregon passed measures to legalize psilocybin, the active compound in psychedelic mushrooms. Cannabis investors must be thrilled as that's a huge boost to that sector of the economy, as well as state governments that are suffering because of pandemic induced economic shortfalls, like poor budgets. This brings some much needed relief in tax dollars that they can collect.

The Future is Green

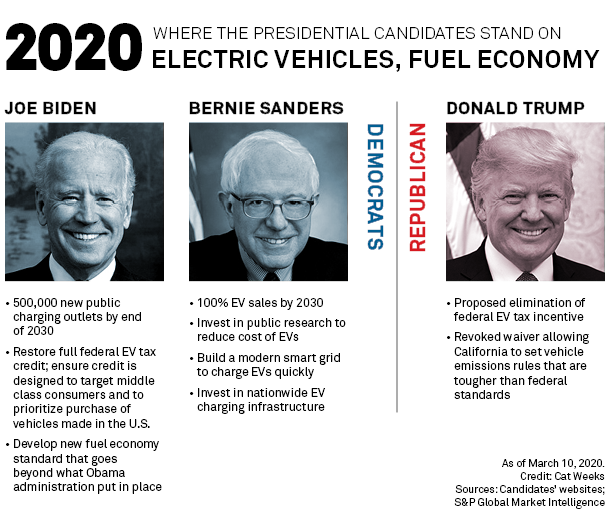

President-elect Joe Biden has proposed a $2 trillion climate agenda that includes provisions ranging from coordinating climate priorities in transportation infrastructure spending to rebooting “Cash for Clunkers” to trade in your gas guzzling Jeep Wrangler for a more fuel efficient vehicle, like a Tesla. This all relies on the Democratic control for Congress that we talked about earlier. Regardless, I think in the short term these stocks in the sector of electric vehicles and clean energy will start buzzing. The election technically isn't over (right?) but his victory is basically priced in at this point. At the time of writing, futures are up over 1%, which is dope. Unless you're a bear, in which case I laugh at you.

Chy-nah.

With Biden heading to the White House, he will have a wine stained Chinese tablecloth to clean up. In other words, when it comes to foreign policy, it's the relations with China that will require most attention. I wonder if he needs to help them or thank them for eating bats first. The Trump administration has thrown tomatoes at our top trade partner and the world's number two economy for a number of reasons: starting a pandemic, trade deficit, IP theft, opioid addiction, spying, and military aggression. My assumption is that Biden will start flirting with Chinese President Xi Jinping, which will create a ripple effect on Chinese stocks. I'm not talking about Alibaba, although I wouldn't be surprised if it had a positive effect. They took a hit last week on regulatory concerns and the Ant Group being on some BS. I'm actually referencing small cap Chinese stocks and pennies that have more room to be volatile and gain quick. You may laugh, but pennies are my jam.

Up at bat: stimulus

Oh yeah, and the pandemic is still a thing. The United States broke its previous record for new infections several days in a row this past week. Fears of a second wave are affecting the economic recovery, with new unemployment claims remaining steady. However, the election has renewed hope for a new stimulus bill before Christmas. Senator Mitch McConnell of Kentucky, the majority leader, said that reaching a deal on aid legislation would be “Job 1” when lawmakers return for the lame-duck session, although the bill will probably be less sexy than what Democrats have been holding out for. Time to load up the Robinhood account.

***Not a financial advisor. Articles are opinions only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.