Clover Health Announces Plan To Become Publicly-Traded via Merger With Social Capital Hedosophia

Clover Health will join the public market by merging with Social Capital SPAC. Chamath leads the charge with his hat trick in acquisitions this year.

Slicks hair back, adjusts tie, folds hands

So this came across my desk this afternoon, and well, I must say I am impressed.

You don't know what this is? Pfff, it's only for my rich douchebag friends to know.

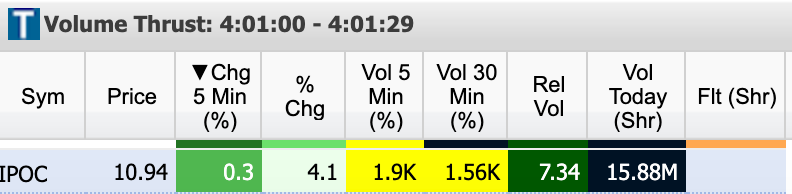

Jokes! I'm not even a licensed broker! This is a screenshot of a volume scanner on my TradeIdeas software. It shows the ticker IPOC, with the percentage change and volume change today (12/07/20). It had DOUBLE the relative volume, which definitely piqued my fancy. Tickled my fancy? Whatever, you get it.

Summary:

- Clover is a next-generation Medicare Advantage insurance company offering best-in-class plans that combine wide access to healthcare and rich supplemental benefits with low out-of-pocket expenses.

- A unique model in health insurance, Clover partners with primary care physicians using its software platform, the Clover Assistant, to deliver data-driven, personalized insights at the point of care. Clover Health collects and analyzes health and behavioral data to lower costs and improve medical outcomes for its customers. The company offers Medicare Advantage plans in 34 counties across seven states in the U.S. for its 57,000 members.

- Backed by Alphabet (GOOGLE), partnership with Walmart, strings pulled by venture capitalist Chamath Palihapitiya.

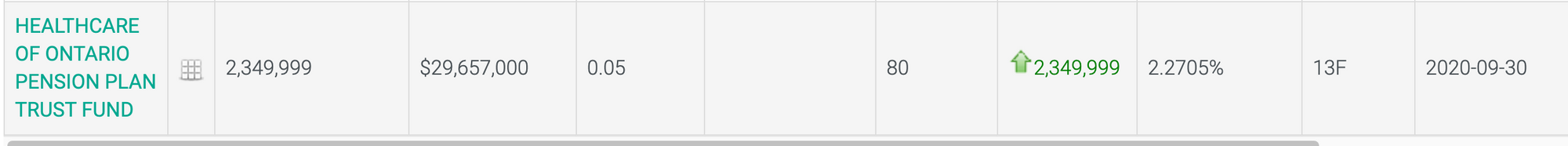

- Deal is valued at $3.7 billion and is expected to provide up to $1.2 billion in cash proceeds, including a fully committed PIPE of $400 million and up to $828 million of cash held in the trust account of Social Capital Hedosophia Holdings Corp. III (“SCH”)

Before we start, it's worth noting that Palihapitiya and Osborne, in the partnership called 'Social Capital,' have listed three companies, and plan to list six more by raising $2 billion. Since you asked, no I can't pronounce "Palihapitiya" and he's important because he was an early executive at Facebook, and is currently a minority stakeholder and board member of the Golden State Warriors. He left Facebook to start his own fund, Social Capital. His fund has stood out strategically, with more attention towards the Healthcare, Financial, Technology and Education sector. Chamath started investing in Healthcare before it was cool, getting praised by Peter Thiel. If you don't know who that is, look up who backed up Luminar (LAZR). Chamath has a solid track record, leading the SPAC craze with names like Virgin Galactic and Opendoor. His next conquest is Clover Health, a San Francisco based Medicare insurance startup.

