Battery Day Sucked... or Did It?

A recap of battery day.

- Tesla CEO Elon Musk reported that he projects vehicle deliver to increase 30 to 40% over from last year.

- Elon and executive Drew Baglino talked about the company's plans to develop their own battery, which would therefore create a lower priced and more efficient vehicle.

- Musk expects to make $25,000 priced models that self drive by 2023.

After a much anticipated Battery Day, the results were kind of.. underwhelming. For some reason, I had expected some crazy news that would launch $TSLA calls into outer space. After hours saw the price of $TSLA up to $448 before closing at $395.33.

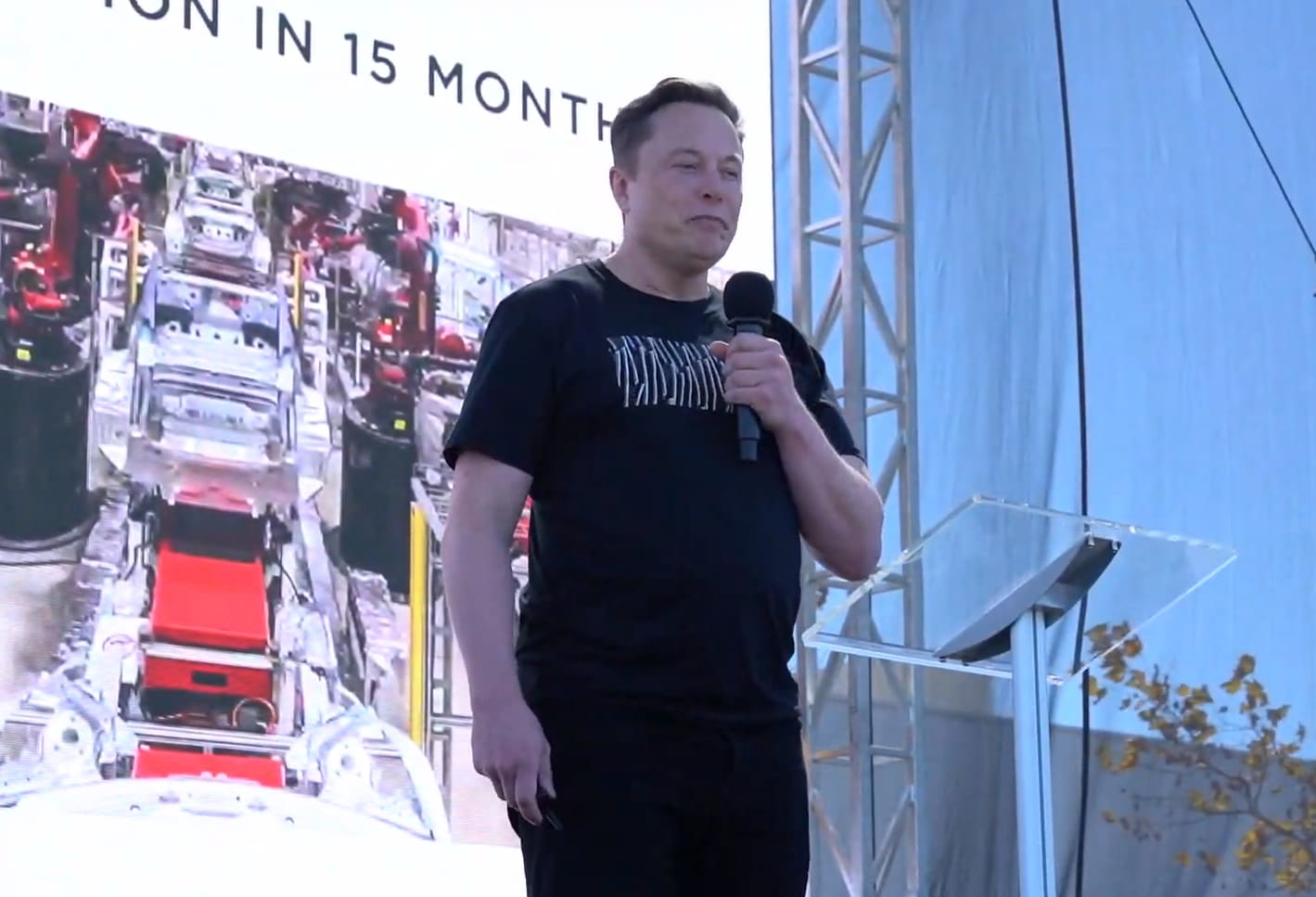

In tonight's drive-in shareholder meeting, Elon addressed his expectations for car deliveries, with an optimistic increase of at least 30%, or half a million of vehicles. He gave the updated numbers and then went on to talk about Tesla's battery advances. He said the battery itself and the manufacturing advances they are working on will soon lead to lower prices, which will put more electric vehicles on the road. More specifically, Teslas.

“In 2019, we had 50% growth. And I think we’ll do really pretty well in 2020, probably somewhere between 30 to 40 percent growth, despite a lot of very difficult circumstances.” - said by Elon Musk at the meeting

So of course this is pretty good news, right? Teslas shares dropped as much as 7% during the presentation. I think with all the expectation, shareholders threw their milk bottles at the wall, made two bite-sized fists, and started throwing a temper tantrum because they have to wait three years for the battery advancements. Musk confirmed that Tesla plans to manufacture battery cells at its factory under construction in Grünheide, Germany. This was a catalyst for Tesla, but it was also a statement for their brand being more than just about cars. If they can replace the combustion engine in a car with their battery, they can crush an industry.

Tesla’s senior vice president of powertrain and energy engineering, Drew Baglino, outlines the new cells as a “large tabless cell,” with a “shingled spiral” design. They are bigger than the ones they buy from suppliers, as well as equipped with "thermal benefits", suitable for electric vehicles. According to CNBC, Baglino said battery, manufacturing, and design changes underway at Tesla would eventually “unlock” a 54% improvement in the range of the company’s vehicles. In the short run, Tesla plans to produce 10 gigawatt hours worth of its new plant in Germany within a year. The company also said it had rights to lithium clay deposits in Nevada (quickly googles mine stocks based in Nevada).

Here's what could be a reality:

Elon squeezes short-sellers, again.

Seriously, with a short interest of 22% and being one of the first companies billions of dollars against it, it should come as no surprise that Elon HATES short-sellers with a burning passion. Musk has described them as "jerks who want us to die" and "value destroyers" back in a tweet in 2018. He had also said there would be a "short burn of the century" months prior. Later that summer, Tesla's stock plunged as investors scurried in fear of price cuts, disappointing sales, larger than expected loss, and company personnel changes. BUT, the company crushed it on production, promising strong revenue growth and positive earnings, driving up shares more than 80% in 2020 (nearly two years later, but k).

So, as I'm swirling my black coffee with an Elon Musk spoon, sitting in my Tesla underwear, I'm thinking: Could this just be another one of his short burning ideas?

Hounder Media Newsletter

Join the newsletter to receive the latest updates in your inbox.