$KCAC

Silicone Valley battery startup poised to profit off of SPAC mania.

- Battery startup backed by Volkswagen and Bill Gates to go public in Q4 thanks to SPAC frenzy. They have $1.1b in funding.

- $3.3 Billion valuation. Big money's in it and everyone is buying anything electric vehicle related, thanks Elon.

Enormous investor appetite for electric vehicles has given us an opportunity to profit off of the theme.

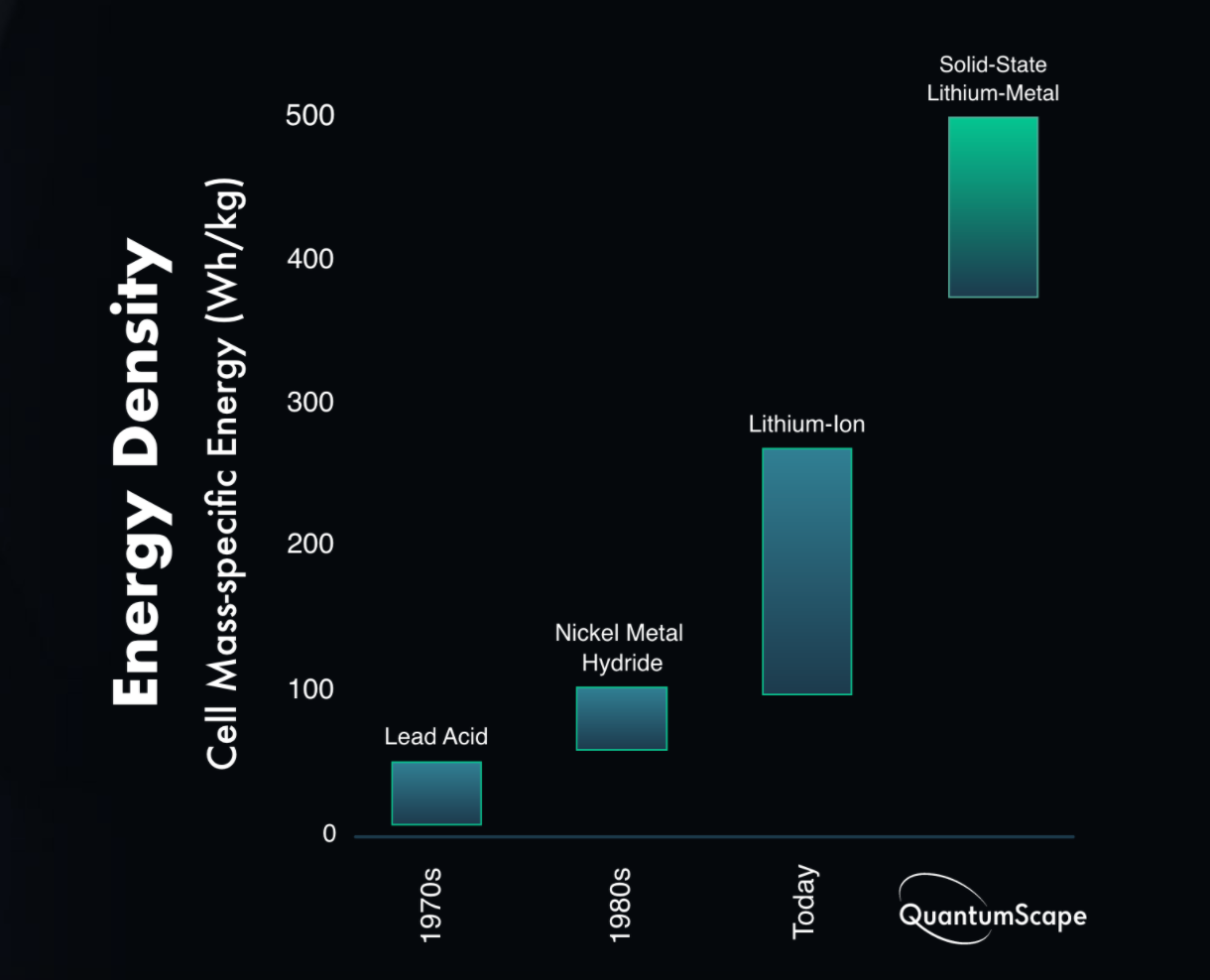

QuantumScape is developing lithium metal batteries for electric vehicles, which are different than the lithium-ore batteries that are currently present in electric vehicles. They are using a solid ceramic electrolyte in the battery, which CEO Jagdeep Singh (not to0 comfortable with that first name) said is better than the current liquid ceramic electrolyte. The battery intends to replace the normal graphite/silicon anode with a lithium-metal anode, speeding up recharge time to 80% capacity in 15 minutes. Also, its energy density is much higher, exceeding 400 watt-hours per kilogram, which exceeds the 250 Wh/kg for the best current lithium-ion batteries.

Their batteries last longer and charge faster. I'll probably buy one and live vicariously through it.

As of now, KCAC is trading at $18.35 and has a market value of $540m:28.75m shares outstanding. The company gives itself a $3.3b valuation with a $4.45b market cap based off of 2027 sales estimates. I told you, it's SPAC season. It has $451m in cash and 200 patents. They are expected to receive $1.1b in funding from Volkswagen and Qatars sovereign fund, as a part of this deal.

“In June 2020, the Volkswagen Group also announced plans to increase its shareholding in the US battery specialist QuantumScape. The objective is to promote the joint development of solid-state battery technology." -- Volkswagen Group Half-Yearly Financial Report, July 2020.

Link to the investor presentation.

Justin Mirro is the CEO and chairman of Kensington. It was just last week he was on CNBC, talking about how revolutionary the battery was in terms of technology. So that's cool, but who is this guy? He worked as an engineer for General Motors and Toyota. He was an investment banker for 25 years, blah blah all that good stuff. What matters is that he dealt with clients that included Ford, Chrysler, Magna and Fiat. Very large companies in the car industry, obviously. Guy just seems like he wants to get rich, ya know? I'm rooting for KCAC.

Risk:

Tesla is a competitor. Apparently, Tesla is also using a liquid electrolyte instead of metal, but still using lithium metal as an anode. Which basically means they have decided to go against Quantumscapes approach. They don't want to use their solid-state technology. I do find it interesting how there is no mention of Tesla as a competitor.

But that's why I simply want to trade the movement. I'm an Elon guy but Bill can help me pay off my student loan debts.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.