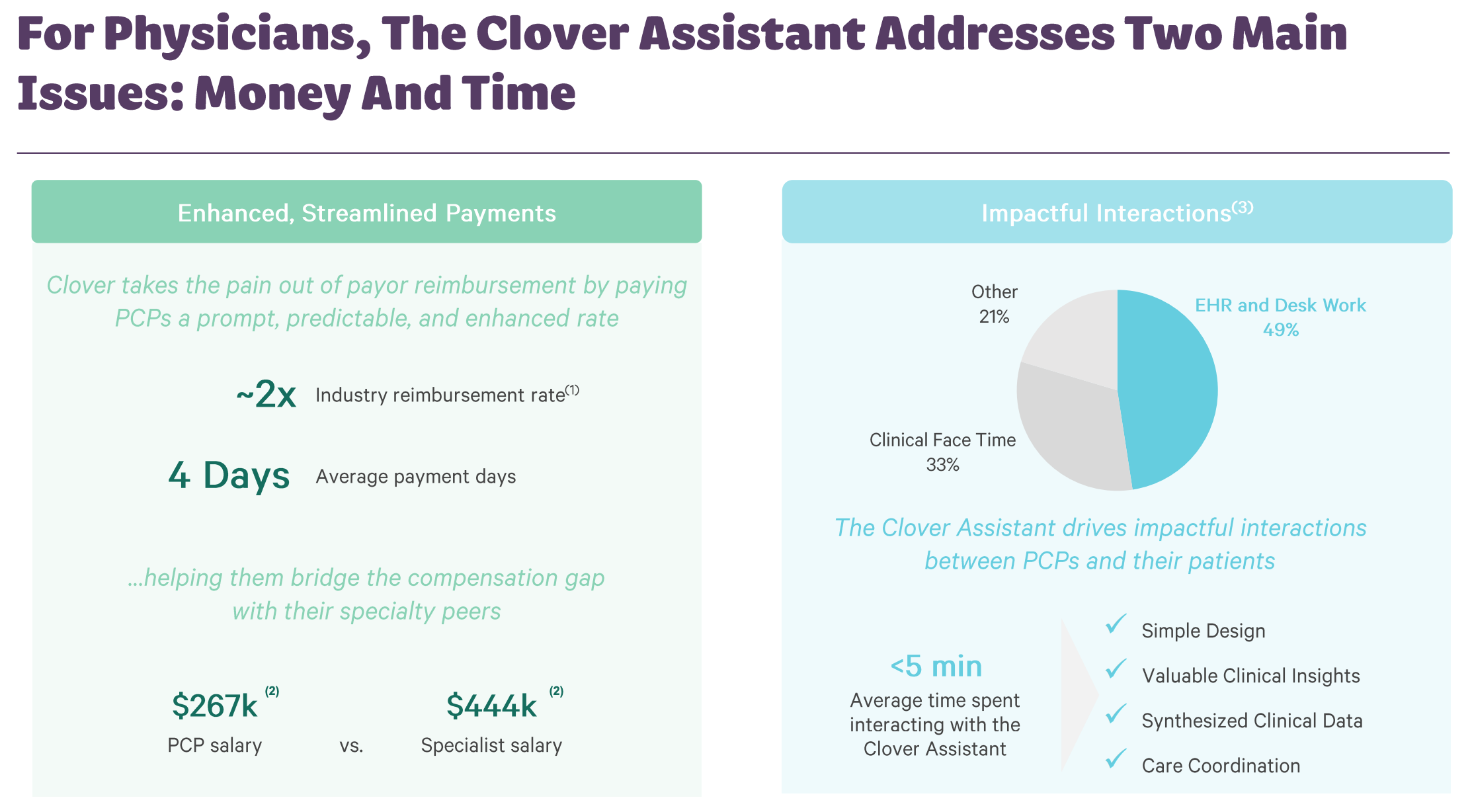

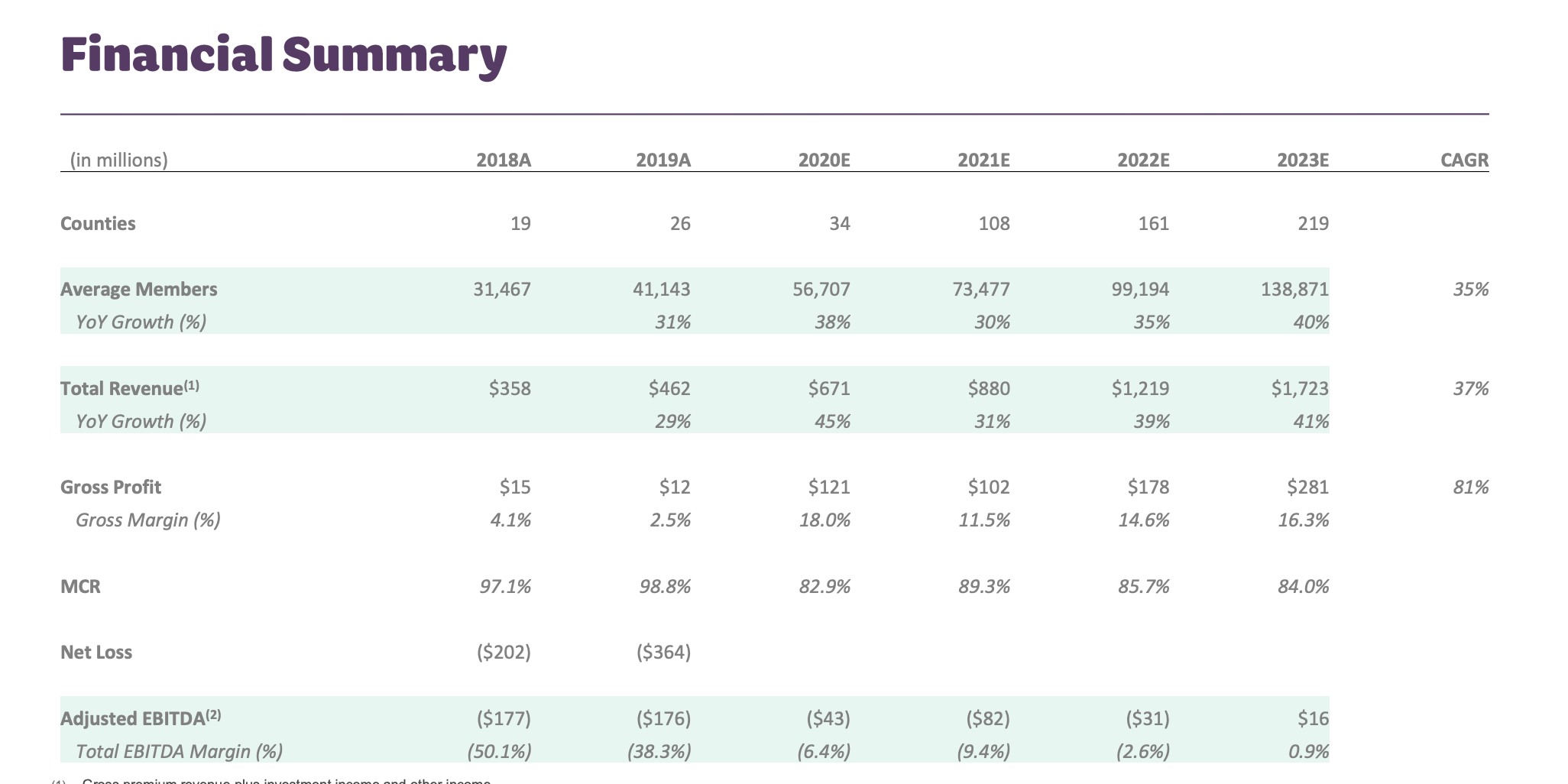

Clover Health presents a unique model in health insurance. Clover partners with primary care physicians using its software platform, the Clover Assistant, to deliver data-driven, personalized insights at the point of care. Clover Health collects and analyzes health and behavioral data to lower costs and improve medical outcomes for its customers. The company specializes in collecting and analyzing medical data for senior Americans covered by Medicare and providing preventative and first-aid care so they can save money on unnecessary hospital visits and prescription drugs. Doctors are in shambles after reading that. Before I get hounded (lol) I KNOW that Clover health is not profitable, and probably won't be until 2023. At least that's what Chamath says.

About Clover Health

Clover has implemented a fundamentally different approach to Medicare Advantage that emphasizes affordability and partnering closely with physicians to deliver the best possible health outcomes for members. The company offers affordable Medicare Advantage plans to eligible individuals, giving consumers access to broad and open healthcare networks, rich supplemental benefits, and low out-of-pocket expenses.

Technology is at the core of Clover’s business – the company is a true innovator in the Medicare Advantage space, deploying its own software to assist physicians with clinical decision-making at the point of care.

Clover’s flagship platform, the Clover Assistant, aggregates millions of relevant health data points – including claims, medical charts and diagnostics– and uses machine learning to synthesize that data with member-specific information. This provides physicians with actionable and personalized insights at the point of care, offering suggestions for medications and dosages as well as the need for tests or referrals, among others, to ultimately improve health outcomes.

The Biden Effect

We have to briefly mention Biden's plan to expand insurance, as well as lowering the age eligibility. He wants to push it back to 60 from 65, and if the Democrats can take control of the Senate in January we could see this benefit Clover Health right on time for the merger. Biden's top healthcare plans include preserving the Affordable Care Act & increasing Telehealth access.

The chart

- Relative Strength Index is showing upwards momentum, breaking out of the bottom.

- Breakout above both Moving Averages (5,10).

- 11.17 is next resistance we need to break, volume and momentum has been very strong at the time of posting. The latest green volume bar is the strongest volume since October. High investor interest.

- Has a gap to fill to $12.63, must break that $12.36 barrier.

- Looks to reverse, very bullish movement.

- Touched 10.68, rejected and consolidated, touched again before consolidating for a second leg up.

- Uptrend and grind up past 11, pulling back and needs to stay at around the 11.20 level for another move.

- Massive green volume bars, indicating people wanting to buy this stock.

- Last candle on the hourly is a bullish dragonfly doji. Buyers are in control.

Last but not least..

Walmart is poised to branch out even further into the healthcare sector as it plans to branch out to eight counties in northeastern Georgia next year. Stated in the press release read "Providers in Walmart Health will use Clover's data-driven technology, Clover Assistant, to help support the healthcare journey of Live Healthy members as they live better, healthier lives,” said Marcus Osborne, senior vice president of Walmart U.S. Health & Wellness, in a statement." The Live Healthy PPO plan would offer a zero-dollar premium and include primary care visits, lab tests, and other services.

The merger is expected to close in the first quarter of 2021. You have until then to make your popcorn and get your iced tea. I'm holding for 100% or until I bite the dust.

**Not a financial advisor. Articles are opinion only.

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.